With PhonePe, Flipkart makes a quiet entry into financial services

India’s most valuable startup, Flipkart, has designs on your money. It plans to use its payment app to become a one-stop application to disrupt banking apps.

“We want to help people grow their money. Managing it is only part of it.”

Sameer Nigam and Rahul Chari, Founders of PhonePe, make their intentions clear as they sit across from me in a meeting room that is curiously named Masala Dosa. (‘Medu Vada’ was occupied, so that wasn’t an option.)

PhonePe, acquired by Flipkart in April last year, is essentially a payment system riding on UPI. But now it plans to cross-sell financial products across spectrums.

Sameer, who was Senior Vice President of Flipkart when he left the company in August 2015, adds,

“We want to do credit and would want to do lending, perhaps. So, what if we could give people a virtual credit line that they can use? The same goes for products like mutual funds and insurance.”

PhonePe’s new plans do not come as a surprise. Over the past few months, two of the biggest payment companies in India, Paytm and MobiKwik, have talked about similar plans, laying the blueprint for their financial services division.

Last month, it was reported that MobiKwik was planning to give its users credit lines of Rs 1 lakh each in tie-ups with banks and NBFCs. The company also plans to offer personal loans and insurance services, and add new segments like mediclaim. Market leader Paytm too has set up its deposits and asset management wing under Paytm Financial Services, a subsidiary of its Paytm Payments Bank division.

PhonePe’s differentiation? Consumer DNA

The founders state that PhonePe wants to explore partnerships between its great technology DNA and finance or banking. Banks have a lot of experience in keeping money safe, but, as Rahul adds,

“We have a consumer DNA, with all ideas coming from consumers. Therefore, our thinking involves consumers—what is the next vehicle to actually offer credit, what are the best ways of identifying the right set of folks? Bringing the stuff that is data-oriented to the fore is where we think our responsibility lies.”

Hence, their philosophy is to structure and leverage financial products from banks and offer these to the right audiences. It also involves relying on strong data points from consumers, including risk assessment and cash flows, derived by looking at their bank statements.

However, the founders agree when they state, “We don’t want to be just a lead generation engine for banks.”

Rahul explains,

“It could be new APIs designed with the banks. And it has to be that way, otherwise saying that we have a consumer DNA will merely be lip service as we will end up throwing generic suggestions at our customers.”

One step at a time

They want to be extremely controlled in the way they roll out these services. Historically, every new category rolled out on an app has a standardised experience, which the firm controls without making any compromise. It would be no different for financial services.

And slowly but steadily, PhonePe is taking steps in this direction, adding one feature at a time.

PhonePe wasn’t meant for UPI

PhonePe wasn’t originally meant to be a payments system riding on National Payment Corporation of India’s (NPCI) Unified Payments Interface (UPI).

Soon after Rahul and Sameer left Flipkart, they were talking to banks to build a payment system riding on IMPS. However, with 15 top banks and their different APIs to be integrated, the process was turning into nothing short of a nightmare. Then, in February 2016, the entire startup circuit got invited to the launch of UPI, which seemed too good to be true at the time. Things began to look real when then-RBI Governor Raghuram Rajan announced that UPI would go live in August 2016.

Eventually, PhonePe was launched as a payment system riding on the UPI, which promised users a seamless experience.

Building the payment container, feature by feature

The founders describe the app as a ‘payment-container’, holding multiple payment options. In early 2017, PhonePe introduced debit and credit card support and scaled up to two million transactions in just six months. The founders state,

“We realised that while we would be instrument-agnostic, we want to take charge on the UPI innovation side because it’s a progressive platform.”

At present, an individual can make transactions on the platform through UPI to the phone number of the receiver, or to their virtual name (VPA). If the receiver isn’t on UPI, you can make a payment by inputting bank details of the recipient – more like an IMPS transaction.

In May 2016, Flipkart received a licence to start operating a mobile wallet. PhonePe, though, took a counter view by disallowing top-ups on the wallet. Hence, the wallet became a mechanism only to receive and withdraw refunds from online stores, which would otherwise take five to seven business days to come through.

Remembering what your customer pays for

Another feature on PhonePe was ‘Reminders’. Rahul explains,

“We found that people were making the same denomination of payments to the same person at regular frequencies. So, we just started structuring information. Now, I can add a reminder (to make a payment) and decide who the person is, as well as the start date and the end date.”

An evolved version of this would be ‘recurring payments’, which they are positive will be available under the UPI 2.0 framework by September.

From cash-on-delivery to pay-on-delivery

The process of cash-on-delivery (CoD) was almost nightmarish for supply chain teams from an efficiency and cash management point of view, recalls Rahul, who headed engineering for Flipkart’s supply chain. There was always a problem of the delivery agents having to carry the exact change and mPoS devices. Sometimes customers weren’t present to collect their orders.

