The Indian Online Payment Story: Are Indian Consumers Really Waryof Electronic Payments?

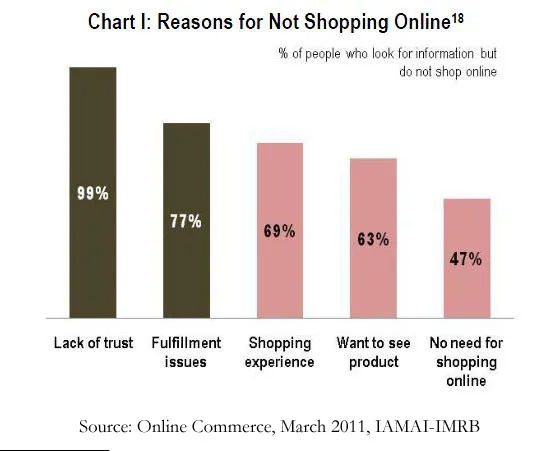

In one of the earlier articles we had discussed at length how the e-commerce and e-tail space in India is set for huge growth in market value over the next few years. In the same article we touched upon the fact that online shoppers in India are still not comfortable with spending money online and prefer a COD option.

However, it will be wrong to say that Indian consumers are completely wary of making online payments. In case of travel portals, which incidentally account for the largest share of online sales in the Indian e-commerce space, all payments are made online. So, it is not just the payment option, but the actual service or product that makes the real difference. If the consumer has confidence in the product delivery capabilities and customer service of the company, then they will be more than happy to make an online payment.

For any e-commerce company, one of the key objectives should be to increase consumer confidence in online payment. The only way to do this is, by streamlining their delivery mechanism and ensuring that there is minimum delay in delivery. Most e-commerce companies use third-party services for delivery and consequently have very little control over the quality of delivery. A big player like Flipkart has managed to build a dedicated internal team to take care of delivery, but not everyone will be able to do that.

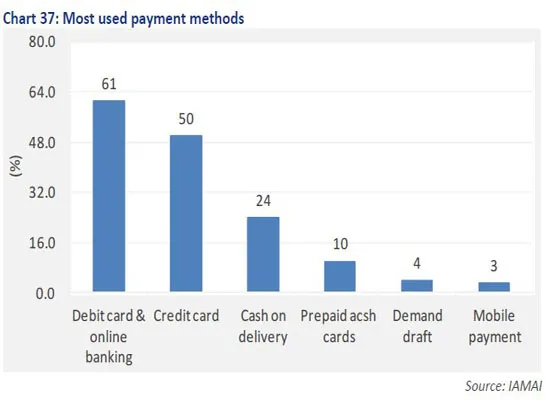

It has been widely said that Indian consumers prefer the cash on delivery (CoD) option over other modes of payments. This is true to a certain extent, but if we look closely at the numbers from the Online Commerce report released by IAMAI-IMRB, 61% of consumers use debit cards and online banking to make payments. Credit cards are the second most used mode of payment at 50% and cash on delivery is at third with 24% consumers choosing it as the mode of payment.

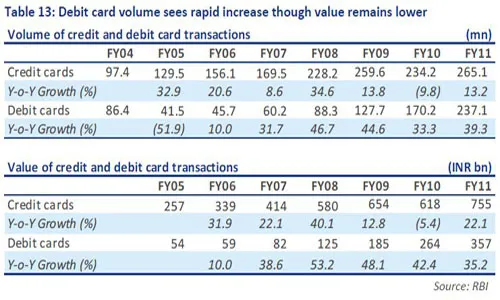

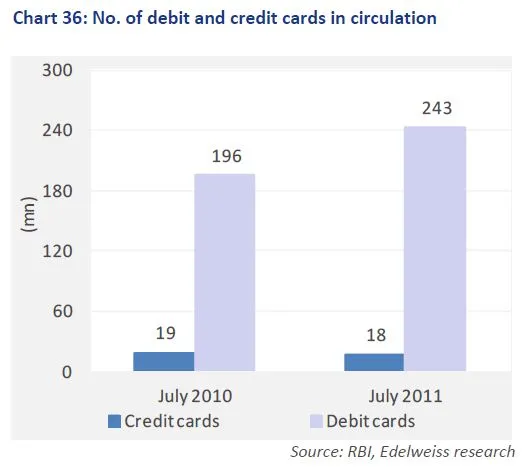

Reserve Bank of India (RBI) stats show that credit card and debit card usage, both in terms of volume and value, has been steadily increasing over the past 4-5 years. In the 2011 FY there were 265.1 million credit card transactions, which accounted for INR 755 billion, and 237.1 million debit card transactions, which were valued at INR 357 billion. Also, there are more than 260 million debit and credit cards in circulation in India presently. Electronic payments have been growing at 60% in India over the last three years. Add to that the fact that India has been one of the fastest growing countries for payment cards or prepaid cash cards in the Asia-Pacific region.

E-commerce can truly become a success in India only if online payments become the norm rather than the exception. Payment options like cash on delivery, prepaid cash cards, etc cannot be the primary payment methods, as these cut down the margins of an e-commerce company to a great extent. Cash on delivery also means that there are chances of consumers returning products and a longer sales cycle, which is not good for business.

We will be keenly following the developments in this space. Watch out this space for more updates about e-commerce, online payment, et al.