Startup Valuation: Valuing your business idea in uncertainty

How would you value your disruptive startup when you aren’t sure how many customers would buy your product in 2 years from now? Do you know if you’ll have competitors? Are you confident your costs would remain as predicted in 2 years? Startup Valuation has always been a subject of mystery for entrepreneurs. For most, it is a black art that a VC practices day-on-day on startups. For others, the value of your startup hinges on your negotiation skills (which is probably more predictive of your success!). Venture decisions are structurally difficult given the countless moving-parts and uncertainties. Analysts keep it simple and intuitive, combining their industry expertise with valuation models such as Market Multiple model, Discounted Cash Flows, etc. Is there a better method to structure this black art? At the risk of being bashed for bringing analytical rigor into Venture valuations, I’m going to apply a pretty neat concept from a course at Stanford - Decision Analysis. Consider a hypothetical startup … (looks around for an idea) … say, OurStory.in!

The Decision Analysis Approach

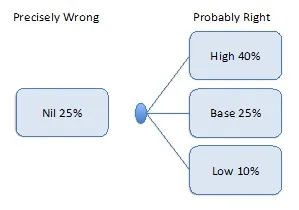

So, Decision Analysis… sounds fly. Really what is it? It’s simply the science of using probabilistic frameworks to determine your best decision in times of uncertainties. Instead of claiming to capture 5% of market share over 2 years, DA would say you have a 40% chance of capturing 7% of the market, a 25% chance on 5% of the market, a 10% chance of 3% of the market, and a 25% chance at 0% share (refer fig 1). These ranges structure intuition. This way, you have taken into account factors that influence low sales of your product with professional judgment. How do you come up with these probabilities? Lets look in a bit. The implications of these are tremendous.

How do I use it for my startup?

By this time, you should’ve stripped apart your business model, understood it in and out and analyzed influencing factors. I have kept it as simple as possible for OurStory.

Step 1: Determine the key drivers of value - readers of tech blogs, competition, International Market, website features etc. If these factors further depend on more factors, break them down account for their interdependencies. Influencing factors reflect how well you understand your business model. In Fig 2, I’ve broken it down one level.

Step 2: Estimate the probability of the each factor. This is easy if you’ve been in the industry. If not, make initial assumptions and keep refining it over time by talking to people, researching online etc. The net success rate at this node is the product of individual probabilities.

Step 3: Repeat step 2 at every node and create the decision tree as show in Fig 3.

Put in your revenue and cost numbers in each scenario by assuming a base value (50th percentile case). You can also choose to be pessimistic where you perform low (refer to “Low” case in Fig 1) at certain nodes. What advantage does this give over other methods? You can perform a sensitivity analysis by varying your confidence at every node and creating a best-case to worst-case scenario valuation model. Sensitivity analysis focuses due diligence. Which means, the more you understand your influencing factors, the more confident you become about your probabilities.

Next, simply use a discounted cash flow model to get your exit value at every scenario and calculate your MoI. The Probability weighted MoI incorporates the MoI with the probability of the scenario. The total pwMoI can be used as a criterion for investment decision.

There have been a few instances in research where Decision Analysis has been used to value venture projects, but they are far too analytical and overcomplicated for business use. Based on my conversations with Clint Korver (ULU ventures) and Prof. Robinson Burke (Stanford University), this form of DA makes most professional sense.