Is the writing on the wall for print media?

The pattern of media consumption has witnessed a paradigm shift in the last decade, with the Internet proving to be a dangerous foe to traditional models. Traditionally, in print media, about 80 per cent of the revenues were from advertising which dropped by about 44 per cent in 2009 when the first wave of Internet usage swept the country. With this stress on revenues, staffing, which was about 50 percent of the expenses, was the first to face the blow. This had an obvious impact on news coverage and reporting.

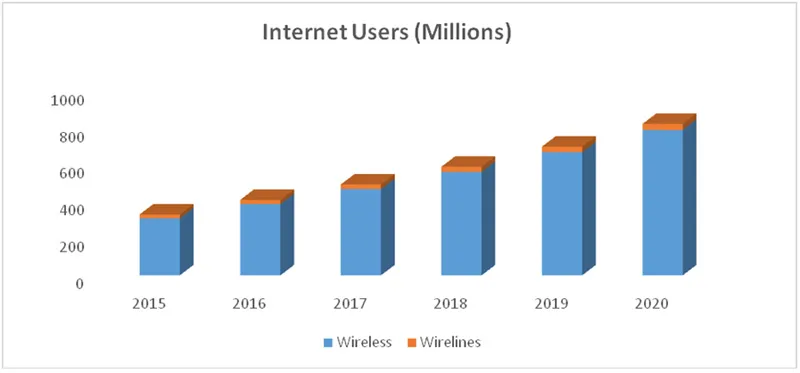

The ready access to Internet through smartphones has led to upgrading of an individual’s day-to-day technology usage and altered almost all aspects of daily lives of people, including the pattern of media consumption. Going forward, the smartphone usage is expected to grow at a CAGR of 29.11 percent between 2014 to 2020; thus, we can expect a larger shift in coming times. Media houses, small and large alike, had no choice but to abandon their traditional methods of operation for a more innovative approach.

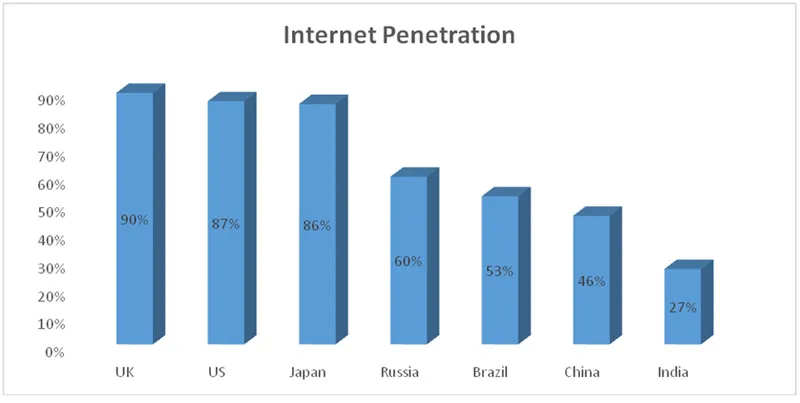

Media is shifting in favour of the Internet with more and more readers moving online, at least for one-time reads like news and articles. Costa Rica’s Tico Times, one of the largest English-language publication in Central America at one time, announced in 2012 that it would discontinue its print operations due to the costs of producing and distributing a physical copy. Valley Journal in Colorado, Harrisburg, and Syracuse are few more examples of print media outlets who cut down their physical copy production around the same period. The impact was negligible in India because of low Internet penetration and unavailability of online news in local languages. However, with growing literacy, ease of usage, and instant access through smartphones, the Internet is going to be the big media winner in coming times.

According to IRS (Indian Readership Survey) data, the daily time spent reading print fell from 32 minutes in 2000 to 28 minutes in 2012, even as the number of readers grew from 232 million to 351 million.

The parallel products like advertising, classified ads, and job notices are also being switched to the Internet, bringing substantial pressure on revenues of conventional media houses.

Source: KPMG in India analysis

The sector has been quick in transition and is continuously adapting and upgrading. The Internet is no longer seen as a threat but an opportunity for new streams of revenues with new programmes, new services, new distribution channels, and new devices. Today, we are moving toward a five-screen world: TVs, PCs, game consoles, TVs and mobiles (be they smartphones or tablets) all interconnected.

According to the KPMG-FICCI Media and Entertainment industry report 2016, the Indian media and entertainment (M&E) industry in set to grow at a CAGR of 14.3 per cent to Rs.2,260 billion by 2020.

Digital media as a category grew the fastest in 2015 at 38.2 per cent and is expected to grow 34.9 per cent in 2016. It is expected to reach a value of Rs.8,110 crore, accounting for 15 per cent of the total advertising expenses in 2016.

