Rs 3cr in 3 days and Rs 25,000 in 90 seconds, Capital Float is cutting out that troublesome wait for business loans

A hybrid marketplace, Capital Float co-lends with banks and other financial marketplaces, contributing at least 10 percent of the loan lent to the borrower.

When Shuchi Pandya, Co-founder of fashion e-commerce platform Pipa Bella, was looking to borrow working capital, she found the disbursal process of a traditional bank lengthy and time consuming, owing to the requirements of excessive documentation and a slow approval process. One day, she came across the platform Capital Float, which cut down on the difficulties plaguing her company considerably, disbursing the required loan in a mere three days’ time. Shuchi borrowed Rs 7 lakh for two years, with an interest rate of 1.2 to 1.5 percent per month.

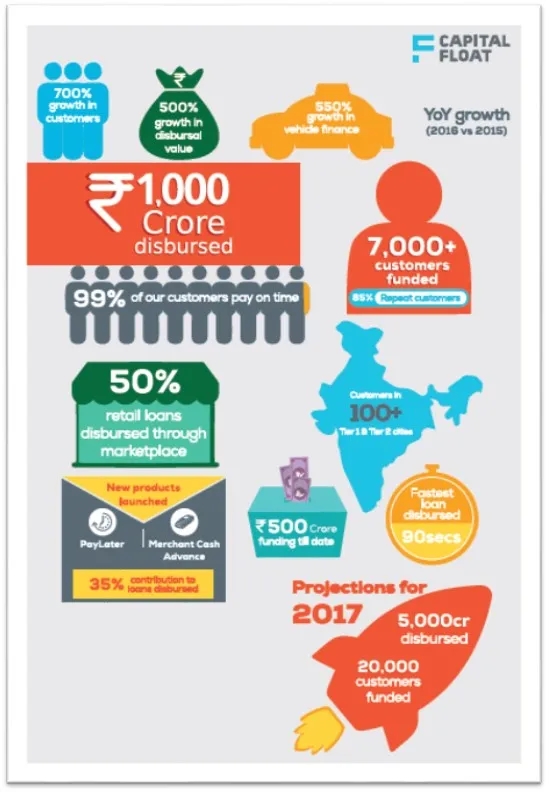

The short turnaround time for disbursing loans is a matter of great pride for digital lending platform to SMEs Capital Float, and is one of the chief differentiators between them and more traditional lenders. The company claimed to have disbursed loans to the tune of Rs 1,000 crore to over 7,000 customers in under ten months, between April 2016 and January 2017.

The duration of disbursing large ticket size loans has been reduced to three days from the original seven, while the small ticket loans are disbursed in as little as 90 seconds. Capital Float offers loans in the range of Rs 25,000 and Rs 3 crore.

Founded in 2013, Capital Float is the trade name of RBI-registered Non-Banking Financial Company (NBFC) Zen Lefin Private Limited. The venture, since inception, has partnered with companies across verticals, having forged partnerships with the likes of Snapdeal, PayTM, Shopclues, eBay, Alibaba, Amazon, VIA, Yatra, Mswipe, Pine Labs, Bijlipay, ICICI Merchant Services, and UBER.

Headquartered in Bengaluru, with offices in Delhi, Chennai, and Mumbai, Capital Float has raised funds from SAIF, Sequoia, Aspada, and Creation Investments Capital Management.

“Sashank (Rishyasringa, Co-founder of Capital Float) and I, along with the first members of the organisation, performed all the activities without much delegation, including sourcing leads, underwriting applicants, and disbursing funds,” says Gaurav Hinduja, Co-founder, Capital Float.

A hybrid marketplace

Since the commencement of the digital era in our country, the delivery of financial services has witnessed a dynamic shift, leveraging the opportunities digital represents. Though traditional banks and financial organisations have their own experience in the sphere, they eventually realised the potential collaboration with fintech startups held.

A hybrid marketplace, Capital Float co-lends with banks and other financial marketplaces, contributing at least 10 percent of the loan size. In case of repayment for co-lent loans, the borrower repays into one account, and not two separate ones. The repayment gets split based on the proportion co-lent between the institution and Capital Float and is automatically transferred to the two separate accounts.

Non-performing assets

According to Gaurav, the non-performing asset rate of Capital Float is one percent, which is significantly lower than the industry standard. Their rigorous underwriting helps in ensuring low NPAs. Their partnerships with prominent players in the SME ecosystem have served to create a library of data on the SMEs operating in those ecosystems.

