Esports startup Gamerji bets big on Middle East’s obsession with gaming to fuel growth

When it comes to gaming, the Middle East and North Africa are nothing short of hubs. This is why Indian esports startup Gamerji has zeroed in on the Middle East as its first international destination.

Over the past few months, gaming startups out of India—Gamerji and Jetsynthesys—are closely looking at expanding into the Middle East.

The gaming sector in the Middle East has clocked a revenue of $1.76 billion in 2021, and this will touch close to $3.14 billion in the next few years. Though the region does not have a large population, it has high spending power. Saudi Royal Prince Faisal bin Bandar bin Sultan Al-Saud is an avid gamer himself.

Earlier this year, Indian esports startup Gamerji announced that it was launching its operations in the Middle East—the next logical progression for the startup to grow outside the country.

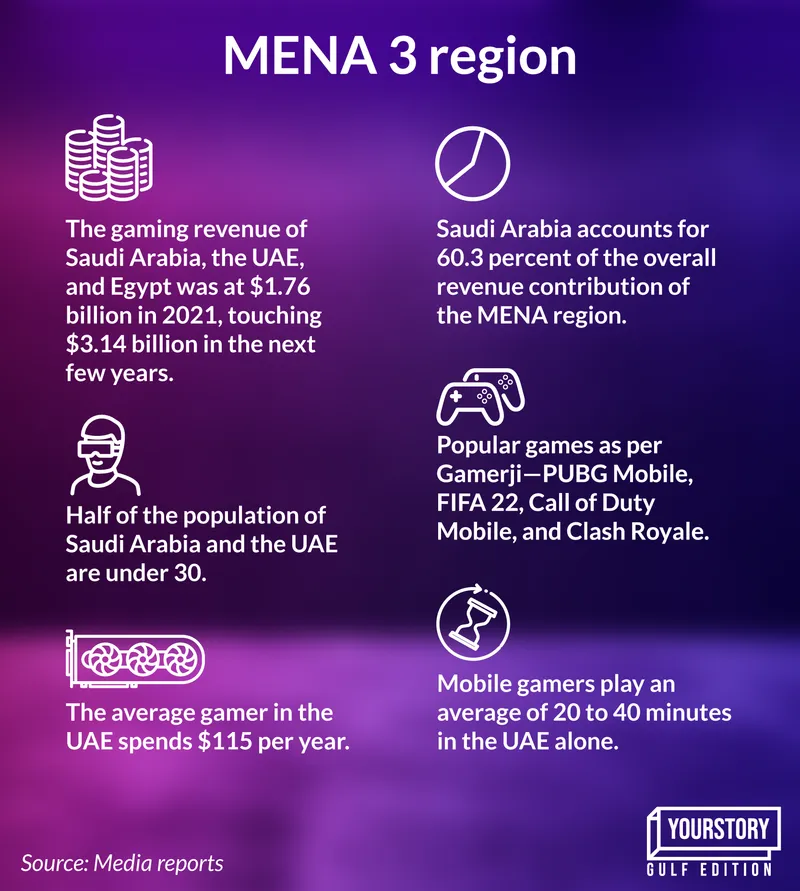

Over the past year, the region has seen quick adoption of esports. Daniel Ahamed, Senior Analyst, Niko Partners, says, that in the MENA 3 region—Saudi Arabia, the UAE, and Egypt—the revenue from the industry was at $1.76 billion in 2021, and is expected to touch $3.14 billion in the next few years. Saudi Arabia accounts for 60.3 percent of the overall revenue contribution of the MENA region.

“Of these regions, Saudi Arabia is a powerhouse as it has a large population with really high spending power. Another significant region is the UAE. While it ranks one of the highest in terms of revenue and user spends, the population representation is a little lower,” he explains.

Recognising the potential for a potential user base, Gamerji entered the Middle East.

The Gamerji office

The Middle East potential

“We realised a wider gap in the market for instantaneous tournaments (where games and tournaments are played directly on social media or online) in regions where there is fewer audience but higher business potential. The lack of traction does not allow gamers to participate at will and most of the tournaments are scheduled at a future date,” says Soham Thacker, Co-founder and CEO, Gamerji.

He explains that as a gamer, you want to play now and not on a random day.

“This is where Gamerji is trying to build a large user base from India and cater to cross-border tournaments in other regions. We saw an opportunity and decided to choose the UAE and Saudi Arabia as our first two markets outside India,” adds Soham.

