Lack of GST can stifle Modi’s Startup India dream

Based out of Rajasthan, Pritam Maheshwari is a furniture manufacturer who retails his goods on an e-commerce portal in India. When he ships his product to Bengaluru, he has to pay Value Added Tax (VAT) in Rajasthan and entry taxes in Gujarat, Maharashtra and Karnataka. Although the tax structure drawn by the e-commerce portal does not show up on the invoice, there is enough evidence which suggests that this complicated tax structure has become a ruse for State governments to harass e-commerce companies (see chart). The classic case of harassment begins when the local government nudges e-commerce businesses to collect tax from vendors like Pritam Maheshwari. In this case, it is the Karnataka State government which contends that the e-commerce company is a commission agent since it stocks multiple products and draws up bills of purchase in their fulfillment centres.

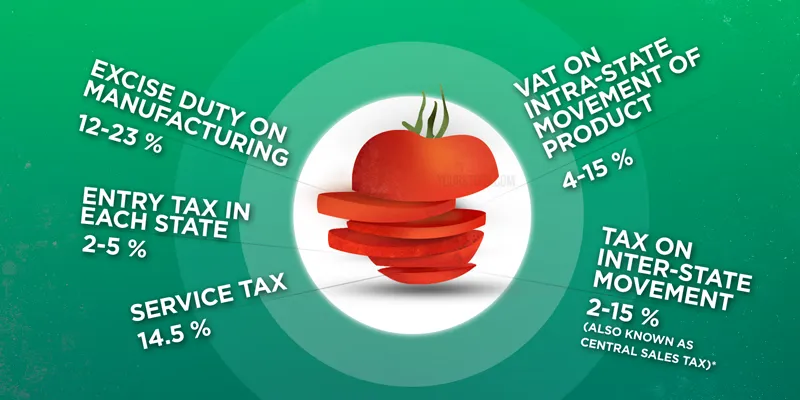

The e-commerce company, on the other hand, contends that Pritam has, in fact, paid his local taxes, and educates the State government by quoting FDI rules. These clearly stipulate that an e-commerce business in India is just a marketplace or a facilitator of a sale and, therefore, cannot tax on behalf of sellers. To make matters worse, the government of each State has its own entry tax, which makes it complicated for any vendor shipping across multiple States. Therefore, the retail revolution which every corporate spoke about in the year 2006 is yet to come to fruition. Blame it on the taxes. The total taxes can be anything from 25 to 30 per cent of the retail price of the product, making it the most outdated and high-cost tax system for a business. We are all pining for a Goods and Services Tax (GST), which is a single origin tax that can take away all the above qualms and misgivings.

Wake up! We need simplicity

One only has to see the long line of trucks piled up outside a border checkpost. The borders of Mumbai, Tamil Nadu and Karnataka are a case in point for a generation waiting to see efficiency creep in to the transportation industry. Thanks to the current tax complications, a generation of new-age businesses like Flipkart, Snapdeal, Shopclues and Shopmatic will continue to be hassled by local governments to pay up unnecessary taxes to boost up State revenues. Therefore, the GST should become a reality for the Narendra Modi-led BJP government or face being ignored by the global investor community which could easily overlook India’s promises as a 'Startup Nation'. Indian infrastructure needs a massive overhaul simply because the cost of doing business is very high because of taxes.

We will see substantial growth in the supply chain of this country with the implementation of GST. With a simplified tax structure transportation will become efficient,

says Nihal Kothari, Executive Director at Khaitan and Company, a law firm.

“Documentation is the biggest challenge in the current structure, because of a tax at every level of manufacturing, distribution and retailing,” says Preeti Khurana, Chief Editor at ClearTax, a technology company simplifying tax payments.

Currently, the Opposition in both Houses of Parliament wants certain items to be out of the purview of GST. The Opposition is also yet to decide the rate of GST. The standard rate is set to be between 16 and 20 per cent. But policy-makers are yet to agree upon a rate. Nihal adds that there will be two levies. The first will be a Central government levy on transport of goods, and the second, a State government levy on services. Hopefully, if it comes through, e-commerce companies need never be hassled by any State government. In this structure, a business has to pay a single tax to the Centre. Later, the Centre compensates the States up to 60 per cent of the total tax collected.

