This 17-year-old is helping the underprivileged gain financial literacy, access govt schemes

‘Invest The Change’, a social enterprise based out of Gurugram, helps people from underprivileged backgrounds gain financial literacy and access various government schemes.

Sakina, a house help, came to Delhi from Jharkhand to find a livelihood. Her initial job as a stall worker paid little. Soon, she found work as a house help and earned Rs 1,500 each month per house. Although this improved her living conditions, sending money home and covering expenses left her unable to save.

“I started worrying about if something happens to me how would my family survive?” she says.

She then came across an awareness session conducted by Invest The Change—a social enterprise started by 17-year-old Kashvi Jindal.

Through the session, she became aware of the Pradhan Mantri Suraksha Bima Yojana (PMSBY) which offers protection against death or disability due to accident. The policy requires a payment of Rs 20 per annum, which she says is “quite affordable”.

“The session was really helpful. I wanted to enroll in the scheme, but I didn't have a bank account, so Kashvi’s team helped me register an account in a bank. Enrolling in the scheme assured me that in the future, my family shall stay financially backed even if I am not present,” she tells SocialStory.

Invest the Change focuses on government schemes for health, accident and life insurance

The Gurugram-based organisation extends comprehensive support, starting from raising awareness about government schemes to helping individuals in the application process as well as teaching them about financial literacy.

How did it start?

Kashvi Jindal

Jindal says she’s always been curious about the financial markets as her father—Gaurav—has been running his hedge fund for the past 15 years.

“Seeing him working in the financial world, I developed a keen interest in its functioning. I remember flooding him with questions about market fluctuations, even though I could not comprehend much back then,” she says.

Later, economics became her favorite subject in school, and by the 10th grade, she had decided to pursue a career in finance.

The push to help the underprivileged came when a 31-year-old housekeeping staff passed away in her apartment society. The worker’s family was devastated as he was the sole breadwinner.

Jindal began discussing financial matters with other workers in the society and found that there was a widespread lack of information about finance and the economy among them.

“While researching I found out that many government schemes like the Pradhan Mantri Suraksha Bima Yojana and Pradhan Mantri Jeevan Jyoti Bima Yojana are available to offer protection to people during such tragedies,” she says.

She found that people are mostly unaware of government insurance schemes.

According to report by the National Survey Office (NSO) of the Ministry of Statistics and Programme Implementation, approximately 10% of the poorest one-fifth of rural Indians (10.2%) possessed some form of private or government health insurance. This leaves many people exposed to health-related financial shocks.

Other studies suggest the situation is not any different for other types of insurance policies.

Jindal recalls that several families had to dip into their savings amid the COVID-19 pandemic. Many of these families lacked life or health insurance schemes, leaving them vulnerable during these challenging times.

This realisation led Jindal to start ‘Invest The Change’ in 2021, to create awareness about government schemes that could offer a cushion to fall back on in times of financial distress.

Recalling her initial session conducted in her society she shares, "The response was overwhelmingly positive, with approximately 50 workers from the society actively participating in the awareness session on government schemes. Following the session, we received calls from people seeking assistance in applying for specific schemes. We established kiosks in the society to facilitate the form-filling process for them.”

Support in availing government schemes

The organisation follows a three-step approach. First, it develops the content for seminars. Jindal says that though the focus is more on health and life insurance schemes, the organisation also covers scheme such as like Atal Pension Yojana, and more.

During the initial session, Jindal explains the diverse range of available schemes and their associated benefits. Subsequent sessions involve hands-on assistance for individuals who encounter challenges applying online, guiding them through the form-filling process.

Third, the team contacts participants to verify whether they have received the intended benefits. If an application is unsuccessful, the team guides possible solutions.

Invest the Change has a team of 15 volunteers who help Jindal from conducting the sessions to doing the follow-ups. So far, she has helped 3,000 blue-collar workers like bus drivers, and wage workers gain avail benefits of eligible government schemes.

The team has conducted approximately 30 sessions so far.

Jindal began hosting sessions in her neighbourhood, schools, and restaurants. She also partnered with the Rotary Skill Development Centre to conduct a workshop about basic financial concepts and government insurance schemes.

