Checkout.com 2022 Report: MENA’s digital economy is evolving rapidly than ever

91% of consumers across MENA bought products online in 2021. Local consumers are now ordering meals online more frequently than ever. 82 percent of consumers in the region use some form of fintech app in 2022, up from 76 percent in 2021.

Checkout.com has released the second installment of its Digital Transformation in MENA 2022 report. It contains insights from Azadea, Lals Group, Al-Futtaim, The Chefz, Qlub, Wego, Tamara, Qlub, baraka, Visa and BitOasis.

Part one was launched last month. It included insights from 15,000 consumers in the region. According to a statement shared by Zawya, the next chapter interviews businesses and their leaders at the forefront of the rapidly growing digital economy.

“If our nearly ten years in the region have taught us one thing, it is that it’s impossible to underestimate the potential, drive and dynamism which exists in this diverse and rapidly changing region. It will be increasingly important on the global stage," said Remo Giovanni Abbondandolo, VP of Commercial, MENA at Checkout.com.

Retail

Ecommerce is hot. About 91% of consumers across MENA purchased products online in the past year. Of which, fashion and clothing making up 46% of all online purchases in the region.

One in 5 consumers across the region purchase retail products online more frequently than last year, with 33% shopping more frequently for fashion and clothing online.

This shows a rapid development of the digital ecosystem that allows all players from government to startups flourish, noted Paul Carey, Executive Vice President of Cards and Payments, Al-Futtaim Group.

“This is particularly evident in payments, where governments have set up regulatory sandbox infrastructure and made it easier for businesses in the region with more flexible visa options and commercial licensing,” he said.

Food & beverage

As per the report, in 2022, local consumers ordered meals online more frequently than ever. Over 53% of MENA consumers purchased food online in the past year, with 42% of consumers saying they are buying food online more frequently this year than in 2021.

According to Ramzi Alqrainy, Chief Technology Officer at The Chefz, a Saudi-based food delivery app, multiple moving parts need to come together in each transaction to facilitate smooth functioning of the online food ordering sector.

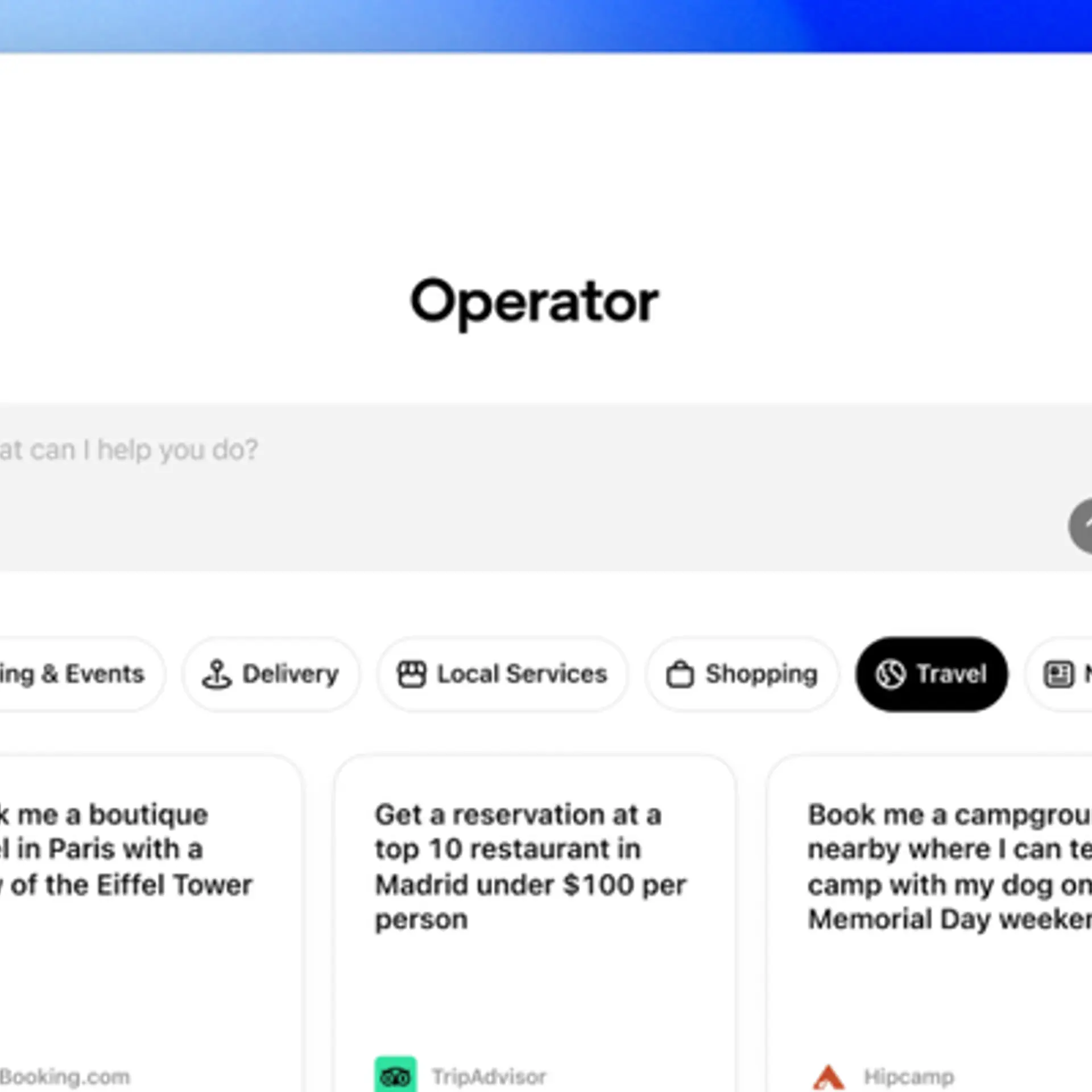

Travel and entertainment

Post 2020, the travel and entertainment sector is gaining momentum in this region. About 20% of MENA consumers bought entertainment services online, with 14% reporting frequent purchase now compared to the past year.

Moreover, 32% shopped for travel services online in the past year, with 21% of consumers buying them more often now than in 2021.

Alexandre Morin, Director of Payments - Risk and Fintech, Wego, a travel marketplace, said: “MENA has become a priority market for many of the world’s tourism boards as it’s a reliable source of long-stay visitors with excellent spending power.”

Fintech

Remittance apps remain the most widely utilised form of fintech in MENA, but as other products increase, so does adoption, added the report.

82% of consumers in the region use some form of fintech app in 2022, up from 76% in 2021.

Solutions like Visa’s Account Funding Transactions (AFTs) which pull funds from an account and for use on a pre-paid card, top up a wallet, or fund a person-to-person (P2P) money transfer, have supported the ongoing innovation.

“The secure, reliable, and fast movement of digital money between individuals, businesses and governments is the engine powering today’s global economy”, said Dr. Saeeda Jaffar, Senior Vice President and Group Country Manager for GCC, Visa.

In markets such as KSA and UAE, half of the consumers used Buy-Now-Pay-Later (BNPL) options this year and as many as 67% across MENA indicated they may use it next year.

Further, 55% of 18–35-year-olds in UAE and KSA would like to be able to pay for goods and services in crypto or stablecoins in the next 12 months.

“Previously, retailers viewed BNPL as just another payment method and often compared BNPL services to other payment providers, resulting in downward pressure on rates. However, we see retailers increasingly focusing on overall growth, including marketing, customer experience and product maturity. As a result, we see a win-win, sustainable partnership model,” said Sargun Bawa, VP of Growth at Tamara, the homegrown BNPL platform.

Edited by Akanksha Sarma