PE deals slump 18pc to $16.3B in 2016

Tech and e-commerce firms attract the bulk of investments.

Calendar 2016 was a bad year for those who sought investments from private equity (PE) firms, says PwC India in a report released on Tuesday.

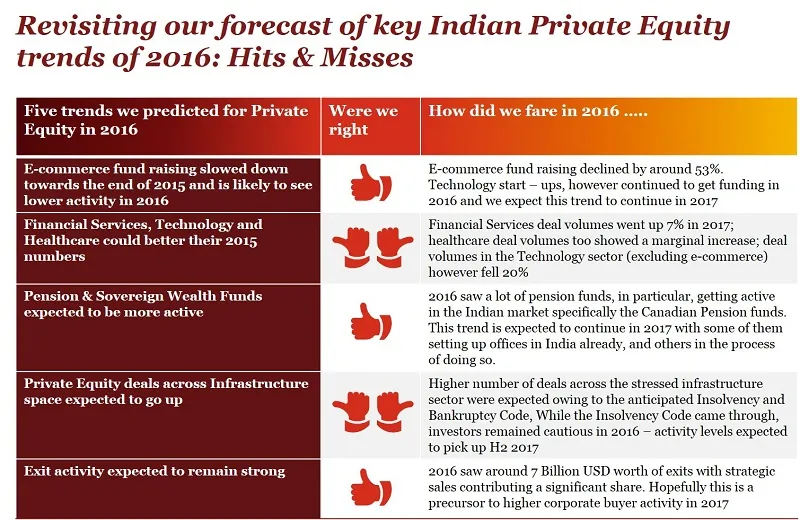

The report notes that PE investments during the calendar amounted to $16.3 billion in 652 deals, a dip of 18 percent in value and 23 percent in volumes compared to 2015 when we saw $19.8 billion in PE investments in 852 deals.

Technology and e-commerce combined gobbled up 31 percent of these investments in 2016, despite a 51 percent decline in the latter. That was because technology startups pulled in $300 million.

Financial services, energy, and manufacturing also saw a rise in activity.

Financial services attracted $2.7 billion and saw a seven percent increase in deal volumes followed by energy ($2 billion, up by 41 percent) and manufacturing ($1.2 billion, up by 25 percent).

In telecom, the largest deal this year was Reliance Communications’ sale of its majority stake in its tower assets housed under Reliance Infratel to Brookfield Asset Management for around $1.7 billion.

Healthcare saw volumes of $600 million, a fall of 16 percent in 24 deals. The sector saw tremendous interest right through the year, but not many deals were consummated. Activity in the consumer and retail space picked up marginally with PE investments worth $700 million, up by 18 percent.

In terms of stage of funding, late growth and buyouts together accounted for over 56 percent of investments in 2016 at $9.2 billion in 116 deals.

“This was partly attributable to the higher levels of activity from sovereign wealth and pension funds, in particular in the second half of the year. Not surprisingly, early-stage and growth investments witnessed a decline — $1 billion and $4 billion of investments respectively,” says Sanjeev Krishan, Leader–PE at PwC (India).

The calendar saw exits worth $7.2 billion in 198 deals, a dip of 25 percent. The manufacturing sector saw maximum exit activity ($2 billion) and was tailed by technology and e-commerce ($1.5 billion) and financial services ($1.1 billion). Over 42 percent of the exit value was due to strategic sales, and this could be a precursor to higher corporate buyer activity in 2017.

PwC stated that these figures were accurate as of December 15, 2016, and excluded real estate deals. Also, healthcare numbers do not account for life sciences, pharmaceuticals, and medical devices and applications.