Uncovering gold at the bottom of the pyramid: 4 trends shaping grassroots banking in India

Gold is a treasure, and he who possesses it does all he wishes to in this world, and succeeds in helping souls into paradise.

– Christopher Columbus

With the recent success of IPOs, by Ujjivan Financial Services and Equitas Holdings, 2016 seems to have brought some long due recognistion to the underdog MFI institutions.. The last one was way back in 2010, when SKS Microfinance got listed. The dull years in between have a story to tell.

MFIs have gone through a challenging phase since 2010. Most impactful were the legislative changes that put SKS and the microfinance industry in a downward spiral, leading to slowed momentum for the financial inclusion initiative. Six years later, the tide seems to have turned. The MFIs seem to be better regulated, have improved business models and better spread risks. But this turnaround shouldn’t surprise us. With such a large potential market at the grassroots, it was never a question of ‘whether’ but ‘how’ and ‘when’.

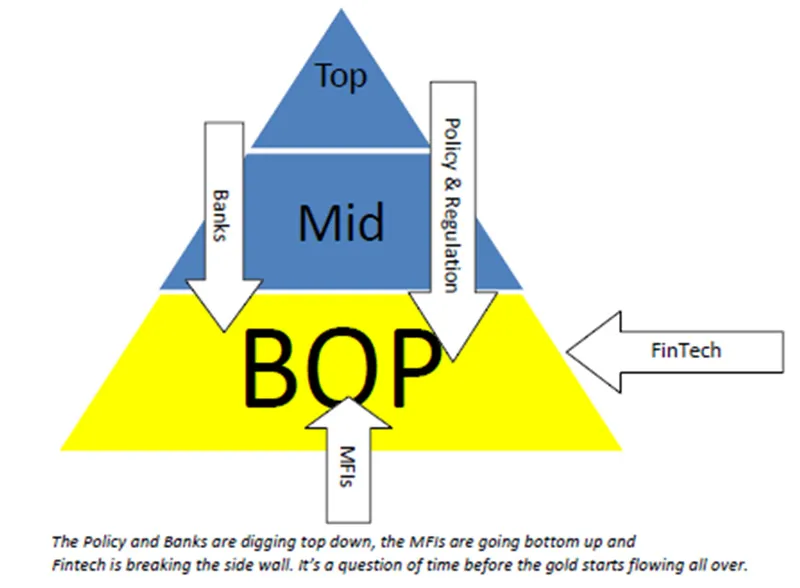

The story of The Fortune at the Bottom of the Pyramid was analysed by C K Prahalad and Stuart L. Hart, back in 2002. Over the years, many corporations have realised and unrealised the tricky nature of this treasure. The first challenge was how to dig deeper to reach the bottom of the pyramid (BOP), i.e. the cost of the last mile coupled with high granularity. The second challenge was lack of awareness at the grassroots and how to engage them with mainstream processes or products.

In the above-mentioned article, Prahalad and Hart articulate the six assumptions that have been preventing large corporations from seeing value at the BOP. Our financial institutions, knowingly or unknowingly, have applied the same assumptions to India’s inclusion story. But as they say, “Fortune favours the brave!” The recent IPO shows that, finally, the holy grail of financial inclusion is in sight. Lessons have been learned, albeit the hard way.

What didn’t happen in decades is happening now!

We have close to 1 lakh Scheduled Bank branches in the country and over 1.5 lakh post offices. While the network may still be inadequate, it would be reasonable to assume that it is deep enough to ensure financial inclusion for large parts of the population. But that hasn’t been the case and the initiative moved at a snail’s pace. While the banks’ earlier reluctance to cater to small ticket lending was one reason, even India Post’s channels could not be leveraged due to inefficiency and ostensible technicalities.

The traditional approach to distribution ensured the granularity of the opportunity never enthused the bankers, who preferred easy large ticket lending. Even the policy and regulatory push was relegated to the RBI’s Master Circular on Priority Sector Lending (PSL)and some wish-list notifications on collateral-free loans and financial inclusion. While PSL attempted to encourage lending to weaker sections, agribusinesses and MSMEs, the real BOP inclusion of, say, that vegetable vendor, village tailor or bicycle repair mechanic just wasn’t happening. It was even worse for women-run enterprises – utensil sellers, fish vendors et al. The straitjacketed approach on credit meant that the unorganised segment never fitted the requirements. Policymakers and regulators seemed helpless in front of the convincing alibi of the financiers.

But my lament is possibly past tense already. We always knew the treasure was for real. It was only the case of getting the digging tools right, which in this case meant overcoming the operational challenges and some change in mindset. In the recent years, the policy, regulator, financiers and technology seem to be coming together, almost magically, to unravel the gold mine at the BOP. And yes, the mainstream banks and India Post (with its payment bank license) are in the treasure hunt too.

The Fantastic Four

It’s possible that you find my optimism on grassroots banking and financial inclusion a little before our time. So celebrations may wait. But there are four key trends that have changed the plot from a slow, boring drama to a fast-paced, action-packed thriller. Let’s evaluate these trends that are shaping the contours of grassroots’ financial inclusion.

