PayZippy’s online payment facility launches on Flipkart

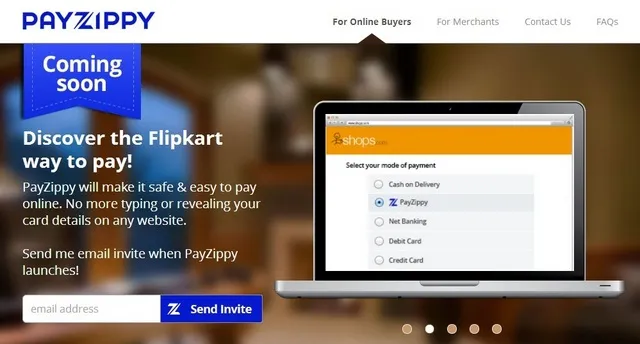

Online shoppers in India will no longer need to repeatedly input card information across sites. A new product from PayZippy allows users to store their credit and debit card information and use it for making online payments on partner merchant sites. This customer-facing product, which promises to let users enjoy a faster, smoother and safer online payment experience across a range of merchants, launched today (18 December 2013) on Flipkart Payment Gateway Services (FPGS) Pvt. Ltd.

PayZippy assures customers that they store only the card number, card-holder name and card expiry date. “We do not store your card's CVV number or 3D Secure password. Your card details always remain encrypted and secure with PayZippy. Our systems have undergone stringent security audits (including PCI DSS) by industry experts,” says their website. Currently, the service lets you save details of up to 10 cards.

Besides Flipkart.com, customers can use PayZippy across merchant sites like MakeMyTrip, BlueStone, LensKart,Travelyaari, Zansaar, Trendin, Justeat, Lenskart, Yepme and Babyoye. Soon, other large online merchants in India will also have it. They have launch offers like cash backs, discounts on transactions and gift vouchers on the merchant sites for the early birds.

“With PayZippy we have actually reduced the time taken for making online payments by 50%. We are expecting at least 150,000 customers to sign up for this service within the first month and our target is to get 1 million customers by next June,” Mekin Maheswari, Head, Payments and Digital Media, Flipkart.com said on the launch. PayZippy for merchants, which launched earlier this year, has been rigorously tested on Flipkart.com.

Sanket Atal, Chief Technology Officer, MakeMyTrip.com, also expressed delight on partnering with PayZippy. “PayZippy serves an urgent need in the eCommerce marketplace for a customer-centric payments product that is both convenient and secure. We expect this to strengthen customer confidence in online payments,” he said.