(Weekly funding roundup April 17-21) Venture investments drop to a new low

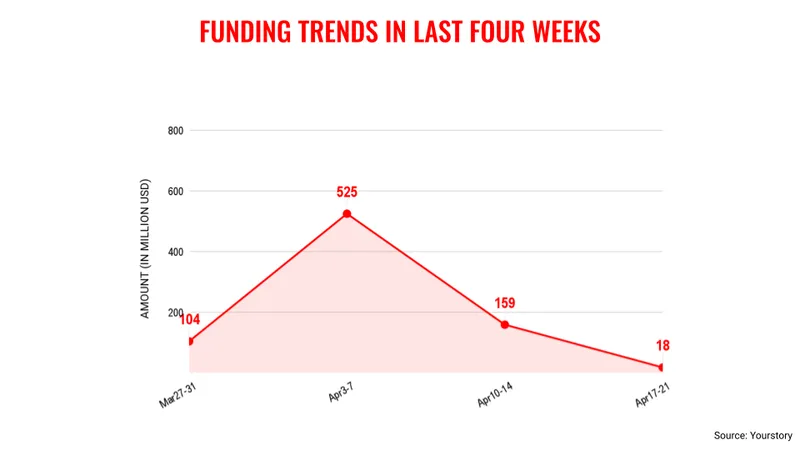

The third week of April saw the lowest amount of capital inflow into Indian startups during this year at just $18 million.

Venture capital funding into Indian startups dropped to a new low, revealing the challenges faced by the startup ecosystem as investors continue to remain on the sidelines.

Venture funding for the third week of April came in at just $18 million with eight deals, compared to $159 million reported in the previous week. This is the lowest amount of funding on a weekly basis that Indian startups have raised this year.

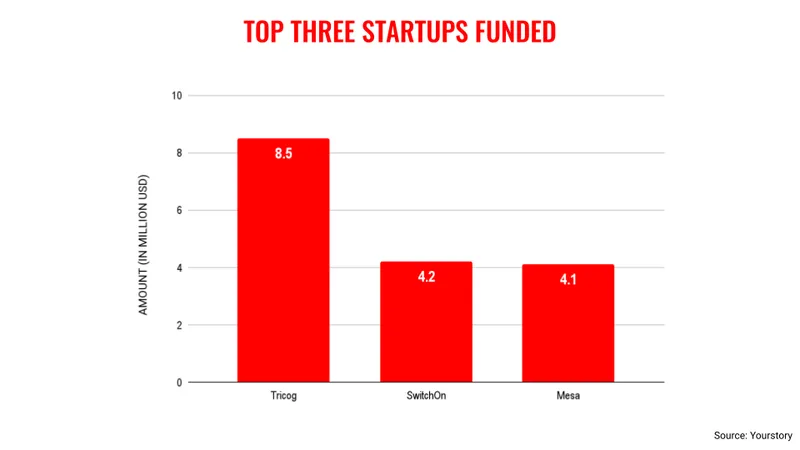

Healthtech startup raised the highest amount of funding at $8.5 million from multiple investors in a Series B2 round.

The third week of the month did not see a large deal, contributing to the low funding amount. As noticed during this year, only a few startups from the unicorn category have been successful in raising a larger round.

This reveals the challenges faced by startups who would like to raise higher amounts of capital but are unable to do so, as investors are quite unsure of the direction the larger economy is likely to move.

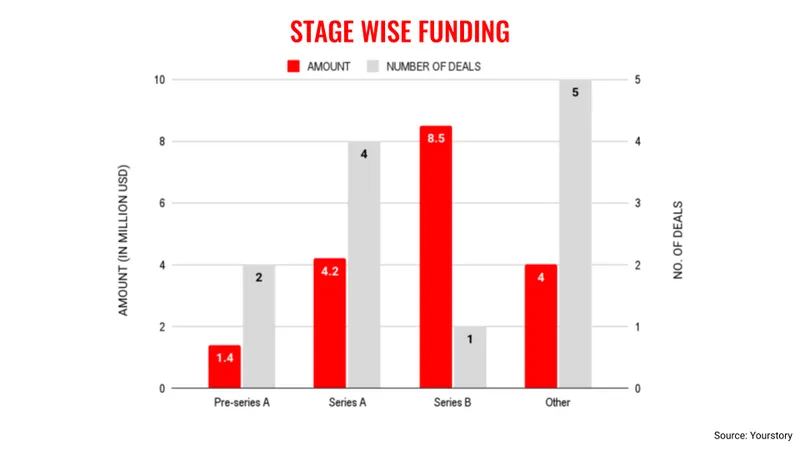

It has been challenging for growth-stage startups to raise capital, as the big ask from the investors has been on their road to profitability, resulting in various kinds of cost-cutting measures and employee layoffs.

At the same time, early-stage startups have been able to raise capital, but the cash flow is low. Larger VC funds are investing in this segment as they would not like to miss out on any potential opportunity that may bring returns in the next two to three years.

The big question is when will the situation turn out for the better. Although, there is some consensus it will be very challenging for the remainder of the year, and any opening of the capital flow is most likely from next year.

Edited by Suman Singh