So PhonePe became a perfect alternative for Flipkart to ensure payments for CoD were taken care of. Sameer explains,

“As soon as the shipment gets pushed out from the delivery hub in the morning, the customer gets a ping on the PhonePe app to pay for the product any time during the day. Customers can then pay using any instrument—UPI, the balance in their PhonePe wallet, a credit card or a debit card.”

Therefore, it allows users to act at a time of their choice—five minutes after the order, during the delivery window, or when the order lands at their doorstep.

What is even more interesting is that customers can now re-route payments and forward the payment request to another individual on the PhonePe app to pay for it on their behalf.

Even with such customer-centricity, not all its features have worked in PhonePe’s favour, especially some of the improvisations.

Bill split: The feature allowed consumers to state the number of people and split the bill between them. Even with early adoption, the team realised that this wasn’t catching on. The learning was that although people liked being able to split bills, they didn’t want to have to enter an mPin every time they made small payments like Rs 30 or Rs 50. So PhonePe is now building a feature that keeps the bookkeeping separate from the payments.

Credit card payments: Sources also claim that the team is working to roll out credit card payments. Given that PhonePe already has millions of cards and bank users on its platform, it will soon allow them to pay their credit card bills with a single-swipe feature, doing away with the hassles of netbanking.

Building the future: Connecting the dots further, its partnerships with banks will allow consumers to even pay insurance premiums and purchase other financial products online, all of which will be incrementally built into the app.

In future, the duo plan to add features that allow consumers to not just check their bank balances but also download bank statements, hence subtly but in strong differentiation, and possibly disrupting the banking applications of various banks. The only thing missing from their plans, as they put it, is the opening of fixed deposits and bank accounts.

Overthrowing BHIM

PM Narendra Modi announced the launch of BHIM (Bharat Interface for Money), a mobile payments app riding on UPI, developed by the NPCI in December 2016 to drive digital payments in the country.

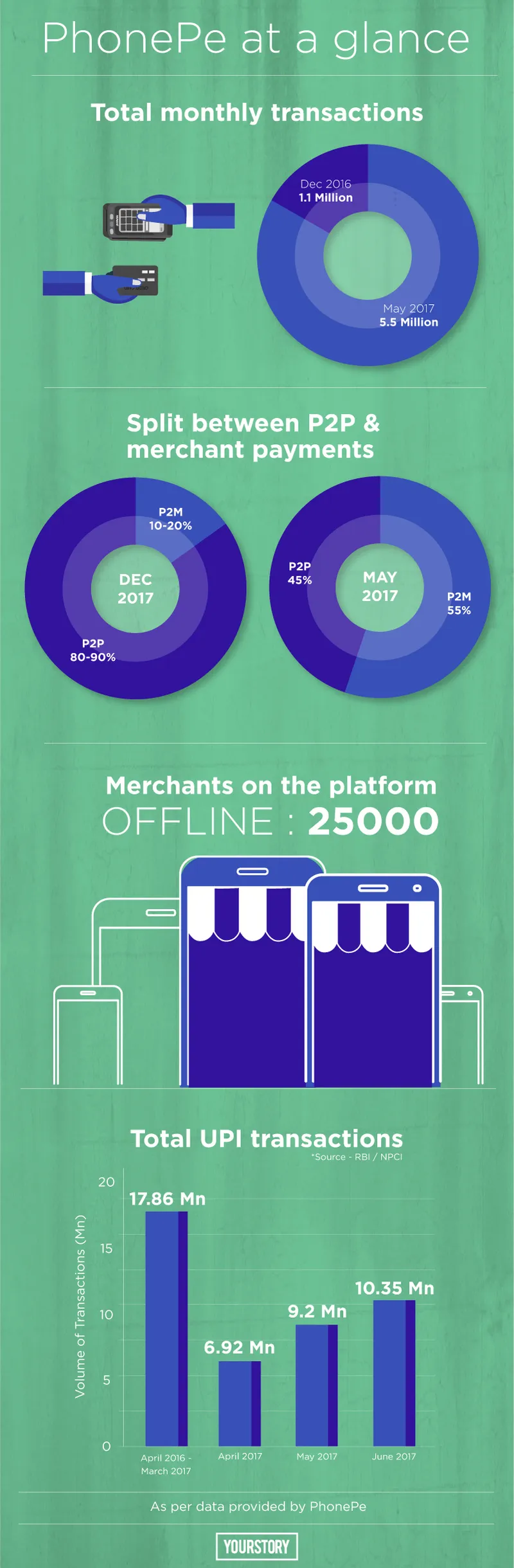

According to representative data from the Reserve Bank of India (RBI), May 2017 saw a total of 9.2 million UPI transactions via BHIM and other private players, which crossed 10 million in June 2017.

