Powai based LoanStreet offers a complete e-commerce experience in the financial services

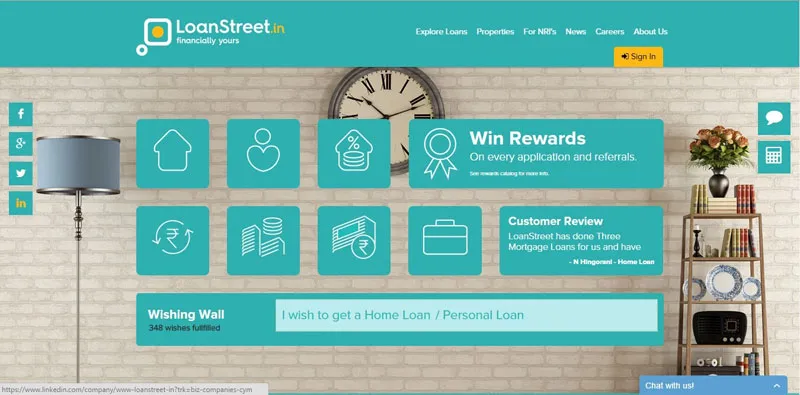

"God help those who buy houses on loans,” says Vineet Jain, CEO and founder, LoanStreet, talking about the pressing need for an all-inclusive financial platform in the loan segment. Started this year, LoanStreet.in is an online marketplace for financial products – ranging from personal loans and home loans, to complex products like lease rental discounting. The one-of-its-kind platform offers the customers the complete support of professional relationship managers until the loan is disbursed and the amount is credited in their account, for a hassle-free total experience.

Founded by industry veterans with thorough domain knowledge, the company’s back-end algorithms, superlative recommendation engine and predictive analysis ability herald a new era in consumer-focused financial solutions in India. With its association with all top financial institutions of the country, LoanStreet has a great pool of choices available to customers for consumer loans, including unsecured loans.

Based in Mumbai, LoanStreet has branch offices in Bengaluru and Indore. It is pioneered by Vineet Jain, Prashant Hegde, Ramendra Mishra and Ajit Pandey. Vineet and Prashant have plenty of experience in managing customer processes, and in the distribution of retail loans in India. Ramendra heads Operations and Ajit is the techie with sound e-commerce experience.

Vineet Jain says,

Through our professional experience, we identified that in India, online facilitation of loans is the need of the hour, both for end customers, as well as lenders. Customers need an advisory platform, beyond normal comparison sites, with an end to end service approach, and lenders need an online distributor with a presence in major cities. With LoanStreet.in, we aim to plug this gap, and also to act as aggregators for the largely unorganized channel partners in the market.

Vineet Jain is a career banker, and has 12 years of experience in this field. Prior to this venture, he was the Zonal Head for Home Loans at Bajaj Finserv and led the portfolio for Western and Central India. He was working across multiple geographies and varied distribution platforms. He has also been associated with other renowned brands like HSBC, ICICI Religare and GE in sales and marketing roles.

Beginning of LoanStreet and early days

In June 2013, when Vineet was a part of the Bajaj Sales Team, his Marwari genes began crying out for an entrepreneurial venture. He therefore made the courageous decision to quit, and start something on his own. He recalls,

The first three months after quitting my job were tough, since I had a concept in mind but I was directionless. Later, my then-colleague Prashant Hegde, and I, started Homeandloan.co.in, as partners with our respective wives. We sourced business for banks through our contacts and made good revenue. After nearly 10 months of thorough understanding and ideation, we created the platform, LoanStreet.in. We are a team of 30 people now, and still growing.

Since its public launch on 14th May 2015, LoanStreet has catered to 6000+ customers and processed 250+ loan applications, 120 personal loans, and 10 mortgages/ home loans with a total disbursement of INR 11 crore so far.

BankBaazar.com, which was started in 2008, is the biggest competitor in this segment. Speaking of competition, Vineet adds,

We make sure that the customer conversion rate is always high, and maintain it through our comprehensive online platform. The need is beyond just a comparison platform. An end-to-end trusted platform is who we are. We want to simplify the whole process and give the customers a wholesome experience. Our USP is that we ensure that customers get the perfect blend of the right lender, right price and right experience on their fingertips.

LoanStreet’s integrated CRM system gives customers complete charge of transaction, through status updates on email and SMS. It also offers a customized rewards and referral programme that gives gifts to the customer at the end of the journey, and a personalized dashboard during. In addition, users can avail of an online chat facility and on-call financial advisors for assistance anytime.

Future plans

LoanStreet aims to expand to 17 locations across India soon. Also, they plan to develop Specialised Eligibility Assessment Tools for the self employed segment. Mobile apps in Android and iOS are also being developed to ease the process via mobile phones. LoanStreet aims to become completely paperless by providing tabs to the entire team and facilitating the whole transaction process online and thus making it a seamless experience.

Check out LoanStreet for more details.