Majority of SoftBank-backed Indian startups have cash reserves for a year: Report

The portfolio of startups under Softbank's fold have undertaken cost-cutting measures which have increased their cash runway.

Around 94% of the Indian startups backed by SoftBank have cash reserves stretching up to a year as most of them have undertaken cost-cutting measures given the tight funding environment, according to a report.

SoftBank's investments in Indian startups are channelled through its two main vehicles—SoftBank Vision Fund (SVF) I and II. A research note from Bank of America (BofA) stated, “94% of SVF investees already had cash runways of at least 12 months at end-March 2023.”

The research mentioned that most tech startups have brought down costs over the last 6-9 months, resulting in growth slowing down from 60-80% to 15-30%.

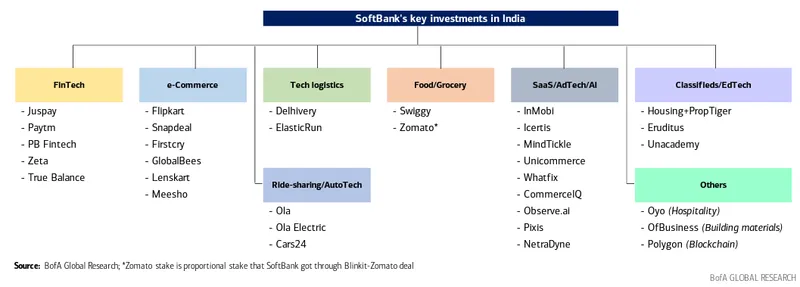

SoftBank emerged as one of the key big-ticket investors in Indian startups across sectors. Among the key companies under its wide portfolio include the likes of Flipkart, Paytm, Delhivery, Policybazaar, Swiggy, and OYO to name a few.

However, the uncertain economic environment has prompted Softbank to considerably slow down its investment activity in India. The BofA research note stated, “We note that the investments materially slowed down in the last couple of years. In 2022, the company only made three investments and ytd in 2023, Softbank has not made any investments yet.”

The investment giant has significantly changed its approach to funding Indian startups. The valuation benchmarks while investing shifted from $5 billion to around $2 billion. The cheque size has shrunk from $1 billion to $100 million-150 million. Softbank’s stakes in the companies narrowed to sub 25% with only one board seat, and most importantly, it has started to work collaboratively with the PE/VC ecosystem in India.

“The company seeks to diversify risk in the fund portfolio itself by managing multiple funds with the characteristics of both SVF1 with its mainly concentrated investments and SVF2 with its mainly diversified investments,” the BofA note said.

The research note said that amid the continued uncertainty, SVF investment companies are putting greater emphasis on strengthening unit economics. This has resulted in more than 40% of overall investee companies being either close to or above break-even.

Edited by Kanishk Singh