Saregama ready to cash in on India's digital revolution

Saregama India, uniquely placed in the content-creation ecosystem, says the digital revolution is set to boom for the entertainment industry.

Music label Saregama India has the largest library of sound recording and publishing copyrights of Indian music across 14 different languages.

As a pure-play content company, the Kolkata-headquartered company wants to capitalise on low data prices and the increasing markets for smartphones in India, where COVID-19 has accelerated digital adoption in the past 15 months.

Here are five insights on the music content industry from Saregama India's annual report for financial year 2020-21:

1. Many players are vying for its content

Apart from being uniquely placed in the content-creation ecosystem, Saregama counts its strength in product development, marketing, investments in data analytics, and a 30,000-strong retail network.

It is pinning its growth ambitions on three pillars: monetising the existing IP, creating new IP, and the direct-to-consumer retail business.

“Over the next decade, over two dozen well-funded video and audio OTT platforms will fight among themselves and with the existing 900 TV and 360 radio stations for the consumer’s time and money. The weapon of choice in this war will be content," the company said.

2. Digital revenues are on the rise

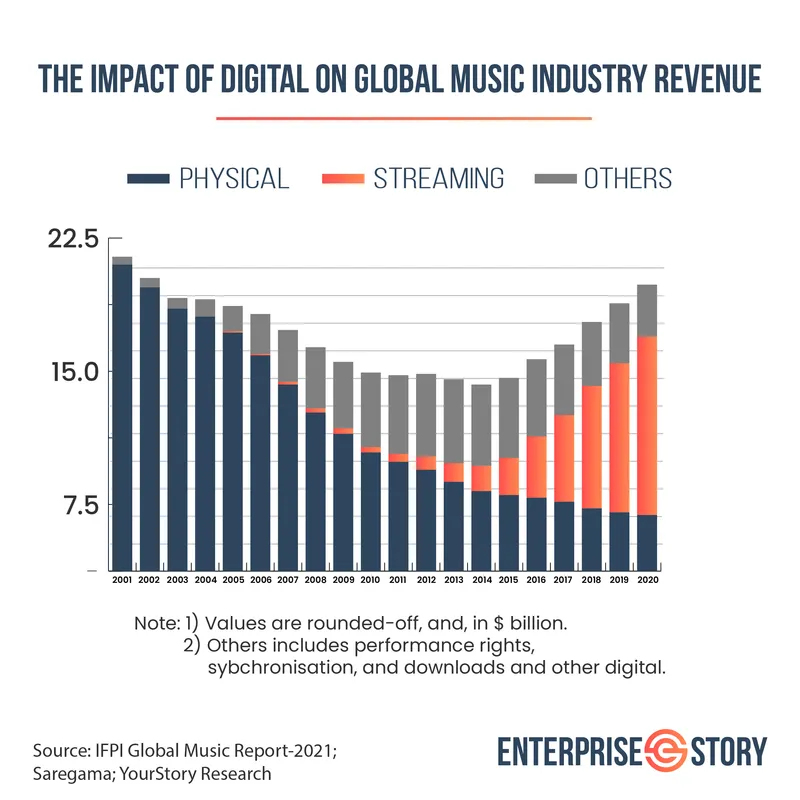

Saregama India pointed to how digital revenues have grown for the music industry globally. Revenue from physical channels have dropped 81 percent on an absolute basis from $23 billion in 2001 to $4.2 billion in 2020, according to the Global Music 2021 Report by International Federation of Phonographic Industries.

In contrast, streaming revenues increased from around $100 million in 2005 to $13.4 billion in 2020.

3. The Indian music industry mirrors the global trend

The Indian music industry has been growing too since 2015 on the back of increased digital revenues, performance rights and synchronisation rights.

“The digital video business has also been growing leaps and bounds, on the back of higher advertising spends on platforms like YouTube and faster adoption of subscription-driven platforms like Netflix, Disney Hotstar,” Saregama noted.

And the company has been preparing itself to take advantage of the explosion in digital media. Saregama India has digitised its entire catalogue of 1,30,000 songs, and built rich metadata behind it.

“Digital has allowed us to put our music everywhere, unfettered by the constraints of the conventional brick-and-mortar distribution network,” Saregama added.

4. Putting analytics to work

Saregama says it has built a robust data analytics tool around 100 billion annual song usage data points. “The predictive models built on the back of data analytics help sharpen our ability to pick the right song at the right price from the market,” it added.

Saregama’s music licensing business has been growing at over 20 percent for the last three years.

5. Audio streaming to rake in big money

Saregama added that the continuous growth of digital infrastructure has paved the way for a massive growth in audio streaming too. Leading platforms like Gaana and JioSaavn estimate the number of monthly active users to be between 150 million and 200 million.

“Currently, Saregama charges platforms on a per stream basis, plus a share of advertising revenues for the advertising-based free service,” Saregama said. And, its revenue from this segment has been growing at 40 percent over the past three years.

If the paid subscriber base of music streaming apps in India moves from the present 2 percent to 5-6 percent, the digital revenues can propel the necessary growth to push the Indian music market towards 20 percent growth, Saregama noted.

This will result in a much bigger revenue opportunity for Saregama India, as contractually it also gets a share of subscription revenue from the platforms. “The digital revolution has been knocking at the doors of the entertainment industry for some time, but is now set to boom,” the company added.

Edited by Kunal Talgeri