An effective 10-minute pitch template for social enterprises

I have seen a >25 page investor deck too many times, where I never have enough time to read till the end. Or a 1-page executive summary page, that doesn’t tell me enough to create a hook. Investor decks for startups of any kind need to be crisp and to the point. Social enterprises need to prove much more than a mainstream startup in their decks though. Investors want to know five main things: 1) Who are you? 2) What is the problem statement? 3) How is your solution the most effective one? 4) Is your business going to be sustainable while creating impact? 5) Will you scale?

Here is a template that I have seen work wonders – it helps you tell a compelling story in just 11 slides, bringing out all the key points that investors look for. You can use this for both delivering a 10-minute presentation at an investor showcase/demo day, or for sending your deck via email. I recommend this flow to weave a coherent story, but you can move the slides up/down as per your preference. You can also split a given slide into two slides as well, as long as it doesn’t double the time it takes for you or investor to go over.

Key overarching points:

a. Use pictures of your product, pictures from the field, pictures of your team, flowcharts to explain your business model, relevant cartoons, etc.

b. Leverage the Smart Art feature from Power Point to include lists, tables, flowcharts, processes, graphs, growth.

c. Use bullet points and very short sentences. Don’t be verbose.

d. Get all your spellings right.

e. Use font size 16 or below.

-1. The master slide:

Before we start with the actual slides, make sure you format your master slide perfectly:

a. Include your logo in the master slide so that it shows up on all your slides in the exact same place. The logo is most commonly placed in the top right corner.

b. Use slide colours matching your company colours/logo.

c. Do not forget page/slide numbers! This is a pet peeve for most investors. Use auto generated slide numbers, not ones you have to add manually. These are best placed at the bottom left corner.

0. Slide 0: the title slide

Yes there is a slide 0! This might be an obvious slide, but getting all the required info here is crucial.

a. Company name with logo: Investors like to see the registered Pvt. Ltd. name of the company (if you have one). If you want to be known by a brand rather than your registered company name, then include your brand as the main name, and the registered name of your company under it.

b. Contact details: Many entrepreneurs leave this for the last slide, but most investors don’t even reach the last slide while looking through your deck, so it is best to have contact details on both the first and last slides. Include your name, email address, and website URL. Basically, you want to make it as easy as possible for the investor to reach you.

c. Date: Your deck will change with time, so you have to make sure to version it. That doesn’t mean adding ‘v1,’ ‘v2’ in the file name, which looks extremely tacky. This also doesn’t indicate any actual timeline. Add a date in the first and last slide, and keep it in the MMYY format.

1. Slide 1: Problem statement and impact potential

a. Problems: Here is where you talk about the plight of your customer segment or problem/gap in the market that you’re turning into an opportunity and designing a solution for.

i Explain the nature of the problem and quantify it (how many people affected, what is amount of crop wastage, etc.).

ii. What is the potential market size in your country and globally?

iii. Use charts/statistics/pictures.

b. Current solutions in the market: Very briefly mention one or two main solutions already there in the market (if at all), and why newer solutions are needed. The purpose of this slide is

i. Who is currently catering to these problems?

ii. What is the gap in these offerings? Is the price too high? Is it not suited to the customer’s needs?

iii. Don’t shy away from using the existing solution provider’s name/offerings, but do it respectfully.

c. Since you are a social enterprise, the impact your business will create should be clear in this.

2. Slide 2: Company overview

This is the first look at your company – a slide summarising your innovative solution to the above problem!

a. Describe your company in two to three lines, summarising how it addresses the aforementioned problems.

b. Clearly cite your target customer segment – for example, farmers with less than one acre of land, or, expecting mothers in low income settings.

c. State the vision you have for your company: This is a big picture statement, but shouldn’t be too general like ‘eradicating poverty from the world.’ It should be specific to your product and your target segment, such as “Ensuring reliable and affordable supply of irrigation water for small and marginal farmers.”

d. State your mission statement (optional): This is a more tangible version of your mission statement, and usually has a timeline attached to it, which should be in line with the investment horizon. For example: “In five years, we intend to reach 100,000 small and marginal farmers across Maharashtra and Gujarat in partnership with stakeholders such as distributors, farmer cooperatives, agri universities, and non-profits.” This gives a good idea of your planned scale right up front. Make sure this number looks plausible and is not insanely large.