The benefits of GST

- Scaling up by organising the transport industry: According to a report by Ernst & Young and the Retail Association of India, road-based transportation is a market opportunity worth $13.5 billion in the year 2015. This number is expected to grow up to $19 billion by 2017. With 85 per cent of Indian transportation being disorganised, the tax structure can organise a lot of small third-party logistics providers.

Kaustabh Chakraborty, VP, Operations, Urban Ladder says,

Scaling up will become easier under GST and we can optimise warehouses based on customer location or consolidate our warehouse strategy.

- Lean supply chain: All these e-commerce players pride themselves on being close to the consumer. Urban Ladder has invested in two large warehouses in India. No wonder Amazon India has invested in 20 fulfillment centres, because of the business opportunity that it can unlock in the logistics industry. Even Flipkart has sunk a lot of money by investing in over 15 warehouses. If GST comes into force, then global brands will set up their own supply chain in India, unlike today, where they need to tie up with multiple distributors.

Take the example of OnePlus, the Chinese smartphone manufacturer, which brings goods into India by taking into consideration the various State tax structures. It works with a distributor who pays all the entry taxes from State to State. OnePlus pays the K-VAT in Karnataka, because all its goods get shipped from Bengaluru. In fact, all e-commerce companies, including Snapdeal, bill from Bengaluru, because of the lowest VAT rates. If GST was in force, OnePlus could ship the product directly from China and reach any customer by investing in its own warehouses.

There is a lack of predictability in the supply chain in India and there is a lot of pilferage, which is why international brands do not risk doing their own distribution,

says Vikas Agarwal, General Manager, OnePlus India.

- Compliance: Today, an average automobile OEM (original equipment manufacturer) has to fill six lakh tax forms every year, on behalf of his dealers, to claim input tax credit. Similarly e-commerce companies will be filling in several tax forms, because they will be working with lakhs of vendors and distribution companies.

“GST will make compliance easier for e-commerce companies. Since the government is banking on large IPOs from startups, it can boost investor confidence by passing this Bill,” says Sanchit Vir Gogia, CEO, Greyhound Research, a consulting company. But he adds that we must wait and see if e-commerce becomes a part of GST if at all it becomes an act.

Bottlenecks to GST

- State governments have trade lobbies in the transportation and retail industry which claim that a monopolistic situation can be created with GST since it favours supply chain efficiencies for those with deep pockets.

- State governments believe GST will reduce revenues.

- The Central government and the Opposition have locked horns over what should and should not be part of GST.

- GST may only include 100 items in its purview; e-commerce may not be part of it.

- Companies would want clarity on the disbursement of credit claimed to avoid double taxation, and will be wary of the fact that money will be locked in for a period with the government. This could have an impact on working capital.

YourStory’s take

Logistics and warehousing has been a struggling industry for years. It is, according to the Indian Brand Equity Foundation, a $130-billion market. Be it in food processing or in movement of manufactured goods, there are no standards of efficiency. Eighty-five per cent of the industry works on a cost arbitrage and, therefore, inefficiency is factored in. Thanks to the smartphone revolution, there are entrepreneurs who are organising the ecosystem and bringing some standards. Startups like RoadRunnr and Delhivery are disrupting the market with their use of data to plan routes and manage warehouses. They are helping large e-commerce companies reach their consumers faster and better.

In turn, e-commerce companies are planning to reward vendors who stick to processes and enable quick turnaround in shipping time. At the heart of all this change is the tax system. Therefore, a GST is not a panacea, but the need of the hour. It is a structure that will make the entire federal system of India more accountable to paying taxes rather than subjecting business to the harassments of local tax authorities. We can safely say that if the Modi government misses the bus on GST, then investors will not board India’s roller-coaster development ride.