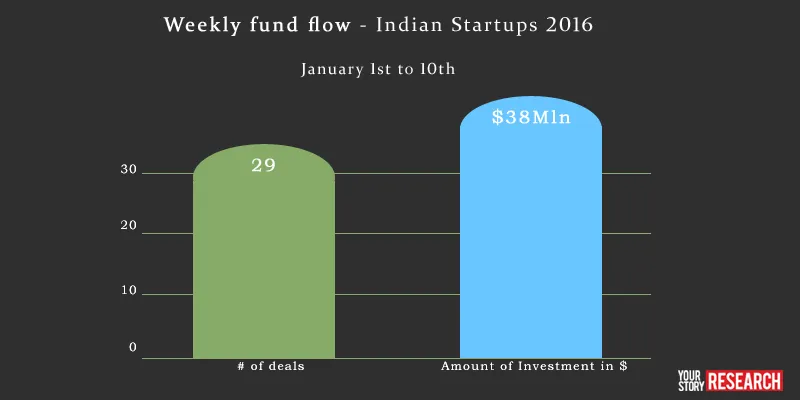

Over $38M invested in the first 10 days of 2016

Venture capital flowed unabated as the New Year dawned. In the first 10 days of 2016 29 startups scooped in funding of over $38 million. This does not include the $180 million raised by Nasdaq-listed MakeMyTrip.

There was one Series B and three Series A deals; the rest fell in the pre-Series A category. Though Indian foodtech startups went through testing times towards the end of 2015, 2016 began with a bang for the sector. FreshMenu bagged $16.5 million in a Series B round led by Zodius Capital, with participation from existing investor Lightspeed Venture Partners. Craft beer company B9 Beverages raised $6 million Series A funding from Sequoia Capital. Snapdeal founders Rohit Bansal and Kunal Bahl also participated.

January 2015 saw 47 deals in total. The deals announced in the first 10 days of 2016 were equal to 61 per cent of the deals done in January 2015.

But across the globe, the world felt the jitters radiating from China’s tumbling market, as China's central bank allowed the biggest currency fall in the Yuan in five months. This had a direct impact on the US markets. However, that did not stop MakeMyTrip, one of the earliest Indian dotcom companies that went public in 2010 on the Nasdaq, from raising investment from Chinese travel booking giant Ctrip. The fresh capital will be used to increase its market share in the online hotel booking space from 25% to 50% in the next three years. This signals continuation of fund flow from China as hedge for looming economic uncertainties. Last year Foxconn, Alibaba and Tencent have made an investment and Baidu, is looking at Indian startups.

Ratan Tata, industrialist-turned-angel investor, has made two fresh investments in Dogspot and Tracxn in the first week of January. He has invested in over 20 startups so far. Six edtech startups were funded in the first 10 days of January.

Top deals of the week

Majority of funding in the first 10 days went to four regions--Bangalore, Delhi, Gurgaon and Mumbai. Combined Delhi-NCR accounted for the maximum number of deals.

Funders who raised funding

Endiya Partners, a Hyderabad-based early stage VC firm, has raised $15 million to invest across 25 companies over a period of three years.

Unicorn India Ventures closed $6 million of its proposed $15 million fund to invest in 30 companies in three years. The fund will invest in the range of $75,000 to $150,000 in 10 to 12 early stage startups each year.

Other developments

With Rocket Internet model, Mumbai-based Sparknext wants to accelerate around 30-40 startups this year. Sparknext is a hybrid venture builder where there will be a mix of both incubation and acceleration. Uber announced a new partnership with InvestIndia, through uberEXCHANGE the company wants to provide mentorship for Indian entrepreneurs via leadership talks by senior Uber executives about fundraising, product design, engineering and scaling up.