Flipkart valuation takes a hit — Valic values it at $7.9B: reports

E-commerce leader Flipkart has had a decent year so far — raising more than $2 billion, acquiring eBay India, putting up a good fight against Amazon India during the festival season sales in the last two months — but the 10-year-old online marketplace still seems to have demons to fight.

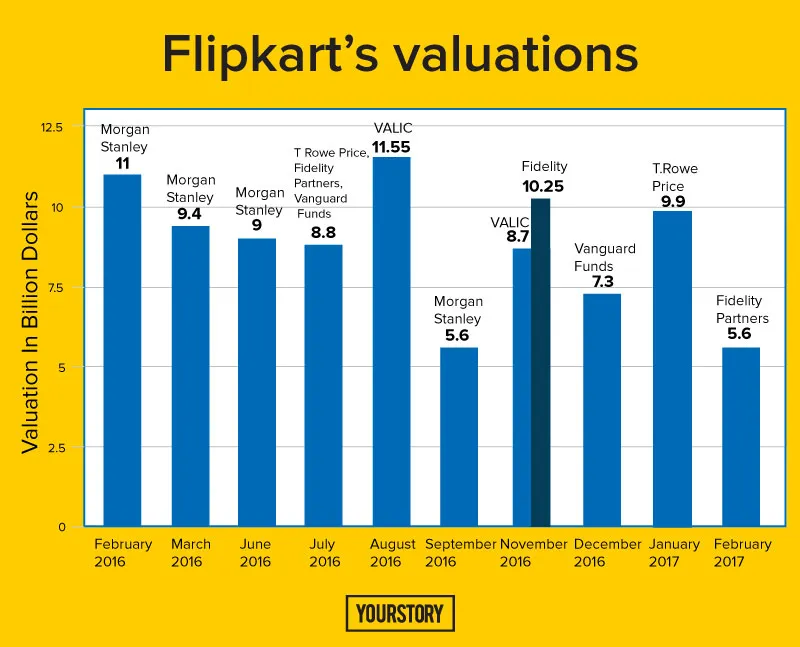

According to media reports, mutual fund investor Valic Co. in its latest quarterly report has marked down Flipkart’s valuation from the $11 billion at which the company had raised funding earlier this year from Tencent, SoftBank, and Microsoft to $7.9 billion. Livemint has reported that Valic had valued Flipkart at around $8.5 billion in the previous quarter. “For the three months ended 31 August, Valic valued each Flipkart share at $88.11, down from $94.27 in the previous quarter,” the report adds.

In 2014, when Flipkart raised $1 billion, it was valued at $15 billion — from which it has been devalued multiple times in 2016 by different investors. In January this year, minority investor T. Rowe Price pegged Flipkart’s worth at $9.9 billion, a drop of four percent over its September 2016 figures.

Valuation is what the investors think the company will be worth if it does as well as they expect it to do. It is a mix of market environment, risk appetite, a fund manager’s biases, hot new trends, fear of missing out, the multiples comparable companies are commanding, and of course, expected cash flows and margins.

Flipkart has been focusing on profitability this year, especially after Kalyan Krishnamurthy took charge as CEO. The company launched a private label in fashion and electronics under the umbrella brand ‘Flipkart Smartbuy’ and has also relaunched its furniture and grocery categories. Along with Myntra and Jabong, Flipkart has about 70 percent market share in fashion, which is also the highest margin category.

However, for a fund to mark down a company’s value, it has to seriously believe that the value of the company is lower than what it was originally marked at. If Flipkart is serious about a successful exit, these numbers matter — after all, valuation is the price at which a seller (entrepreneur) is willing to sell and a buyer (investor) is willing to buy. The price gap occurs because an entrepreneur looks at what has been built, while investors look at what they are buying for the future.