What kills you and me makes us stronger

“The phoenix hope, can wing her way through the desert skies,

and still defying fortune's spite; revive from ashes and rise.”

- Miguel de Cervantes

The phoenix is unreal, but that does not make it a lie. It is a myth, a metaphor, a story which reflects the wisdom of generations, the time tested profound truths in an otherwise impermanent world.

The opposite of a fact is a lie, but the opposite of a profound truth is another profound truth. There could be one profound truth about some entities, and there could well be another contradictory profound truth about the system as a whole. It is true that all parts of the phoenix has been turned to ashes, but it is also true that the phoenix - like the ship of theseus - exists. What has really burned in the phoenix is its beaks, talons, feathers, and other body parts. They are ephemeral, and dead. But the system phoenix lives, and thrives.

Please mishandle

There are fragile things (and entities, systems, concepts) - which break under stress or disorder; and there are robust things which don’t (easily) break under stress or disorder. And then there are things that aren’t just immune from disorders, but actually gain from them. Such things - as Nicholas Nassim Taleb would put - are antifragile. Phoenix is antifragile - burning in the fire only enlivens it. Other examples of antifragility range from biological evolution (mutations over long periods weed out weaker organisms, thereby increasing fitness of species), to airline industry (the overall efficiency of the industry actually improve after a mishap - since the nature of the industry is such that after each mishap anywhere, the whole industry attempts to corrects itself of that mishap).

And an (ideal) startups ecosystem is antifragile. Startups fail, but the startup ecosystem thrives. Each startup is but a part of the ecosystem, which is a part of the economy, and which in turn is part of the society; and the success of the whole depends inevitably on culling of many of its parts.

And this is where the game changes. With the failure rates of over ninety percent in startups - which is a necessarily evil for a thriving ecosystem - how could the entrepreneurs be motivated to carry on? An entrepreneurs must take pride not just in personal successes and failures, but being the part of the grind to begin with.

Entrepreneurs should be treated like soldiers. In a war many soldiers inevitably die. But that doesn’t make them a failure. Everything is not about your own petty ego - there must be honor inculcated in trying and failing, and trying fast and failing fast, and trying better and failing better.

Moreover, a given startup itself can also be seen as a system - as much as society, or economy, or startup ecosystem is a system. With this zooming in, the success of this system startup depends on the culling of its many non-working parts, viz. business models, target market, coworkers, VCs, internal culture, etc. Apple, arguably the company most respected for its design, did not start out with the sleek Macs and iPhones we see today. It started with a rather dull and ugly product.

This was Apple I, in 1976. It had no case, no power supply, no keyboard, no screen. There is nothing in common with the Apple I and the Apple products we see today, except the brand name, of course. In sculpting an elephant, you chip away everything that doesn't look like an elephant, and what's left is an elephant.Skin, not stakes

What happens when you are asked to cut the branch of the tree, but you don’t know how to climb the tree. No matter how well-meaning you are, the branch will still remain affixed, since you’re the fish who has been asked to climb a tree. You don’t have a skin in the game. And neither do you have stakes.

Now just because you happen to take a stroll around the trees doesn’t put your skin in the game either. An unassuming passer-by might take you for an expert in all things trees, and you might be celebrated for your tree punditry. You now have stakes. But you still cannot kind climb that tree, and you still don’t have skin in the game. Just like so many consultants, and policy analysts, and investment bankers, etc. Therefore, following the psychologist Gerd Gigerenzer’s heuristic, never ask the doctor what you should do. Ask him what he would do if he were in your place. You would be surprised at the difference.

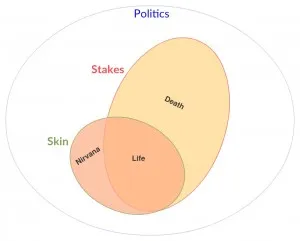

But then, what happens if indeed you know how to climb the tree, and are asked to cut the branch of the tree you happen to be sitting on? Unless you are kalidasa, chances are that you won’t do it. You do have skin, and you do have stakes. The tobacco industry has a long history of hiding negative health impacts of tobacco and exaggerating some of its flimsy immediate effects. The oil and gas industry has a long history of supporting climate change denial movements. This is not surprising, since they were sitting on the branch of the tree which was meant to be chopped off. How could they? They had skin, but they also had stakes. This is real life.Notice the Nirvana in the skin-stakes scheme of things. This happens when the skin is high and stakes are low. When there is an element of detachment with the thing that you can die for. The higher this Nirvana, the higher the antifragility in the system.

What should VCs eat for dinner?

The antifragility describes the survivability of things that last long. But to create a normative model- that is how to benefit from it- is not trivial. Peter Thiel talks about the power law nature of the startup ecosystem, and specifically how startup funding (should) work. He promotes a heuristic in which the expected returns on any given investment exceeds the whole portfolio. In simpler terms, the idea is to favour a system of investments in which each startup carries a huge risk of failure, but the profits - if they happen to hit the admittedly small window of success- are exponential.

Peter Thiel is a man of his words. He co-founded PayPal and Palantir, was the first investor of Facebook, started a fellowship to encourage young students to dropout and startup, and even has funded a whole new floating city outside any government control; and therefore can hardly be called a maverick. What differentiates him is his taste for black swans- or rare phenomenon (technology, or events, or startups, etc.) with high impact. When many others are fighting for staple food, he waits for his favourite black swans on his dinner table.And the existence of black swans is what makes the game highly impactful, even profitable. It bets on the culling of most mediocre ideas, and the thriving of rare few brilliant ones. It promotes a philosophy of (almost) all or (almost) nothing, of moonshots and antifragility.

‘The three most harmful addictions are heroin, carbohydrates, and a monthly salary.’, Taleb signs off.

References –

- Nassim Nicholas Taleb, 2012, Antifragile, Random House

- Nassim Nicholas Taleb, 2007, The Black Swan, Random House

- Peter Thiel, Zero to One, 2014, Crown Business

- Eric Ries, 2011, The Lean Startup, Crown Business

Related Essays –

What a piece of work is a man!

Following your passion and other absurd ideas