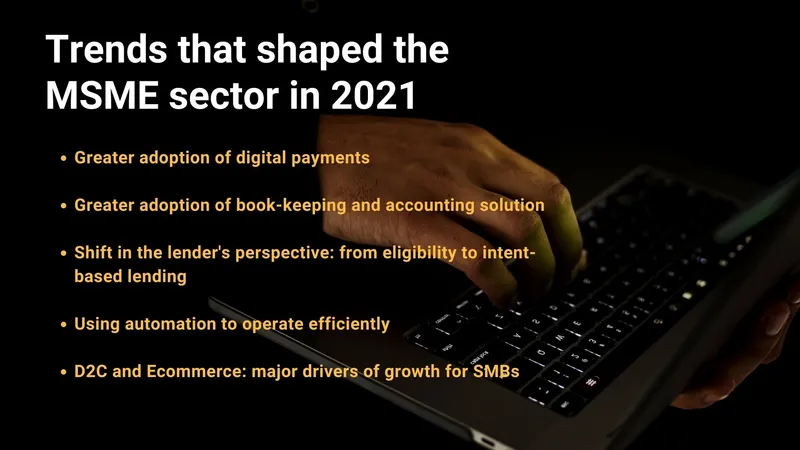

[Year in Review 2021] 5 trends that dominated the MSME sector

The year’s drawing to a close, making it the perfect time to look into the rear view mirror and assess some of the top trends that prevailed in the MSME sector.

The year 2021 wasn’t an easy one. It began with people thinking they had almost won the war against COVID-19, only to be knocked down by the second, more deadly wave of the pandemic.

Businesses were fraught with uncertainty, and it took a while for owners and employees to find their way.

The pandemic is not yet over but the year is almost at an end – making it the perfect time to look into the rear view mirror and evaluate some of the trends that prevailed in the micro, small, and medium enterprises (MSME) sector.

SMBStory spoke to a couple of experts to understand what worked for small and medium businesses (SMBs) in 2021, and how these trends can help them become future-proof.

The exponential growth of digital payments

According to a report by digital ledger app , payment modes like UPI really helped SMBs scale business.

Take the example of Ankit Ralhan, an electronics supplier based in Haryana’s Hisar. “When COVID-19 struck, I went back to my village with large customer outstandings. There was no hope of opening up again. But thanks to new payment modes like UPI, a lot of my customers paid up, which helped me start afresh.”

Ankit has seen a 129 percent increase in his business, thanks to digital payments.

Another reason why digital lending has grown exponentially is because of options like ‘Buy Now Pay Later’ (BNPL), according to Gurjodhpal Singh, CEO of Tide IN. He highlighted that a lot of working capital gets locked in supply chains in the daily operations of MSMEs – this was completely upended during the COVID-19 pandemic.

Gurjodhpal said options like BNPL are going to become more popular going forward as lenders have realised that “credit taps” need to open for SMBs to function better.

The rise of digital book-keeping and accounting solutions

MSMEs have realised that adopting digital means is the way forward. Abhishek Dalmiya, Director of Product Management at Tally Solutions, says, "The pandemic has forced all businesses across sizes and segments to look at newer ways of conducting their business in the most efficient way and digitization has undeniably played a key role in this. While large enterprises were way ahead in their journey towards digitization, MSMEs had to adapt to more changes."

He further added that this led to an unprecedented increase in the business owners digitising their books of accounts for easier business operations and using digital payments for faster flow of money.

The OkCredit report said the last festive season saw more than 70 percent rise in retail SMBs (jewellers, eateries, stationery suppliers, travel agencies, and more) adopting digital tools to manage their books.

States like Kerala, Karnataka, Meghalaya, Manipur, and Tamil Nadu benefitted the most from digital bookkeeping and accounting tools. Merchants in Kerala and Karnataka reported an eight percent increase in their businesses. The largest jump was recorded by business owners in Pondicherry (28 percent).

Even new players in the ecosystem have actual proof of this trend.

, a Bengaluru-based digital accounting solutions provider founded in 2019, saw immense growth during the pandemic, said Founder Rahul Raj. “I would say that all the growth has happened during the pandemic,” he added.

The platform today has 1.2 million monthly active users which also includes merchants from Tier II cities like Patna, Lucknow, Indore, etc.

The shift from eligibility to intent-based lending

Banks and lending institutions are reportedly hesitant to lend to MSMEs because of their not-so-great “track record.”

However, Ketan Patel, CEO of Mswipe, highlighted that the pandemic has significantly resulted in changing lender perspective.

“From eligibility-based lending, we are shifting to intent-based lending,” he said, emphasising that lenders now dig deeper into the needs of the SMBs rather than looking singularly at their balance sheets, income tax returns, etc.

Another trend in the lending space is that it is being majorly driven by collaterals, said Shachindra Nath, Executive Chairman and Managing Director of MSME lending platform .

“This is because (earlier) it was very difficult to assess factors such as revenues of SMBs, their expenses, and how much money the business could afford to pay back. So, having physical collaterals secured the lenders,” he said. “That is dramatically changing because lenders have data and technology now. In fact, I believe that MSME financing will reach the level of consumer financing in the next three years.”

He added that GST and digitisation of the banking sector, which happens through account aggregation, and bureau footprint, have helped lenders analyse MSMEs better in a matter of minutes.

The rapid increase in automation

Cash crunch and working capital challenges apart, the pandemic also brought immense business uncertainty due to shortage of labour. The ambiguity around the virus led to several labourers and workers fleeing to their villages, hometowns, or getting infected, which left owners short of hands, especially in the hospitality sector.

Bengaluru-based , which manufactures machines that automate cooking, was a witness to this trend.

Eshwar K. Vikas, Co-founder, said the demand for these machines grew exponentially during COVID-19.

“Hospitals that were facing staff shortage in their kitchens benefited hugely from the deployment of these machines.”

He added that the company sold more than 150 machines quarterly pre-pandemic; this number has gone up to more than 500.

“Automation can really help brands struggling to be profitable. By adapting automation, they will be able to grow their businesses exponentially and remain profitable,” said Eshwar, adding that businesses will be able to significantly bring down costs and increase productivity and margins by automating product lines.

The emergence of D2C and ecommerce as drivers of growth

Amid the coronavirus pandemic, many buyers shifted from offline to online. Businesses were quick to catch up with this trend as contactless buying seemed to be becoming the norm. According to Ashvini Jakhar, founder and CEO of , local businesses are now increasingly taking the online route to reach out to their customers across India. In 2021, 80 MSMEs across India registered with Prozo to help them with their warehouses and shipping requirements.

Mangesh Panditrao, Co-founder and CEO of , believes that COVID-19 pushed SMBs to look for new growth avenues, and D2C and ecommerce emerged to be a powerful channel.

“It can drive new markets and generate exponential sales for SMBs. Moreover, this channel holds tremendous potential to connect SMBs with a vast customer base and offer a personalised brand experience. Technology has made this shift simpler,” he said.

While the impending threat of the third wave continues to loom, the first two waves have helped MSMEs find the tools to survive - and thrive. The challenge now lies in sustaining these strategies and finding new ones to grow.

Edited by Teja Lele

![[Year in Review 2021] 5 trends that dominated the MSME sector](https://images.yourstory.com/cs/21/e1da3a20368f11ea8ceed32dbcb77ccc/MSME-sector12-1639978639558.png?mode=crop&crop=faces&ar=2%3A1&format=auto&w=1920&q=75)