Startups beware, the taxman has an eye on your foreign company

Atul Sharma is the sole owner of a technology company based in Hong Kong. Most of his clients are based out of the USA and other countries. This was one important reason behind his decision to register his company in Hong Kong – that his income will not be taxed in India.

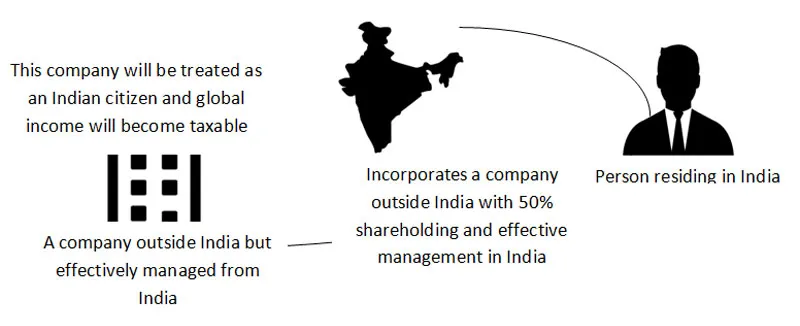

Like Atul, many start-ups incorporate companies outside India to avoid taxes. Things were going good for Atul and his ilk, until finance Minster Arun Jaitley tweaked the rules of taxation in his 2015 finance bill. According to the new rules, Atul’s off-shore office is no more a foreign company, but will have to pay taxes like any other Indian entity.

Ending the trend

The trend of incorporating companies outside India to shift the tax liability has been restricted by the new rules of taxation. Also, prosecution and penalties have been made stringent: if you forget to disclose any of your foreign assets (even shares in a foreign company) when filing your income tax return; then your slip could turn your property into an illegal asset.

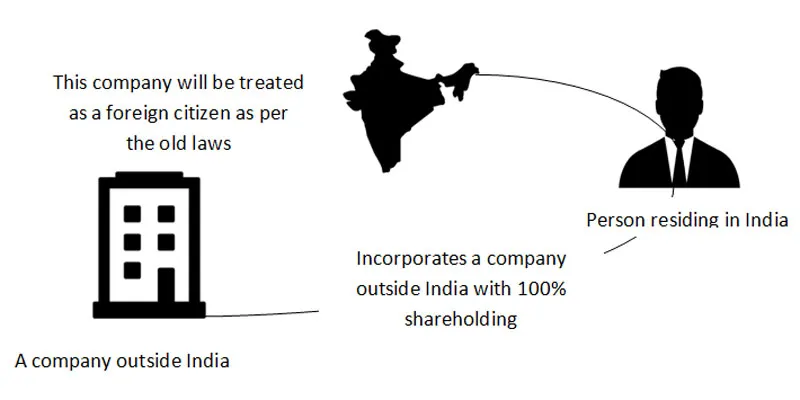

Situation before the rule

As per the old rules, if a company is incorporated outside India, then the company is treated as a foreign citizen; even if the entire share capital is held by persons residing in India. This was a loop hole in the law, which was being leveraged by professionals, businessmen, and the startups.

As per the new rule, if the effective management of a registered foreign company resides in India, then the company will be treated as an Indian resident, and its global income will be taxable in India. This rule has a far-reaching impact on the startup industry as well. Now, any company which is being treated as resident should comply with all the legal formalities under the law like TDS, etc. If it should fail to comply, it will be treated as a defaulter and penalised.

Precautions and procedure to follow

The following steps should be taken in order to comply with the new rule.

- Check the impact on yourself: The first and foremost step is to check whether this rule applies to you or not. You could take the help of a tax professional.

- If the rule applies to you then treat your company as an Indian resident and start complying with the Indian norms. The initial steps in this case would be to:

- Apply for PAN: The first step is to apply for a PAN card for the foreign company and declare it as an Indian resident.

- Apply for TAN: If you have payments to be made on which TDS is deducted then you should have TAN number, to redeposit the same to the Government of India. Note: when you are making any local payment in the foreign country the amount will be treated as a payment outside India.

- File income tax return: The company will have to file an income tax return in India, as well as, for the foreign income. Note: ITR has to be filed irrespective of whether the company has any income or not.

- Other Formalities: If we could list down every formality the list might be too long. It is always recommended to get a legal opinion on all the formalities.

Conclusion

Laws are dynamic and will keep changing. There is a very well-known quote of Charles Darwin: “It is not the strongest of the species that survive nor the most intelligent one but the most responsive to change.” Hence, it is advisable to accept the change, comply with it, and go win the world.

(Disclaimer: The views and opinions expressed in this article are those of the author and do not necessarily reflect the views of YourStory.)