Why success of on-demand laundry and beauty verticals is actually a mirage

Being a startup journalist and ecosystem observer over the last five years I have seen rise of Internet commerce, payment, technology and many peripheral verticals. In 2010-11, online retail (horizontal plus its various niche segments) took off as people in metros tend to buy online on pretext of convenience, discount and wide assortment. Four years later, on-demand phenomenon garnered unprecedented interest and became a battleground for angels. YourStory’s research indicates that about 80 percent of hyperlocal startups got funded last year (majority during H1).

Besides on-demand grocery, vegetable and food platforms, and home services also witnessed the debut of over 20 serious startups. However, most of them (except Urbanclap and Housejoy) shut shop or got consolidated as they lacked value and failed to raise follow-on capital.

On the lines of horizontal home services platform, two home-service niches, ie., beauty and laundry, mushroomed in various cities. Hailing them as the next big verticals, angels started showering seed funding on both. Consequently, many startups in these two verticals got funded at angel or pre-Series A levels but they failed to break Series-A barrier (except Doormint). As a result, there are barely a handful of companies that are up and running currently. A majority either consolidated (through stress acquisition/merger) or shut shop.

Consolidation and shutdown

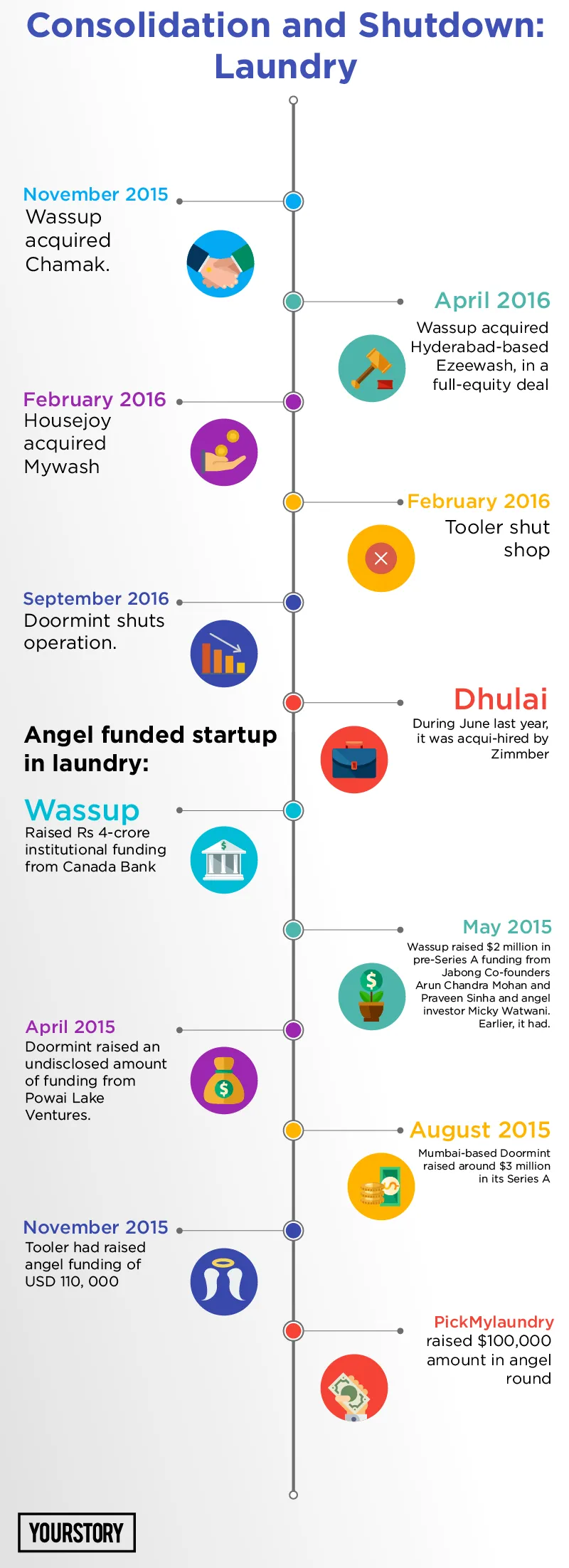

In November 2015, Wassup acquired Chamak for an undisclosed amount in an all-equity deal. Delhi-based Tooler shut shop early this year, while Hyderabad-based Ezeewash got acquihired in a humble deal by Wassup. In February, Housejoy acquihired on-demand laundry startup Mywash for an undisclosed amount. Recently, Mumbai-based Doormint ceased operations.