This data is used to understand and underwrite the SMEs, enabling Capital Float to offer customised, innovative working capital finance solutions. The proprietary algorithms of Capital Float crunch over 2,000 data variables while underwriting borrowers, using both traditional and non-traditional data.

As reported by PTI, for private sector banks, gross NPAs grew to Rs 70,321 crore by December 31, 2016, up from Rs 48,380 crore as on March 31, 2016. The bad loans of public sector banks rose by over Rs 1 lakh crore during the April-December period of 2016.

“The team at Capital Float, comprising of 450 individuals, engages in regular product innovation to create a working capital finance solution that addresses the needs of SMEs from various segments. We have disbursed over Rs 1,500 crore in FY 16-17. Our interest rates vary between 16-20 percent,” says Gaurav.

He added that unlike banks, which take eight to twelve weeks to disburse funds, Capital Float requires minimum documentation from the borrowers and disburses funds in just three days. Potential borrowers can apply for a loan online via their mobile device or desktop at any time.

Product offerings

Pay Later: A collateral-free credit facility that allows the borrower to make multiple drawdowns within a credit limit. The borrower can make bullet repayments and reset the credit balance, making this a rolling loan facility. Interest is charged on the drawdown amounts and not on the entire credit limit.

Kirana Loans: Capital Float has collaborated with IndiaStack to offer micro loans to kirana store owners in India. These loans are disbursed in less than 90 seconds, and are completely paperless in nature, digitally processed and disbursed to the borrower’s bank account. There is little to no human intervention, as even the underwriting is done by algorithms.

Online Seller Finance: Capital Float’s partnerships with India's biggest e-commerce platforms help online sellers access fast and flexible working capital loans to operate optimally. Borrowers can opt for fortnightly repayments, preventing the burden of paying larger sums at the end of every month.

Taxi Finance: Capital Float offers to help cab drivers own and drive their taxi on taxi-aggregator platforms like Uber and Ola. These companies deduct the weekly instalment from their driver’s earnings and transfer the amount to Capital Float, before remitting the earnings to the driver’s account. The weekly instalments reduce the burden of heavy EMIs on the driver.

Merchant Cash Advance: Since Capital Float has partnered with Mswipe, Pine Labs, Bijlipay, and ICICI Merchant Services, merchants can receive financing of up to 200 percent of their monthly sales from card swipes.

Invoice Finance: Invoices can be liquidated into funds that can be used to fuel business operations. Borrowers can manage their payment commitments better with Capital Float’s invoice financing option. Capital Float’s product converts invoices into money that can be immediately deployed to get their business going. Borrowers can opt for the one-time bullet repayment mode to suit their cash flows.

Term Finance: This is a typical unsecured business loan, and is relevant to B2B service providers, manufacturers, and distributors. The loan tenure ranges between six months and three years, making it a relevant product for different types of businesses.

“Merchant Cash Advance and Pay Later contribute to over 35 percent of the loan disbursals at Capital Float. We also experienced a 550 percent increase in the disbursals of Taxi Finance last financial year,” says Gaurav.

Easy access to finance for SMEs

The Government of India has introduced several reforms to liberalise, regulate, and enhance this industry. The government and the Reserve Bank of India (RBI) have taken various measures to facilitate easy access to finance for Micro, Small, and Medium Enterprises (MSMEs). These measures include launching the Credit Guarantee Fund Scheme for Micro and Small Enterprises, issuing guideline to banks regarding collateral requirements, and setting up a Micro Units Development and Refinance Agency (MUDRA).

According to an India Brand Equity Foundation (IBEF) report, the financial sector in India is predominantly a banking sector, with commercial banks accounting for more than 64 percent of the total assets held by the financial system.

The lending market, which until just a few years ago was little more than a few concepts strung together, now has a plethora of startups, with some of the biggest players being Finomena, Lendingkart, and Rubique. Finomena last year raised funds from Matrix Partners and others. Lendingkart raised $32M funding led by Bertelsmann India Investments (BII), with participation from Darrin Capital Management and existing investors – Mayfield India, Saama Capital, and India Quotient.

There are other platforms like IndiaLends, P2P lending platform Faircent, and Kudos Finance and Investment operating in the space. Platforms like EarlySalary and Khadkee, meanwhile, focus on payday lending.

“We earn revenue from interest and processing fees. Over the next year, we want to increase our reach to over 20,000 customers in 150 cities and disburse loans of over Rs 5,000 crore,” says Gaurav, filled with optimism for the future.

Website: Capital Float