- Proactive government policy– According to a recent PWC India report, India’s unbanked population has more than halved from 557 million in 2011 to 233 million in 2015. The Jan Dhan Yojana provides the required impetus by ensuring that traditional banks go the extra mile to include more people in the network. With Direct Benefit Transfer (DBT), insurance and pension schemes getting linked to this, there is a whole ecosystem that incentivises the last man down the pyramid to join the formal banking mainstream.

‘Digital India’ aims to provide a platform for documentary digitisation and services. Add the Aadhar programme to this and you have a key solution to the pet crib of the bankers – Know Your Customer (KYC)! As Aadhar gets integrated with the financial system, we would move towards verification based on social security identification, like in Singapore or other developed countries. Apart from the benefit of government schemes, those joining the mainstream would also find access to formal banking and credit a little easier.

- MFIs – Today, there are more than 250 MFIs in India, including those registered as NBFC-MFIs with RBI. They reach an estimated 38 – 40 million customers and are growing at a brisk pace. The significant regulatory changes by RBI in last 4-5 years have been the key impetus for MFIs. The key changes include:Recognition of MFIs as non-banking finance corporations (NBFCs);

- Opening-up growth path for MFIs with small finance banks and payment bank licenses;

- Recognising the need for self-regulation through the concept of SRO (self-regulatory organisation);

- Mandating credit bureau referencing;

- Permitting NBFC-MFIs to act as a business correspondent channel for SCBs; and

- Encouraging banks to lend to MFIs by according PSL status to such loans.

The best practices of a regulated financial system have trickled down the pyramid. This has helped MFIs to focus on improved corporate governance, manage risks better and, importantly, attract investments. The MFIs follow the Grameen Bank model with 99% of the borrowers being women through self-help groups (SHGs) and ticket sizes ranging between 10-25k. And the lending is not limited to rural areas. In fact, the larger ones like the Janalakshmi and Ujjivan have diversified portfolios with an increased focus on the urban poor.

However, the journey is on and there are significant challenges to overcome. The end user’s lack of tech understanding has restricted the ability of MFIs to aggressively use technology to scale faster. Their models are high touch based, requiring frequent face-to-face customer interactions. This helps mitigate the shortfalls in credit risk assessment through a deeper, real-time understanding of the customer. However, it also means higher operational costs, risk of frauds (since the field agents handle cash) and challenges in scalability. But there are silver linings – increasing mobile phone penetration, data usage, and broadband connectivity coupled with mandated or incentivised digital platforms through Digital India and other initiatives by the government. It’s only a question of time before the comfort with technology cascades and new distribution models evolve.

- Expansion in bank branch network – The last five years have seen the private Scheduled Commercial Banks (SCB) expand their network aggressively. For example, HDFC bank has grown from around 1500+ branches in 2010 to 4200+ today – and many of these branches have come up in Tier 3, Taluka levels and below towns. It’s a similar story for other large private banks like ICICI and Axis. With the 10 small finance banks and 11 payment banks, the distribution challenge of last mile connectivity may soon be the past. It may be a good idea to encourage the correspondent banking model between the larger SCBs and small finance banks to optimally use this growing digital and physical network. Another big game changer could be the India Post payment bank, with over 1.5 lakh brick-and-mortar offices across the country, which is more than the total banking network combined. The only way the investments in expanded networks can become viable is by getting more and more customers onboard, i.e. deeper financial inclusion. What was only a social need is now a necessary business requirement to ensure these branches breakeven or turn profitable.

- Fintech: the new kid on the block– Just like MFIs, the fintech ventures in the payments space are already moving mainstream to become payment banks. There is no reason why the same wouldn’t happen for P2P, algorithm-based lending startups or crowdfunding platforms . Business models are still evolving, as is the regulatory framework. When the dust settles, we may be looking at new kinds of banking structures, enabled with analytics, AI, blockchain, near field communication (NFC) and virtual branches. It’s still early days in India and inspiration is coming from US-based fintechs like Kabbage. We have Lendingkart and CapitalFloat building their models on the back of corporate supply chain linked funding. But this space in middle of the pyramid may be crowed very soon as the banks up the ante and many other fintechs enter this assumingly safer segment of SMEs. The real action, however, may be deeper down at the bottom of the pyramid where the likes of Rang De, MicroGraam and Milaap are targeting. Should the startups take the universal banks head-on in a crowded space or should they target a segment where there is enough for everyone and rules are just being written? You may guess the where the smarter lot is betting. I’m betting on BOP gold.

Everyone wins

The grassroots are spread wide and the story will continue to evolve for years. But there is no denying that gold lies underneath. Government policy and RBI intervention are creating the ecosystem; the MFIs are defining the balance in the business model that’s stable and profitable; the SCBs are diving deeper to offer wider product suites; and the fledgling fintechs will bring disruption to overcome the operational challenges of reach, credit evaluation and high touch based systems. We are witnessing an amazing confluence of structures, rules and technology that’s rewriting the rules of the game.

The best part is – everyone wins in this gold chase!

(Disclaimer: The views and opinions expressed in this article are those of the author and do not necessarily reflect the views of YourStory.)