How you can save 40pc of unnecessary expenses while running a business

Raj started a technology company. In the first year he made sales of Rs 9 lakh and paid Rs 3 lakh as rent and Rs 4 lakh to freelancers. So he made a profit of Rs 2 lakh. Now, ideally, he should have paid Rs 60,000 in taxes considering 30 percent is the current tax rate.

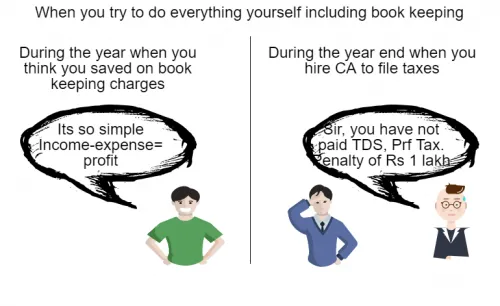

When he went to a chartered accountant that year to file his tax return, the CA calculated a tax liability of Rs 3 lakh. Raj was confused because his profit was only Rs 2 lakh, but the tax calculated was Rs 3 lakh.

The CA then explained that he had disallowed the expenses of Rs 7 lakh, which Raj had incurred as no Tax Deducted at Source (TDS) was done from the same and no TDS returns were filed. If Raj had a proper accounting system, where a CA reviews monthly accounts, he could have saved Rs 2.4 lakh, which is more than the profit he earned.

Proper bookkeeping and maintenance of records not only helps entrepreneurs in tax savings, but also for decision making and for raising funds.

- Better financial analysis and management

Cash flow management is one of the most important things to focus. Delayed invoices, no follow-ups made on customer payments and low tracking of receivables will eventually bring you down. Bookkeeping can systematise it up from up-to-date follow-ups, invoicing and on-time payment for suppliers.

- Fulfillment of tax obligations

Bookkeeping keeps track of information and documents in order to accomplish annual taxes. This way, when the time comes, you are not scrambling to to find all those bills or try remembering expenses when tax time comes. Tax returns are also made easier with an organised balance sheet, cash flow and Profit & Loss. This way, your tax advisor will devote time to give you sound tax advice instead of correcting entries in the financial statements.

- Reporting to investors is easy

The process of reporting to your investors on crucial information about the financial status of the company is no longer a worry. Charts, graphs, lists of data presented to the investors are all acquired from the book of accounts.

- Business planning is easy

What you need is only the balance sheet and Profit & Loss to check if the company is on the right track financially. From there you can start your business planning easily.

Bookkeeping may seem like a burden when you are trying to grow your business, but it is essential if you are to not only survive but also prosper in today’s tough economic climate. Many businesses that were doing well have ended up closing shop, due to poor bookkeeping. In business, the more you earn and the lesser you spend the stronger you become.

A proper bookkeeping system is essential for any business, big or small, in order to manage its daily functions and keeps the business running smoothly. For any successful business, the main obligation is to maximise profits, minimise any loss and, at the same time, maintain its position as a responsible entity within the society. A business that does not have a proper bookkeeping system is like a blindfolded driver who can easily cause an accident.

(Disclaimer: The views and opinions expressed in this article are those of the author and do not necessarily reflect the views of YourStory.)