DevOps In Financial Services - Here Is How Everyone Won

Companies in the finance industry were perhaps the slowest to adopt DevOps as a Service, but it is safe to say that they are currently leading the innovation in this sphere of technology. This slowness in using DevOps in the initial stages can be attributed to the gray area in security that DevOps posed - the financial services industry, after all, requires all the network and data security it can get.

What Changed?

Companies in the financial services sector realized that they had to differentiate themselves by providing their services at improved speed and flexibility for their customers. At the same time, companies also had to ensure compliance with regulations, and continue to ensure that data security was given top priority.

Financial services companies still rely heavily on legacy systems, data, and applications. DevOps is playing a crucial role in allowing financial institutions to modernize those applications and processes to support the growing demands of customers. DevOps is constantly enabling companies in the financial sector to greatly improve the quality of their services while also ensuring that governance, risk, and compliance are addressed. When companies in the financial services sector realized that DevOps mitigated these risks, it helped them address issues faster, and prompted them to adopt DevOps as a Service.

In 2015, Barclays announced that it was adopting Agile and DevOps for their digital transformation. In one of the most successful transformations, Barclays increased their throughput by a factor of 3. Now, Barclays processes payments which equate to around 30% of the UK's Gross Domestic Product. The leadership team at Barclays have credited DevOps with significantly reducing the complexity of their codes, which has allowed them to reduce delivery risk and, ultimately, improve the quality of their services.

However, financial institutions have spent millions of dollars in setting up legacy solutions earlier, and so these remain a part of their core services. Despite more and more processes shifting to Agile and DevOps methodology, legacy systems, therefore, cannot be left out in the cold. With financial institutions embracing DevOps and the hybrid cloud environment, they had the capabilities to tie modern cloud applications with on-prem applications. However, there are several complex operations which require the collaboration of these newer applications with outdated legacy systems and applications which are probably humming away at the back of your data center.

But what is DevOps?

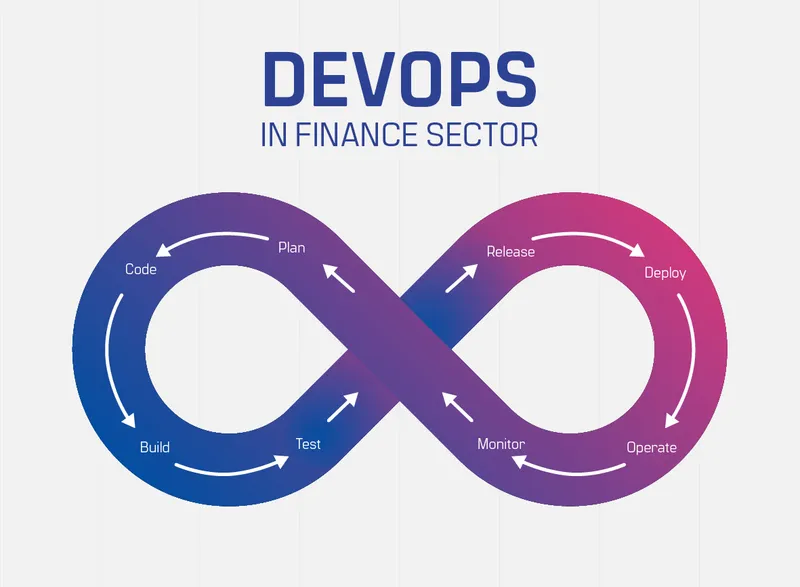

DevOps refers to a culture that promotes a holistic approach to the software development lifecycle (SDLC) by building stronger relations between the software development and IT operation divisions in an organization. The main objective of DevOps is to completely break down barriers between development and operations, so as to establish an effective working environment that is transparent, rapid, responsible, and smart, for the overall success of a project.

Improved visibility with DevOps

Traditionally, for banks to build financial service software, the software development lifecycle was complicated and unnecessarily long. However, with DevOps, the build-test-deploy-release process became streamlined and a lot more effective. Now, despite IT solutions being developed in geographically distributed locations, DevOps has ensured that there is end-to-end visibility across departments and functions across the teams. This has effectively eliminated the fragmentation of the development process, delays, and errors.

With DevOps, shared control and a robust pathway to production have allowed financial services companies to scale their operations and remove the friction between teams. The biggest advantage, however, is that predictable and repeatable processes can be initiated across releases. This has allowed for better automation and less human intervention, making releases faster and helping the organization mitigate the problems they face.

Essentially, DevOps has improved developer productivity, software quality, resource utilization, and overall collaboration.

If you work with financial institution aiming to make it big using DevOps, here are a few pointers to ensure that your efforts succeed.

1. Before proposing a company-wide adoption of DevOps, consider rolling it out for a single project. It helps if you gain confidence with a single project before proposing the approach to all of your operations. It also gives you a heads-up about possible pitfalls and changes which you might have to deal with on time and on budget.

2. Once you have adopted DevOps, understand the cultural differences between the different off-shore, on-site and near-shore teams. For your DevOps efforts to succeed, it is far more important to understand a team’s work culture than their technical capabilities. Ensure that there exists a collaboration beyond just work across all your centers. This way, you can ensure that when an issue comes up, there is no room for a blame game, but only for a collaborative effort to fix it.

3. Introducing automation processes wherever required can drastically reduce the workload on your cross-functional teams. It also reduces the time taken to perform monotonous and repetitive tasks. Automation is the key to making release cycles shorter and faster.

4. Try not to centralize the whole DevOps effort across all your verticals. Instead, have separate teams for retail banking, investment banking and other services that you would like to work on. This can go a long way in improving the efficiency of your development team and well as for improving the throughput of your DevOps effort. Restricting them to a single team might stunt your growth.

5. Use cloud technology to create and test environments and make the code instantly accessible for anyone from your team across the globe. This also gives you a view into any glitch that your customers might face once the code is deployed.

6. Breakdown large processes and releases into manageable microservices and work on a tight feedback loop with the stakeholders. To do this more efficiently, the Agile method of software development can be considered. By effectively combining Agile and DevOps, you can see more iterations and faster releases.