Digital advertising, is expected to continue its strong run with 38.2 per cent growth over 2014 and is likely to scale up to Rs.255 billion by 2020 contributing upto 25.7 per cent of total advertising revenues. “With the wide rollout of 4G finally underway, coupled with the 'Digital India' initiative, the future of digital advertising is very bright” said Jehil Thakkar, Partner and Head of M&E at KPMG in India.

Despite the massive digitalisation, newspaper have yet not lost ground in India due to a deeper penetration than internet; however, it poses a threat in coming times. Print media circulation grew 8.2 per cent in 2015 with a lower pace of growth of advertisement revenue at 7.3 per cent in the same year.

This change in pattern has proved to be a boon to new entrants. The lower costs associated with an online-only format creates opportunities for small news businesses. Startups with a modest investment, or even a single reporter, have the opportunity to emerge and have their voices heard across the globe, something that couldn’t be imagined before the Internet.

An eventual shift in cost structure

This digital shift has brought about analogous alterations in the costs associated with the sector. Many costs of the industry are being reallocated and the costs have moved from the “production” side to the “distribution” side.

Some costs associated with the core operations remain unaffected, like creation/ development, editorial process, marketing and sales, However, a few others are shifting. What used to be one of the major costs i.e. manufacturing of the physical goods, physical transportation, and storage have now started disappearing. With the surge of blogs and other tools and innovations, promotion costs have also moved from the traditional ones. Also, new costs are appearing mostly on the software side (security, rights management etc.), bringing along a growing segment of enabling technology providers (web hosting, content delivery networks, billing).

This radically changed cost structure paved the way for developing innovative business models, to monetise sales and channelise the newly emerged revenue streams into the business.

To thrive in today’s environment and be prepared for coming times, companies need to adapt and renovate their strategies, operating models, and technology and be more innovative in content development, distribution, operations, and monetisation. The media companies will require to address the below-mentioned imperatives on priority in coming times.

Monitoring and minimising content development cost

Though the consumption pattern is moving online providing a huge customer base, it is very difficult to monetise the sales on this platform. This has put a lot of pressure on the media companies to watch their major cost i.e. content development. The companies have to work towards efficiencies in variable costs by maintaining fewer staff editors and content producers and instead develop a network of external contributors. Fixed costs can be controlled through centralisation, outsourcing, offshoring, and portfolio rationalisation.

More accountability and interactivity to advertisers

Advertisers too feel the pressure of changes in the consumption pattern and have started devoting more resources to digital, database marketing, event marketing, place-based media and even loyalty programmes. This shift requires media companies to increase their focus on innovation and ROI as they craft their revenue models. Media companies can be more innovative and tap the opportunities to build new businesses around lead generation, custom media, and marketing services.

Building relationships with customers

The vast Internet platform has made it very easy for new entrants and smaller players to enter the market, and led to emergence of fierce competition. The consumers are spoilt for choice and have infinite options available at a click.

Companies have to quit their passive approach and come forward, and enter into a relationship with the customers. Only publishing is not enough, they need to do more, like build communities where readers can share values and interests. Add value by gathering, supporting and empowering people. Offering memberships – not just a product but access, privileges and opportunities to mix with a community, interest-specific e-newsletters, or registration-required applications. Companies need to move from creating impressions to building relationships with consumers.

Active participation in the growth platforms of the future

The media companies need to get more innovative in approach and keep abreast with technology and software upgrades and consumption patterns. More than following the trend, they need to get more aggressive and innovative and embrace a “test-and-learn” approach. Try new methods and scale up on the one’s that “work”. Digital media is emerging as one of the favourite destinations for news and updated information leveraging platforms like social media, search engines, app development, and content aggregators. Media companies need to vision opportunities and work out “benefit both” models.

Conclusion

With the digital shift, the media and content Industries are facing pressure as they are losing control over their customer base and also have to compete with new set of competitors such as network operators and IT companies. This is only going to increase as digital infrastructure in India is still underdeveloped and a major part of the Indian population is yet to upgrade to smartphones and Internet. Current Internet penetration is India is only 27 per cent.

Source: KPMG in India analysis

Monetising consumption and enabling content creation calls for collaborative schemes among all industrial players to define new business models and pricing, as well as to achieve the fair redistribution of revenues among all.

Digital media is facing its own cost and technological challenges in the swiftly evolving new ecosystem. Advertising generates only a fraction of the revenue on the Web compared to what print or television advertising once earned. Going ahead, mobile ads have brought down these revenues even more. Thus revenue streams are only shrinking for the digital space. Also, social media presents a clear threat to traditional media and entertainment platforms as it steals a growing share of audience attention and advertising expenditures. Buzzfeed recently slashed its projected revenues for 2016 by half due to the high “cost of revenue”, which includes the payments it has to make to Facebook to keep online and keep driving the social media traffic.