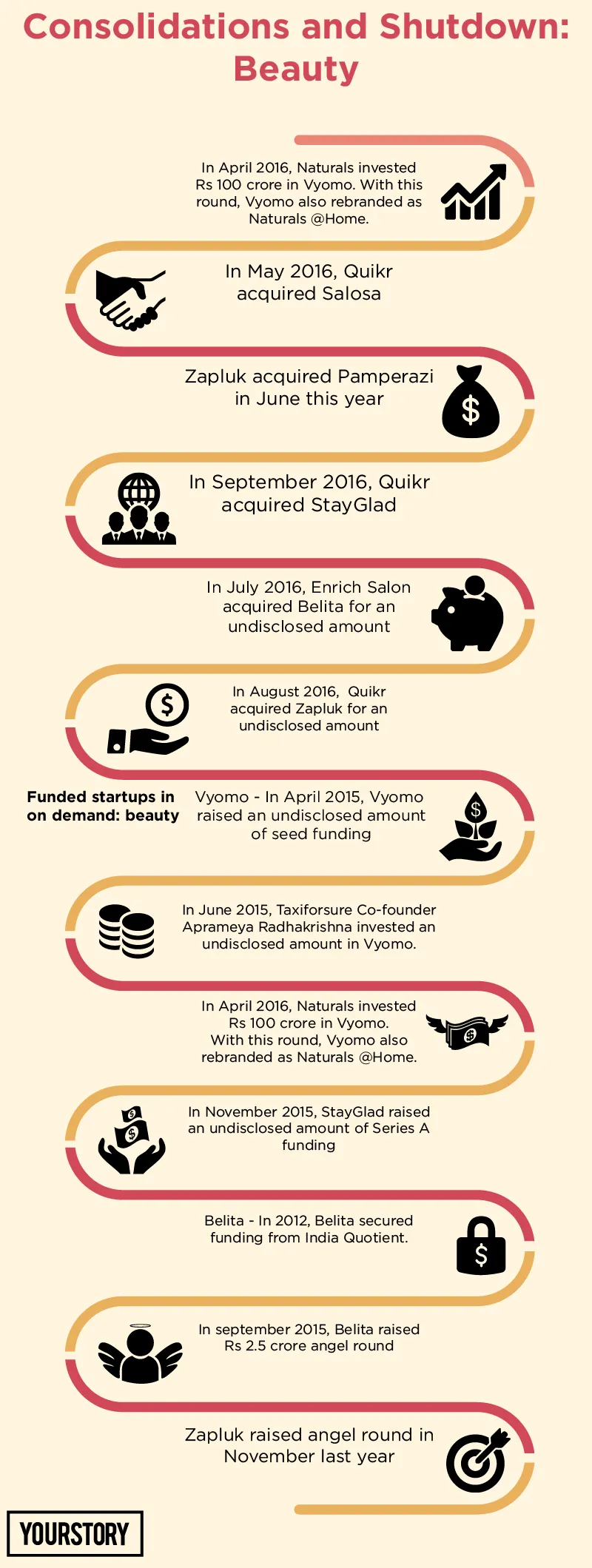

On the beauty side, YouWeCan Ventures-backed Vyomo merged with salon chain Naturals at about Rs 100 crore. However, according to YourStory’s sources the deal was largely on paper. Five-year-old Belita got acquired by little-known beauty chain Enrich Salon, while Stayglad and Salosa were acquihired by Quikr (though they were announced as acquisitions).

So, is it an end to vertical play in on-demand home service? The answer is partially yes. At least according to data.

Cracking niche is a game of consistency, not speed

Kashyap Deorah, author of The Golden Tap: The Inside Story of Hyper Funded Indian Startups, opines:

Vertical plays in home service have lost the plot. Startups in these segments died or became oblivion because they were built at the mercy of the investor. Like other e-commerce peers, on-demand laundry and beauty startups chased unsustainable growth. They should have explored organic growth instead of buying customers in haste.

