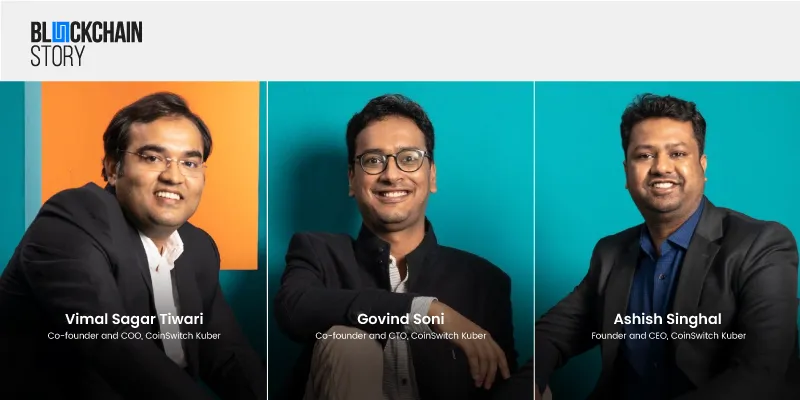

Inside CoinSwitch Kuber's journey: How 3 engineers built India’s largest crypto exchange

Ashish Singhal, Govind Soni, and Vimal Sagar landed on the idea to build a crypto exchange aggregator startup at a hackathon, which went on to become CoinSwitch Kuber, India’s second crypto unicorn.

On Wednesday, made headlines when it announced a $260 million Series C funding round from Andreessen Horowitz (a16z), Coinbase Ventures, and existing investors Paradigm, Ribbit Capital, Sequoia Capital India, and Tiger Global.

This marks the first-ever investment by a16z in an Indian startup. CoinSwitch Kuber also becomes the second Indian crypto startup to enter the unicorn club after CoinDCX in August 2021.

CoinSwitch Kuber, started in 2017 by Ashish Singhal (CEO), Govind Soni (CTO), and Vimal Sagar (COO), is also India’s largest crypto platform — with over 11 million registered users.

In a video interview with BlockchainStory, Ashish narrates the journey of the crypto exchange platform. On how it all started, he says:

“Govind, Vimal, and I are all computer science engineers, and we go way back. Govind and I are batchmates from college, and Vimal was a common friend. We always loved tech and tried our hands at various innovations, as well as participating and winning several hackathons. The idea for CoinSwitch came from one such hackathon.”

The three friends were working at Amazon, Microsoft, and Zynga. But the allure of turning their hack into a product set them on the path of entrepreneurship. Thus, CoinSwitch Kuber was launched.

Origins of CoinSwitch Kuber

While trading in crypto, the co-founders had seen the price of crypto varied slightly across exchanges, based on supply and demand. If users wanted to get better returns from the market, especially at scale, choosing the right exchange played a critical role.

So, they set out to build an aggregator of crypto exchanges, one which provided real-time data on the best prices and exchanges for a certain cryptocurrency to be traded.

“When we built a simple crypto exchange aggregator in a hackathon, we never envisioned it as a company. But when we launched the product online, we started seeing users come onboard. The simple and intuitive nature of the product was working since users needed simplicity in the crypto world,” he adds.

The goal was to make crypto easy to understand and accessible for the Indian masses. However, the Reserve Bank of India instructed banks not to support crypto transactions in 2018, effectively signalling a ban.

This forced Ashish, Govind, and Vimal to take the first product, which was known simply as ‘CoinSwitch’, to the global market. With Sequoia Capital backing them in a seed round, the journey began.

While the platform saw transactions worth millions of dollars globally, Ashish and his team’s hearts were still set on India. And the opportunity arrived in March 2020 when the Supreme Court overturned the RBI ban.

This spelt open season for CoinSwitch and a number of other Indian crypto exchanges such as ZebPay and WazirX.

“We put all our focus on India and launched CoinSwitch Kuber, an app just for this market. Our mission was to make crypto trading as easy and accessible as ordering food online,” Ashish says.