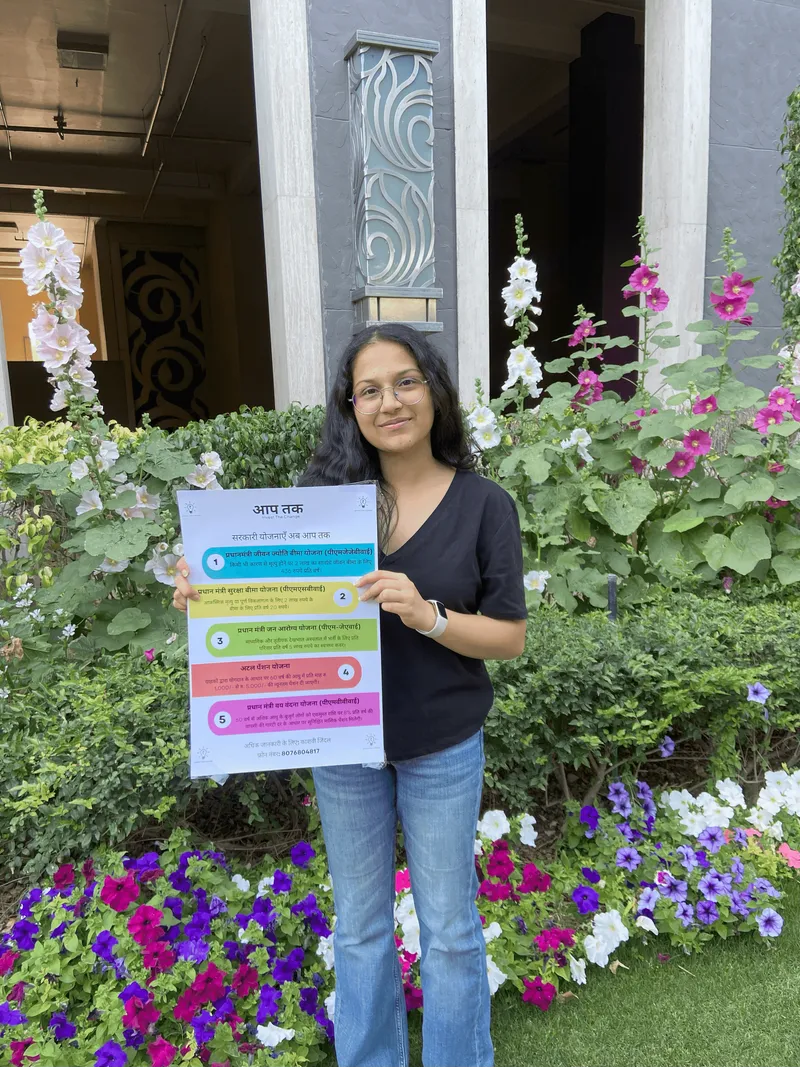

Kashvi Jindal taking a session

Jindal says that there is no specific time cycle for conducting these sessions. She reaches out to schools and societies wherever she is to organise these sessions.

Invest in Change has impacted many people. One of them is Prakash Mandal, an office boy in Gurugram who was going through a tough financial phase during the pandemic. Jindal’s organisation taught him about government policies that could help him.

“Out of all the schemes what had my attention was Pradhan Mantri Jeevan Jyoti Bima Yojana where I had to pay a premium of Rs 436 per annum and Pradhan Mantri Suraksha Bima Yojana where I had to pay a premium of Rs 20 per annum,” he shares.

He had no prior knowledge of the schemes. After attending, he was skeptical about the schemes as benefits were being offered at a minimal cost. However, he decided to enroll after a thorough online research.

“While enrolling I faced problems with fully understanding the paperwork but Kashvi Jindal and her team helped me with the paperwork process. These two schemes have brought great ease in my life because now by paying small amounts I can stay assured of anything unexpected that might happen in the future,” he adds.

These sessions also include lessons on financial literacy.

“Financial literacy makes people independent and capable of making informed decisions. Therefore we also suggest ways to save and manage money more effectively so that they can grow their wealth,” she adds.

Challenges and future

No journey goes without roadblocks and Jindal’s life has not been any different.

She communicates primarily in Hindi and English, which poses a difficulty in certain situations as many workers are not fluent in the two languages. “We decided to keep volunteers who spoke certain regional languages to mitigate this issue,” she says.

Additionally, she shared that most people used to be apprehensive about sharing their personal information with her. “People fear deception so they do not trust easily. Building trust within the group has been a challenging task but during physical sessions, we tried to build a connection to fight that mistrust,” she adds.

Furthermore, she acknowledges that her age was another problem as many people did not take her seriously. She says it was hard to convince others that her work was not merely a hobby but a dedicated effort towards a social cause.

The organisation has helped 3,000 people so far

Nevertheless, Jindal says that her father has been her ardent supporter throughout this journey. From helping in creating presentation materials to sorting out logistical details for the company, and providing motivation during challenging moments, he has consistently been her biggest cheerleader.

Talking of challenges, she also shared that since she is a student, it becomes challenging at times to manage her studies and her organisation work. But she adds that one has to prioritise their goals to achieve anything in life.

"I create planners and schedules to stay on top of my routine," she says.

For the future, Jindal says that she wishes to scale up the company and reach out to more people.

“We are also integrating an app on the website which will filter out the various schemes that the user is eligible based on the given information. This will simplify the process of applying for schemes online for the users,” she adds.

Edited by Affirunisa Kankudti