3. Slide 3: Your product/service

a. Products:

i. Describe your main products including their purpose and pricing.

ii. Show pictures of your products.

iii. What stage is the product in: R&D or prototype or clinical testing or commercial rollout already done.

iv. Mention any patents that you have or intend to file.

b. Services:

i. If you’re a service business, describe your offering including your distribution model (how your offering reaches your customers).

ii. What stage is your service in: pilot planned or successful pilot complete or already generating revenue.

iii. Show pictures from the field.

c. Competition:

i. If there are many players in the market offering similar products/services as you, create a separate slide to detail how you are different/superior.

ii. Compare price.

iii. You can create a table with the main features to show how you shine against them.

4. Slide 4: Business model

This is an extremely important slide, which can make or break your case.

a. Implementation/execution strategy:

i. Startup successes are all about great Execution, Execution, Execution. Use this slide to demonstrate that you’ve thought through your go-to-market strategy, distribution strategy, on-ground partners, customer awareness, etc.

ii. Mention any parties that you’ve been talking to.

b. Revenue streams:

i. Businesses often have two to three diversified revenue streams. This is generally a positive, but make sure you’re not doing too many things that require different skillsets early on in your business.

c. Cost structure:

i. Highlight your main costs – COGS, manpower, sales, marketing, business development, R&D, etc.

ii. Think about this on a unit economics level. You can also describe how cost structures will get optimised with scale. For example, manufacturing 10 units/day may cost you INR 100/unit, but manufacturing 10,000 units/day will cost you only INR 80/unit.

5. Slide 5: Unit economics (in tabular format)

a. Define your unit first – is it a clinic, a training centre, or a hub-spoke cluster?

b. Unit economics are especially important in brick and mortar social enterprises – if your unit economics don’t work right now, then you will find it extremely hard to make it profitable at scale as well.

c. Ninety-nine per cent of the investors will not be convinced if the unit economics don’t look robust.

d. Unit economics can give you a good way of measuring profitability later – that is five out of 10 clinics have achieved break-even in six months each.

6. Slide 6: Progress thus far

Execution (pricing, distribution, financing) is often the main risk in social enterprises, so the more you’ve already implemented on the ground, the better. Use this slide to show how far you’ve come, perhaps without much marketing budget. Cover the following:

a. Pilots done/milestones achieved.

b. Progress made on product development if any.

c. Number of customers served till date/products sold till date.

d. Key clients serviced/partnerships forged

e. Pictures of operations/camps, etc.

f. Hiring progress (team size).

