This is a user generated content for MyStory, a YourStory initiative to enable its community to contribute and have their voices heard. The views and writings here reflect that of the author and not of YourStory.

This is a user generated content for MyStory, a YourStory initiative to enable its community to contribute and have their voices heard. The views and writings here reflect that of the author and not of YourStory.

RBI in it’s circular DBR.DIR.BC.No.14/13.03.00/2019-20 has directed All Scheduled commercial Banks , Small Finance Banks and Local Area Banks to link their Retail Loans and Small business loans to an external benchmark.

We thought to take a deep dive on this to make it simpler for our readers to understand the real benefits of it.

Let us first clear the basic difference between Floating and Fixed interest rate loans – Floating rate loans are where the interest we pay to the bank changes over the tenure of the loan depending on what it is linked to. Fixed rate loans are those where interest rates remain fixed for the whole tenure. When we take a loan, we have option to opt between one of them.

Now, The RBI guideline of linking floating rate loans to an external benchmark is only for

A) New Loans taken by Individuals (Retail loans – personal, Auto & Housing)

B) New Loans taken by Micro & Small Enterprises

This Circular is only applicable for Banks (effective 1st Oct’19) as of now since Housing finance companies are yet to come under RBI (as per last budget proposal).

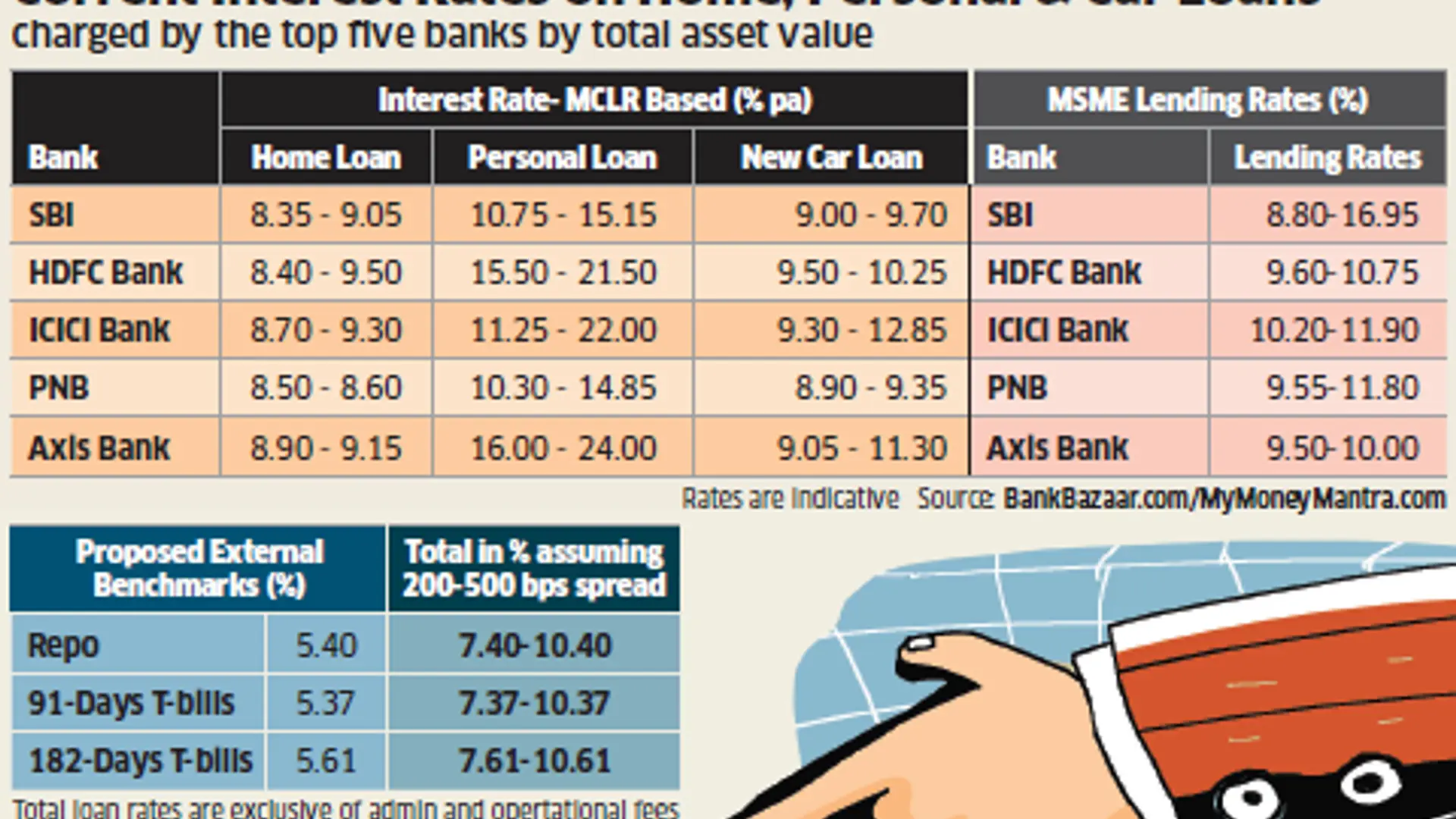

Why RBI has taken this step - All our retail loans till now have been linked to an internal (Bank’s) benchmarks. To name a few-

A) PLR – Prime Lending rate

B) MCLR – Marginal cost of Lending rate

C) Base Rate

Each of the above mechanism were set by the Banks with an intent to provide transparency but it proved inefficient in terms of transmission of rate cuts done by RBI. Resulting rates increases at a faster rate when RBI hike rates but go down slowly when rates were cut.In a layman term we can say these internal benchmarks are more beneficial for Banks and lesser to the customers.

In order to bring more transparency RBI has finally come up with this idea. The External Benchmarks that can be used by Banks are

A) RBI Repo Rate

B) Govt. of India 3- months Treasury Bills (published by FBIL)

C) Govt. of India 6- months Treasury Bills (published by FBIL)

So the interest rates we pay on a fresh loan (on & after 1st October’19) will be linked to any of the above mentioned Benchmarks alongwith a Spread. As & when external benchmark will move down we will have to pay lesser interest.

What happens if you have an existing loan with Bank

A) You have the option to move to the new regime of external benchmarks

B) The bank can charge you a reasonable one time Processing fees

But remember once you shift, you cannot switch back.

Ideally as an end user we should take the benefit of this new setup as it translates more transparency.