'We should celebrate products, customer success, not funding' - Vani Kola, MD, Kalaari

With a 22-year entrepreneurial journey across multiple companies, and more than a decade as a venture capitalist in India, Vani Kola, Managing Director, Kalaari Capital, has vast experience on both sides of the startup trenches. Addressing the gathering during her session at YourStory's TechSparks 2017, she remarked,

"Looking back is sometimes important before you look forward."

Vani Kola joked that given her long innings in the startup ecosystem, she is often requested to talk on topics like 'startup evolution' or learnings from the last decade in the startup ecosystem.

Indian startup evolution

In 2006, Vani Kola had just returned from the US and realised that the Indian startup ecosystem was virtually non-existent. Compare to 2017, there were virtually no startups and very few late-stage investors. Talking about the dilemma that early-stage startup investors faced, she said,

We could write the first cheque. But who would write future cheques?

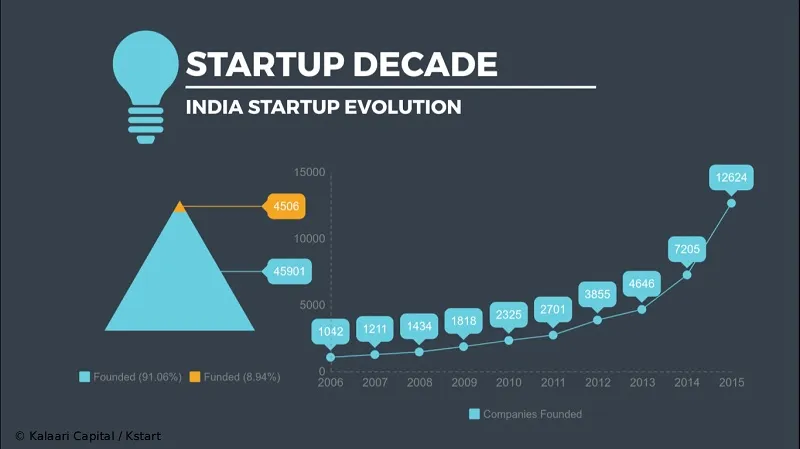

The lack of late-stage investors in India at that time meant that early-stage investors had lower chances of getting good exits on their portfolio companies. From a list of about 45,900 startups founded in the period of 2006 to 2015, Vani Kola noted that only 8.94 percent had actually raised external funding.

She was, however, quick to point out that raising funds is not the real metric that startups should measure their progress or success by. She said,

I do believe we celebrate funding too much... Instead, we should celebrate product and customer successes.

She also noted that a lot of startups that have sustainable business models don't really need to raise external capital to succeed. There have been many successful ventures that raised funding at late stages, and then there are startups that have raised huge amounts of capital but still gone bust.

Observing another trend Vani Kola said that many Indian startup founders pitch their startups to investors along the lines of 'We are Uber for X' or we are 'X for Y'. She, instead, asked startup founders to change their mindsets with more aspirational thoughts,

I don't want to hear who you are like. Somebody else should want to become like you.

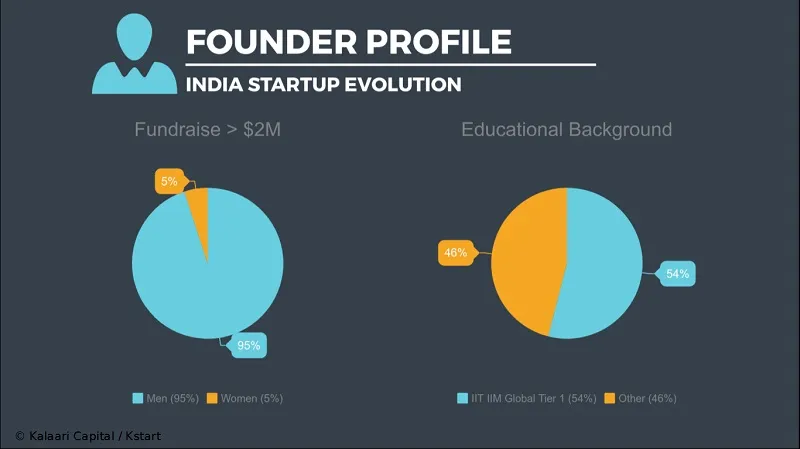

Founders that have raised more than $2 million

Referring to a Kalaari report of startups that have raised greater than $2 million, Vani Kola made interesting observations about founder demographics. Ninety-five percent of the funded startups were led by men. She observed,

