Is Indian e-commerce too reliant on the festive season?

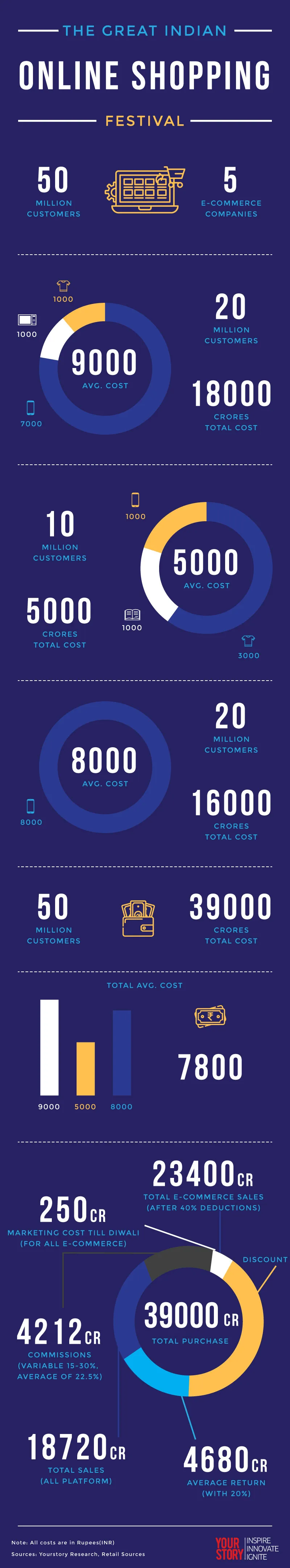

Over the next 60 days, e-commerce companies are going to stop at nothing to build their revenues. Sources say that the top five e-commerce companies will spend upwards of Rs 250 crore on marketing to push their total sales on their platform to around Rs 39,000 crore. However, this number is the gross merchandise value and does not take into account the price negotiated with vendors, the discounts and the returns. The real sales number of e-commerce giants like Flipkart, Myntra, Snapdeal, Amazon India and Shopclues is expected to touch around Rs 18,720 crore, which means their absolute commission numbers will be Rs 4212 crore. Sources in the retail business say that Flipkart and Myntra combined would have gathered 40 percent of this business followed by Amazon India, Snapdeal and others.

The sources also claim that over 50% of the total annual sales for the top five e-commerce companies take place within 2 months of festive season(October-November).

Does this mean our e-commerce businesses have still turned the corner? Not yet!

The burn rate on staff, rentals, forward and reverse logistics and customer service still make their business vulnerable to losses. Transporting low value items (small electronics and mobiles from small retailers) can never recover the logistics costs involved. A majority of their business still comes from preferred distribution companies. These new product distributors were created after FDI rules on e-commerce stipulated that there cannot be more than 25 percent bought from one seller alone (remember Cloudtail of Amazon and Flipkart’s W S Retail). Although now every e-commerce company claims to have reached over 100,000 SMBs, the consistency of these SMB retailers selling on the platform is anybody’s guess. Again only 10,000 retailers seem to be regular sellers on an average.

“The fulfilment cost for these businesses is very high and they also spend a lot on customer acquisition,” says Kishore Biyani, Chairman and Founder of Future Group. He says that e-commerce is still not more than 20 percent in many developed markets and that the customer will still need all retail formats. “To succeed in retailing one must understand the ethnography and buying habits by regions. But I am yet to see the digital businesses understand this,” he adds.

In many ways the funding has slowed down with no major funding announcements from Flipkart or Snapdeal. At least this festive season, Flipkart is proving that it still has the chops to be a leading e-commerce retailer and can still make some money. But the problem is that Amazon has amassed a large war chest and is already going clinically to acquire customer mind share.

“Retailing in India needs a shake-up, whether it is e-commerce or brick and mortar businesses. Modern brick and mortar retailing is yet to use technology to reduce sourcing and supply chain costs and e-commerce companies still continue to play the discounts game,” says Mohandas Pai, Founder of Aarin Capital.

According to Ernst and Young, the organised retailing industry is $600 billion with organised retailing pegged to be around $60 billion. The e-tail industry is said to be around $8 billion in size. At least the festival season buying can create some loyal customers for e-commerce businesses. But everyone knows it is because of the attractive discounts that people throng to buy products online in India.