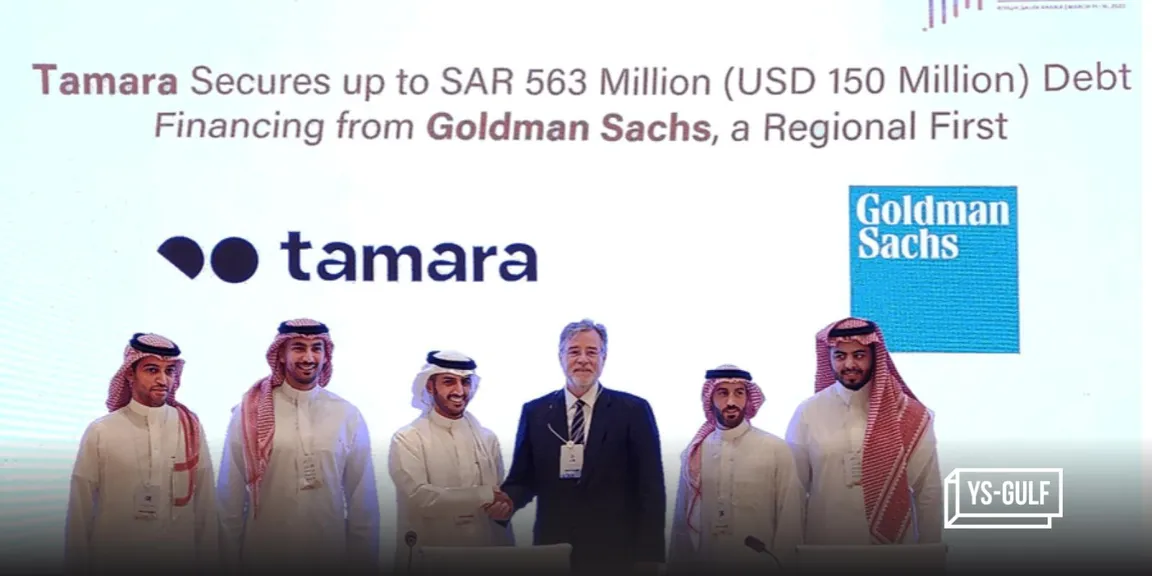

Saudi's Tamara raises $150M debt financing from Goldman Sachs

With this funding, Tamara aims to finance the demand for its flagship BNPL product and continue its growth across new verticals.

Saudi Arabia-based fintech startup has raised $150 million in debt funding led by Goldman Sachs. With this funding, the total funding raised by Tamara touches $366 million since its launch in 2020.

The company will use the funds to finance the demand for its Buy Now, Pay Later (BNPL) offerings and growth across new verticals, it said in a statement. The deal is the first of its kind in Saudi Arabia, according to Abdulmajeed Alsukhan, Co-founder and CEO of Tamara.

Since its launch in 2020, the company has had six million customers across Saudi Arabia and other GCC countries like Kuwait, Bahrain, and the UAE, the company said.

It also works as a commerce enabler for over 15,000 partner merchants across online and offline fields. It counts IKEA, H&M, Noon, Shein, and Jarir, among others, as clients.

Tamara's mission is to empower people in their daily lives and revolutionise how they shop, bank, and pay.

According to the company, the region is still developing with cash on delivery prevalent in ecommerce and low credit card penetration compared to global markets. The population in Saudi Arabia is skewed towards the youth who comprise nearly 70% of the country's population, it said.

For any press related queries or to share your press releases, write to us at

[email protected].

Edited by Akanksha Sarma