Only five percent of the funded startups have women co-founders, and that's what distinguishes YourStory*, and I am proud of that.

A big perception in the Indian startup ecosystem is that founders from institutions like IIT and IIM generally get more investor attention. But Kalaari's report indicated that the numbers are not skewed that much. While 54 percent of startups do have the IIT or IIM tag, a healthy 46 percent from Tier II institutions and others have also successfully raised funding. She noted,

In this sense entrepreneurship has somewhat been democratised... Globally, too, there is no resume that prepares you for the startup journey.

Funding rounds vs exits

Vani Kola said that the Indian startup has seen tremendous progress in the last decade and many startups have raised significant capital and gone on to be successful ventures. India now has a vibrant investor base too, with a lot of national and international funds looking to invest in startups. Vani Kola remarked,

If we build great companies, global capital will flow.

In 2016, $4 billion was invested in Indian startups – deal value decreased 55 percent, volume increased by three percent compared to 2015. Vani Kola, though, noted that while a lot more startups are now able to raise capital from investors, there are a few outliers that raise a staggering amount of money and this sometimes distorts the overall picture of the startup ecosystem.

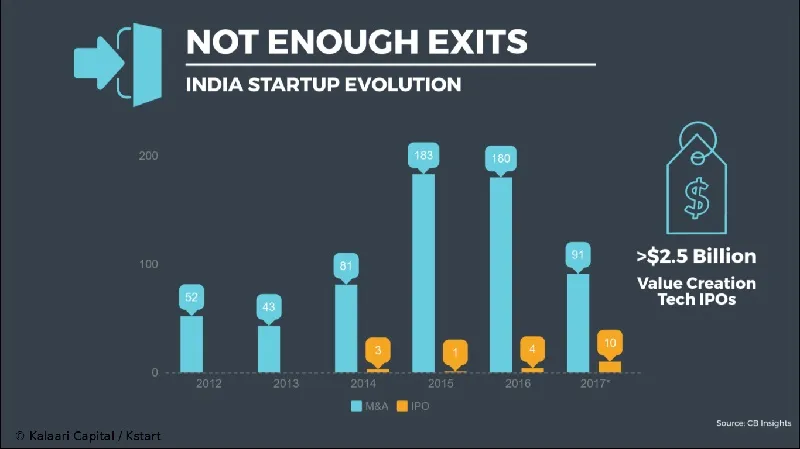

But the distortion becomes more apparent when one sees the exits and mergers and acquisitions from India. Though startups have $2.5-billion value creation tech IPOs, Vani Kola believes that there have not been enough exits in India.

She believes that a vibrant startup ecosystem is made possible by diverse stakeholders — angels and VCs, incubators and accelerators, universities and government — coming together.

Way forward

Looking towards the next decade of startup growth, Vani Kola believes that there needs to be more alignment among the various stakeholders of the Indian startup ecosystem to deliver better results. She summarised them in three points -

1. Need larger exits to happen; so far most exits were smaller M&As.

2. To facilitate exits there needs to be better entrepreneurial culture. Entrepreneurs should learn to build companies of scale.

3. Need to move from a knowledge economy to an innovation economy. Referring to her earlier point of 'Uber for X' and the mindset shift required in the ecosystem, Vani Kola encouraged startups to contemplate and implement based on how the country's startup ecosystem could move from a knowledge economy to an innovation economy.

(*Disclaimer- Kalaari Capital is an investor in YourStory)