“Niche businesses work well with long-term vision and it could only be sustained if supported by organic growth,” he adds. Fernsandpetal (fnp.com) is a classic example of this. Many consumer-centric gifting businesses have come and gone with a lot of fanfare, but only online gifting platform FnP managed to kept its foot firm.

Laundry and beauty: Limited ground for tech play

Startups in on-demand beauty and laundry service misconstrued the problem they are solving to be largely tech-related. Manual involvement is involved at various stages in both verticals. In case of laundry, a platform needs two-way logistics (pick and drop) along with touch points during washing, ironing and folding. A founder of a beauty startup says,

Similarly, unlike handymen services, beauty is highly personalised and sophisticated. “Customer experience highly depends on work from professionals. And these professionals require one-to-one training for weeks. It’s not like Uber where drivers can be trained within hours. Managing freelance beauticians involved high human intervention at various stages. Application of tech is minimal but human touch is very high and crucial.

Laundry and beauty: margin of error is negligible

Ensuring consistent quality across cities or different parts of a particular city in both verticals is difficult in aggregation model. “Margin of error is very low in laundry and beauty services. People love their attires and skin and they don’t want to compromise as stakes (clothes are expensive and beauty is a personalised service) are very high,” says Satish Meena, analyst at Forrester.

VCs preferred horizontal home service over niche

While angel investors placed their bet on various startups in laundry and beauty services, VCs didn’t take them too seriously. Instead of betting on vertical plays they thought horizontal ones would be more reckoning in the future. Remember online-only fashion brands Zovi, Freecultr and Americanswan? They caught investor interest in 2011-12, but soon VCs realised that horizontal e-commerce play would be a much safer bet. Hence the capital kept flowing to horizontal peers, and investors (even existing ones) turned down the online-only fashion brands.

Pravin Sinha, who invested in Wassup, has a contrarian view. He says:

Laundry market isn’t an unsustainable vertical but gestation period is high as compared to other verticals. Just like any other hyperlocal vertical, laundry has gone through correction. I personally believe that a few, say 3 to 4, players will achieve significant scale.

Was hybrid model a holy grail?

About 90 percent of the startups that shut shop or were consolidated were aggregators. Experts suggest that hybrid model (in-house plus aggregation) is a way forward but it needs accountability and capital. Doormint and Tooler tried this model but were probably a little late. Both opened their own units just before pulling the final plug. Gaurav Agarwal, co-founder and CEO Pickmylaundry, says,

In the aggregation model risk of damage is vendor’s responsibility while this onus becomes yours when you do it in in-house facility.

Evangelism of hybrid model is a capital-intensive affair and, ironically, none of the laundry players (except Wassup and Doormint) amassed required capital to experiment on a decent scale. Same is the case with the on-demand beauty space. Keeping on roll in-house beauticians is an asset-heavy model and it can only be tested with deep pockets.

Some say that besides direct B2C model, startups should also have focussed on corporates (like Wassup). But entering the B2B space is not easy and one needs to have working capital for upto three months. “Lack of trust and integrity are major issues in B2B market. In India, very few respect contract and believe in its enforceability. Tooler cracked a Rs 15-lakh contract with a hospitality firm but four days later the company scrapped the contract as some other vendor quoted Rs 50,000 lower than us,” adds Sukant Srivastava, one of the co-founders of Tooler.

So, what lies in the future for on-demand laundry and beauty services? Parameters like market size and potential are not as rosy in real as they look on paper, but a couple of players can emerge in both verticals in long term. “Just like food tech and grocery a few will survive in these verticals too,” concludes Pravin. While it is difficult to say whether these vertical will be big or not, data so far shows that cracking verticals in the on-demand home service space is really challenging.

Despite failures and early consolidations, I do believe that some startups will eventually rise from these two verticals in the long run. The potential in the laundry and beauty space is immense but perseverance and long-term approach will provide an edge to those who thought of building on the momentum of funding.

The failure of these verticals indicates that all problems can’t be solved through tech alone. While technology has the ability to change the status quo of basic on-demand services, it also has some limitations. The human interface is critical to delivering services in real time, and technology has to play the role of an enabler rather than replace washermen and beauticians.

To summarise, I encourage players like Wassup, PickMyLaundry, Oneclickwash, and BigStylist to keep going despite all odds. Only time will tell how they fare in the long term...