According to the NPCI, of the total UPI transaction volume in June, only about 22 per cent were merchant-based, with a large chunk being peer-to-peer transactions. However, PhonePe claims that almost 55 percent of its total transactions are merchant-based, and claims to have outperformed BHIM in terms of share of UPI-based merchant transactions.

For May, BHIM reportedly had a 42 percent share of UPI transactions by volume, slipping from the 44 percent in April. PhonePe is close behind, claiming a 38 percent share in June.

The founders add that if ICICI hadn’t blocked transactions via PhonePe (the bank had cited security concerns) they would have done a whole lot better. (According to ICICI and the other bankers, Flipkart’s PhonePe app was asking users to open a UPI handle on the app, not letting users use UPI handles of other banks, which went against the rule of interoperability.)

In May, PhonePe clocked 5.5 million transactions, of which 3.5 million were on UPI while the rest were on a card or the wallet. This was a sharp rise from December last year when it clocked about 1.1 million transactions. In June, it kept up the pace, recording 6.5 million payments.

Some of this sharp rise can also be attributed to Flipkart’s ‘Big 10’ sale, which accounted for 2.5 million (or 45 percent) of the total transactions on PhonePe for May. Further, over 40 percent of all prepaid transactions for Flipkart, Myntra, and Jabong also occurred on PhonePe.

When asked about facing the heat by a government-endorsed entity like BHIM, Sameer explains,

“I think of BHIM as both a competitor and a facilitator. Their presence makes the UPI network real because if the government and the Prime Minister say that this is an offering to mainstream India, I know that UPI is not shutting down anytime soon. In the long run, it is only going to help us.”

However, in the short-term, their outlook is somewhat different.

“We do see BHIM as a major competitor and actually an interesting one. We are challenging our marketing teams, saying we don’t have Narendra Modi endorsing us, so how do we gain market share without spending a billion dollars? There’s also Jio Money, which has a crazy amount of cash and political clout. So this is a far more fascinating market than what people think,” adds Sameer.

While much has been written about peer-to-peer (P2P) payments, which is a strong use case for UPI, peer-to-merchants (P2M) is where the action is going to heat up. At a conference in September, Dilip Asbe, COO of NPCI reportedly said,

“We’ve made the UPI live on the P2P side. However, it holds great potential on the P2M side … P2P transactions are not that frequent from a consumer standpoint. It happens once or twice in a month.”

And that’s the market where PhonePe is trying to lead the pack.

Taking UPI to the merchants

In the online world, PhonePe considers the top 150 online merchants while looking to reach the offline merchants through aggregator partnerships like with payment gateways, including BillDesk and CCAvenue. Among the top 150, the app has 35-odd integrations and has gone live with 15 merchants already (including with Swiggy, Box8, and ClearTrip).

Within these partnerships, PhonePe looks at deeper integrations, with senior engineers in the team trying to identify special problems—like multi-party settlements—that can be solved for or with partners.

PhonePe is looking to partner with offline chains like Apollo Hospitals, Barista, and Café Coffee Day. Another way is through integration with partners such as Pine Labs, where a dynamic QR is shown on their PoS machines or a direct PoS integration with their systems. By this end of this quarter, PhonePe expects to be live in 15 national chains across 18,000-20,000 outlets.

In unorganised retail, the company has started experimenting with specific use cases, with a bunch of QR codes and is putting feet on the street via account managers to drive adoption of PhonePe among small retailers. Sameer adds,

“It is not how many QR codes we can deploy but how many conversions we can get from each outlet. We are also doing some R&D on our own PoS solution.”

The eureka moment

From banks and the government to fintech startups, everyone has woken up to claim a slice of the country’s digital payments pie post-demonetisation.

In March 2017, 24 banks came together to launch a common QR code for payments. A month later, the Prime Minister launched Aadhaar Pay (AEPS), a payment system where consumers will be able to make a payment by just verifying their Aadhaar number.

While the Indian user has a plethora of options, the good news is that this will help more individuals to become part of the digital payment grid. The bad news is that payment systems will have to work harder to prove themselves and outsurvive competition. Clearly, UPI cannot be the only strong differentiator for PhonePe in the long run. What PhonePe needs are features that will take the system to the masses and set it apart from the crowd.

PhonePe needs to just refer to its parent company Flipkart’s history for lessons. During the initial days of e-commerce in India, Flipkart was just one of the many companies operating in the industry. It took features like CoD and no-questions-asked-returns to win over customers. PhonePe needs a similar game-changer.