Simplicity is key

In just under two years, the platform has landed more users than other Indian crypto exchanges. Ashish attributes this to a simplified UX and the decision not to provide users with certain trading features.

“Other exchanges did a brilliant job as well, but their products were more aligned for traders who are used to seeing features like order books and buy/sell orders. We differentiated ourselves by targeting those who’d never seen an order book before and didn’t know what it was. So, we built ourselves for new retail traders and made all such complexities go away,” he explains.

Most crypto exchanges charge a transaction fee, but CoinSwitch Kuber is more of an aggregator. It doesn't charge users directly. Instead, it negotiates with crypto exchanges on transaction fees as a maker (which creates buy/sell orders for users, thereby creating liquidity).

“We give a fixed price to users and aggregate supply on the backend, Our execution engine is where the revenue comes from. But going forward, earning models may evolve as new innovations and regulations come into play,” Ashish adds.

Lending and withdrawals

Some of these new revenue models potentially include lending and staking features, which CoinSwitch plans to use some of the fresh funding for.

Although Coinbase recently got in trouble with the SEC due to its proposed lending feature and ended up dropping the idea, Ashish believes it can work out differently in India.

“Here, we look forward to working together with regulators and taking them into confidence. We will explain how and why we plan to launch these new features, and how it won’t be a problem for them. We will also clarify exactly how we will protect user funds and why these features can benefit India’s economy,” Ashish says.

Due to the lack of clear regulations around trading crypto, CoinSwitch recently paused crypto withdrawals for its users. This is generally seen as a move that goes against the ethos of crypto as self-custody of funds is one of the primary tenets of decentralised currency.

Although Ashish expects a backlash, he explains it is a temporary move that will be undone once the right regulations are in place.

“This was perhaps the hardest call we had to take. But regulators are worried about crypto being used as legal tender and hurting the sovereignty of the Indian rupee. Further, they are worried crypto can be used for money laundering and other illicit activities. So far, no one has figured out how to stop it, but disabling crypto withdrawals in a stopgap measure till the right policies come in place,” he explains.

Building an investment platform

Going forward, the founders look to turn CoinSwitch Kuber into a complete investment destination and platform with crypto and traditional financial instruments available for retail as well as institutional investors.

“We stand for investment and want to go beyond crypto. There needs to be an amalgamation between crypto and traditional financial instruments of investment. The younger generation, especially, will want to diversify beyond crypto. So, we aim to become an investment platform for the masses and simplify every use case,” Ashish says.

However, the platform for retail investors will be different from the product targeted at institutional investors. CoinSwitch maintains it cannot offer a retail platform to large companies and funds looking to add crypto to their balance sheets.

“A large fund would not feel comfortable keeping their crypto assets with us. Further, they’d require inbuilt dashboard access, escrow account features, etc. With the fresh funding, we plan to build a product for institutional investors and provide them with all the security and accessibility tools they’d require,” he says.

The investor connect

CoinSwitch Kuber sees this future as a paradigm shift in finance and the Internet, and believes its VC investors think the same way.

a16z, which is famous for making bold bets on “software that is eating the world”, is a case in example. “Our investors are some of the brightest and look at the bigger picture. There’s no playbook as such for crypto companies to talk to investors, but it is crucial to talk to those who understand this paradigm shift,” Ashish adds.

Interestingly, in 2013, a16z invested $25 million in Coinbase at a time when crypto companies in the US were finding it difficult to move forward amidst lack of clear regulation and inability to find bank partners. Coinbase went to give a16z its biggest exit yet when it went public earlier this year.

Now, a16z and Coinbase Ventures’ investment in CoinSwitch Kuber in India is taking place amidst a situation similar to the US in 2013.

In an upcoming bill, the government could define crypto and compartmentalise virtual currencies on the basis of their use cases, or mandate that all private cryptocurrencies, except any virtual currencies issued by the state, will be prohibited in India.

But market sentiment now suggests the former is more likely. Further, investor confidence and inflow of foreign investment from a16z and Coinbase Ventures could be an indicator of positive regulations and a generally bullish outlook towards the future of India's crypto market.

Edited by Saheli Sen Gupta