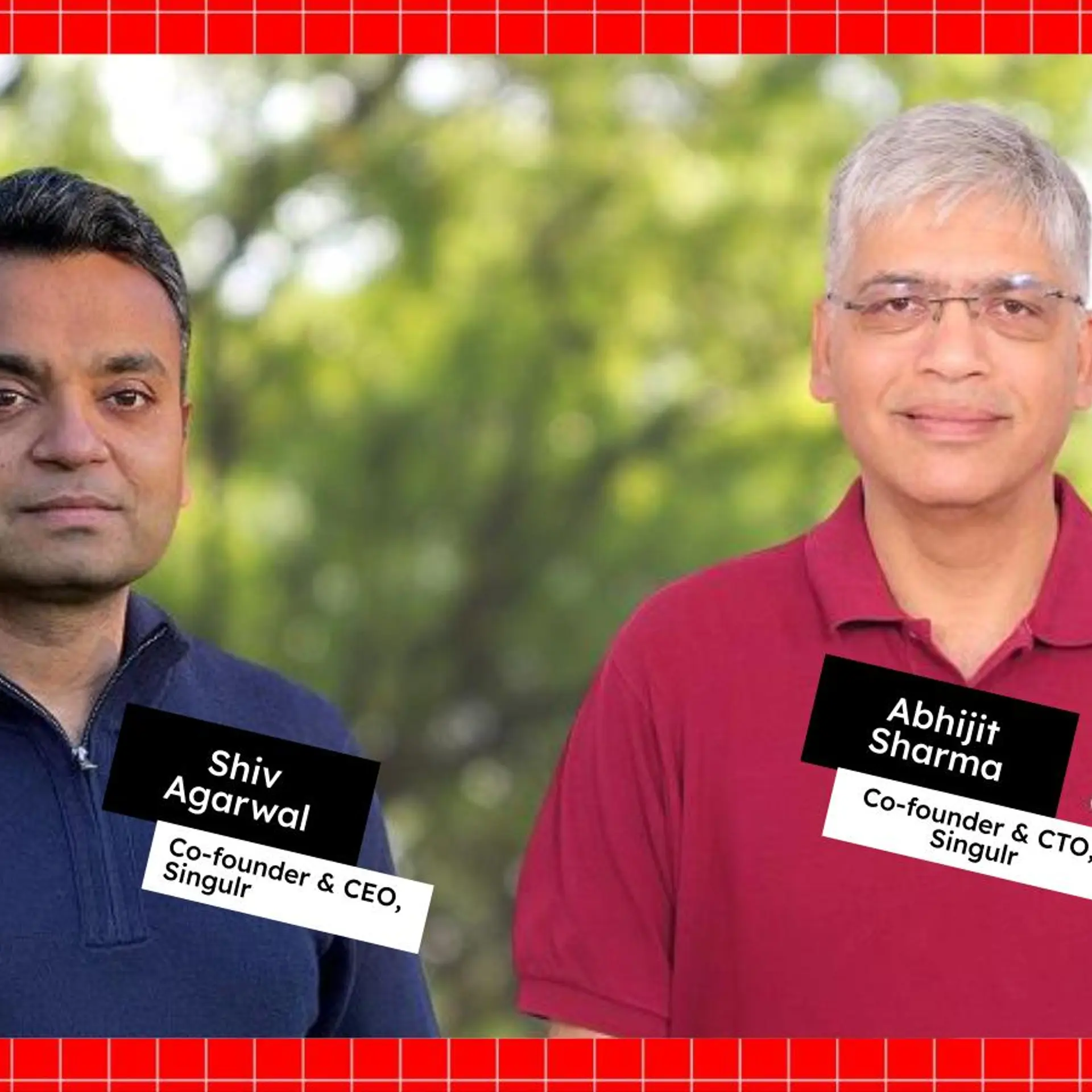

7. Slide 7: Strong management and advisory team

Many entrepreneurs like to have the team profiles come right upfront in the presentation, which is totally fine. We recommend it coming at this juncture right before going into your asks from the investor.

a. Core management team profiles (in bullet format):

i. Add picture of each team member.

ii. Name, designation, role in the company.

iii. Previous work experience – number of years+main companies worked at.

iv. Educational qualifications.

b. Current team size and future hiring expectations.

c. Advisory team names and roles.

8. Slide 8: Testimonials/awards/recognition in the press (if any)

a. Include awards, press mentions, pictures of you speaking.

b. Add pictures/logos of awards to make the slide interesting.

9. Slide 9: Scale up plan

This is where you put your vision and mission into tangible metrics. How do you plan to scale the company in a one-year, three-year, and five-year timeframe?

a. Expansion of service/product offerings.

b. Include graphs of operational growth and financial growth. For example, number of centres, revenue growth, EBITDA growth highlighting breakeven point, etc.

c. Maps for geographical expansion look good.

10. Slide 10: Financial projections

a. These should reflect the above scale up plan.

b. P&L for three to five years including main operational assumptions (example: number of centres launched), revenue lines, total revenue, COGS, gross profit %, main cost heads, EBITDA %. This should also show when the business as a whole will break even.

c. How much capital the promoters have put in a business+How much total capital has gone into the business.

d. Funding requirement use of funds in a tabular format. This will also determine what kind of capital you need to raise (equity or debt or other instruments).

11. Slide 11: Challenges/risk and mitigations

This is an important slide that entrepreneurs often don’t realise they need to have. While you’re obviously selling your and the company’s story, it is important to show investors that you’re realistic about the on-ground situation, you realise what the risks and challenges are, and you’ve thought about how to mitigate them.

a. Mention four to five biggest micro and macro risks. For example, lack of financing partners for your product, or regulatory landscape (be specific).

b. We recommend using a tabular format with the challenges/risks on one side, and your idea for mitigating/hedging against them on the other.

12. Slide 12: Thank You!

a. A call to action sentence is a great way to wrap up your presentation. For example, “Support us to educate 100,000 low income students in the next five years.”

b. Same contact details as Slide 0.

c. Same date as Slide 0.