Late last year, W Ventures, a gaming-focused fund, announced that it would be investing $50 million to build esports and gaming infrastructure in Dubai.

According to an accounting and business report, close to half of the populations of Saudi Arabia and the UAE are under 30. The average gamer in the UAE spends $115 per year, which is at par with the global average of $116 per year. An AdColony report adds that gamers play an average of 20 to 40 minutes on mobile video games in the UAE alone.

Soham explains the primary advantages of the Middle East are industry growth, higher-paying audience, and minimal competition. JetSynthesys, too, is eyeing the market. While Gamerji did not disclose the kind of revenues it is expecting from the region, the team stated it is significantly bullish about the market.

“Also, since Gamerji is not a real-money gaming platform, it is legally approved in the Middle East and also among the game publishers. We plan to run the Middle East operations remotely at the moment. However, in the future we would look to set up a marketing and partnerships team in the region,” he adds.

Showcasing gaming skills

Gamerji is an online esports platform for gamers to compete, host matches, communicate, and show their gaming skills. It targets more than 99 percent of the gaming audience who does not get a chance to compete in the professional leagues and can’t show their skills due to the lack of proper tournament infrastructure. Some of the popular games for Gamerji in the middle east include—sPUBG Mobile, FIFA 22, Call of Duty Mobile, and Clash Royale.

"Being an avid gamer myself for over 20 years, I never got an opportunity to take my passion forward. This is where a virtual tournament platform gives accessibility to the gamers to make more from the hours spent,” says Soham.

Speaking of the Middle Eastern markets for gaming Salone Sehgal, Founding-General Partner, Lumikai Fund—a gaming-focused fund, explains,

“While the size of the market may seem small, if you look at Saudi Arabia, it still is the highest ARPU market in the MENA region. The Middle East is predominantly a consumer market today. There hardly is any supply, hence for Indian companies that have already established a successful model in their domestic markets, the consumer base of the Middle East will seem significantly attractive.”

What helps this push, according to Niko Partners is that close to half of the MENA population is under 25 and have grown up as digital natives, with gaming being a significantly high portion of their entertainment.

The royal play

Apart from that, Daniel says, “Governments in the region are supportive of the video game sector. Saudi Arabia and the UAE have introduced policies to encourage game localisation, local game development, new studios, and offices of international game companies, and hosting major esports tournaments.”

Salone adds, “There are a lot of concentrated efforts by the governments in the UAE and other Middle Eastern countries to encourage companies to come and scale in the region.” According to Global Newswire, the middle eastern gaming market is expected to grow at a compound annual growth rate of 13.88 percent during 2022 to 2027.

Saudi Royal Prince Faisal bin Bandar bin Sultan Al-Saud is the President of the Saudi Esports Federation (SEF) and the Vice President of the Global Esports Federation. An avid gamer himself, the Saudi royal has contributed significantly to the expansion of esports in the region. In an exclusive interview with the Arab News publication, the Prince said,

“We have always said that gaming and esports are the ultimate social activities. They are not bound by space or borders. At GEF, we truly embody this belief through our mantra of #worldconnected. Our goal is to cultivate competition along with developing communities and the connection between sport, esports and technology.”

Gamerji’s MENA strategy

So far, for Gamerji, the strategy for growth has been kept simple—gain maximum users from India and leverage upon the traction to provide instantaneous tournament experience to other regions which have larger business potential.

The first version of Gamerji was conceptualised and built by Soham along with the CTO Valay Patel. After launching a beta version in July 2019, the team had significant learnings from the early adopters of the platform. Gamerji was officially launched in October 2019 while conducting tournaments for just two games at the time.

“To onboard any new game, we first conduct research on the popularity and esports compatibility. Once we have established the understanding, the game is integrated on the platform and tournaments are hosted,” says Soham.

As a startup in an emerging industry, the co-founder says the team initially faced challenges to create awareness and also gain necessary integrations. While the team had just barely started growing, the company saw an unforeseen surge during the first COVID-19 lockdown.

While the team battled this hurdle out, one of the most popular games in India (PUBG Mobile) was banned and their fundraising came to a halt.

“Multiple hiccups and learnings have made us into the platform which is now serving more than three million gamers and hosting tournaments for more than 20 games,” he adds.

The team has now launched in the UAE and Saudi Arabia and will soon be launching in other gulf countries. There will also be efforts to build local partnerships for offline tournaments and collegiate leagues.

“We plan to expand to other countries in the Middle East and Southeast Asia within the next 12 months,” adds Soham.

Edited by Kanishk Singh