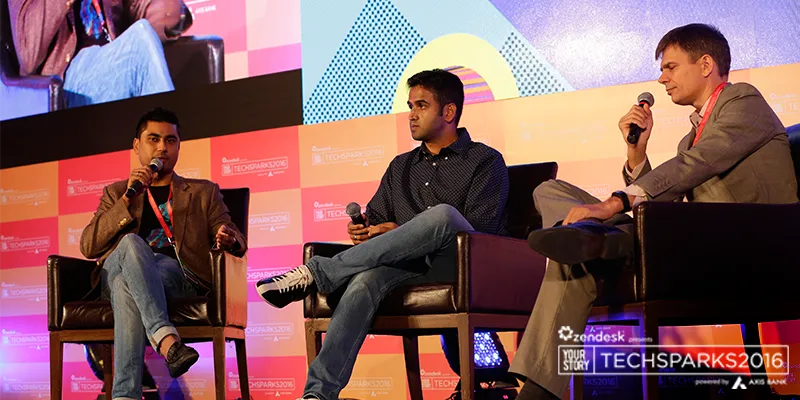

‘Do not chase money, let it float towards you,’ says Nithin Kamath of Zerodha

Nithin Kamath, Founder and CEO of Zerodha, who started trading in stocks as a teenager and went on to build a successful company compares trading markets to driving on the road. “While driving, you need to make decisions based on your brain and not the heart. If you give in to panic, you will meet with a road accident,” says Nithin Kamath, on the sidelines of the seventh edition of TechSparks. “Similarly, the markets keep throwing situations that could lead to accidents. Thus, I often say that you cannot make money out of scared money,” he adds.

According to Nithin, it is important to put money that you are not afraid to lose in the market. “As a trader, that’s the biggest edge to have. To trade off of money that you can afford to lose,” he says.

There are primarily two types of stock traders – traders who make money and traders who don’t. “Making money from trading is like searching for the holy grail,” says Nithin. He believes that essentially a winning trader knows how to manage his risks well. “The one who does not put all his eggs in one basket,” he adds.

Zerodha, started by Nithin, is a one-of-its-kind bootstrapped brokerage firm that has memberships on all the stock, commodity, and currency exchanges in India. The team is believed to be one of the first in India to disrupt the existing pricing structure by introducing a flat fee-per-trade model.

Thus, when you get to spend some time with its CEO, the obvious question to ask is for tips to make money from the stock market. Here’s what Nithin had to say,

- For someone who has zilch idea about investing in stock market, they should start by picking up a diversified mutual fund and start investing. Though mutual funds are an efficient way of saving money, it will not help you become rich. To be rich, you need to make some direct investments.

- The stock market is all about spotting trends. You need to keep a watch on businesses that are doing well. It is best to stick with industries that you understand. For example, it is tough for a chemist to track what is happening in the auto industry.

- Start reading about the markets. We have an education initiative called Zerodha Varsity, which is a good place to start reading about everything related to equity investments.

Nithin says there were advantages he had by dabbling in the stock market so young. It helped him understand all aspects of it which he learned through trial and error. “It all turned out good. But it could well have turned out all wrong for me,” he says. “I was lucky that my parents stood by me. Today, everyone calls it passion. But for 10 years of my life, people thought I was being a fool. People would say I was wasting my time trading when I should be working in a software firm.”

He believes as an entrepreneur and a stock trader, the only way to play it is to give it your hundred and one percent. “There are no shortcuts.”

Nithin says for most of his trading life, he would keep a money target every time. “As long as I was chasing money, I was not successful. I think one of the things that turned around for me in 2007/2008 when I probably realised that setting a money target is not the right way to go about. And when I stopped focusing on the money is when it started working out for me,” he says.

Thus, Nithin concentrated more on the work, to better his efforts and his processes. He adds,

“My uncle keeps saying that ‘Goddess Lakshmi sits on the lotus and floats. You cannot chase her down. You have to wait for her to come to you.’”

With the way Nithin’s startup is growing, it seems the goddess of wealth is floating right up his doorway already.