This mutual fund investment startup helps millennials squirrel away their investments and savings

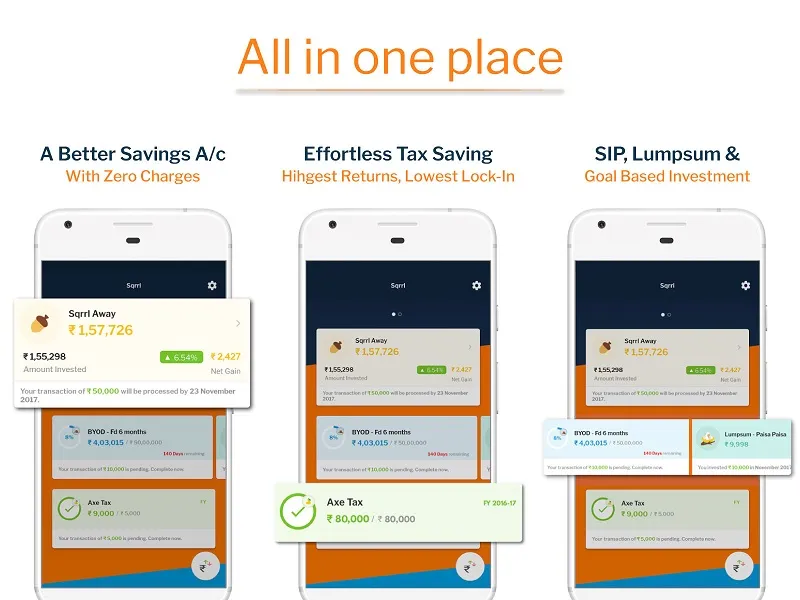

Sqrrl, an app-based financial services platform, is targeted at millennials, currently offering three unique mutual fund investment options.

At a glance:

Startup: Sqrrl

Founders: Samant Sikka, Dhananjay Singh and Sanjeev Sharma

Year it was founded: 2016

Where it is based: New Delhi

The problem it solves: App-based financial services for millennials

Sector: Financial services

Funding raised: Bootstrapped

Samant Sikka has worked for almost two decades in the financial services domain, constantly exposed to challenges of building distribution in a country as diverse as India. He was intrigued by the fact that, despite the passage of seven decades since independence, the financial services ecosystem is still struggling to provide access of financial services to many Indians.

Samant saw the impact of technology and internet on democratising “access”. E-commerce was starting to gain traction and people started getting access to goods and services hitherto restricted to larger cities and towns. Given the economic prosperity in the last two decades, people had both aspirations and means to consume and were demanding better experiences. Internet had started to travel deeper in the country; social and digital were starting to have an impact on consumer behaviour and consumption patterns.

“The single most important reason that came in the way of expanding financial services footprint was ‘Unit Economics’. Unit economics dictated who got access to financial products and services and also which type of products got sold,” says Samant on how he saw digital technologies changing the unit economics for the financial services industry.

In May 2016, Samant teamed up with Dhananjay Singh and Sanjeev Sharma to start Sqrrl. The startup counts Shripad Nadkarni, Advait Dikshit and Carl Richards as advisors. The vision was to build a digital financial services platform aimed at millennials. They started with an initial offering around savings and investment products powered by mutual funds.

Sqrrl has been bootstrapped so far and has a team of 10 people. “We are in advanced stage of funding closure with an early-stage VC and the term sheet is being discussed,” shares Samant.

Sqrrl differentiates itself by offering unique mutual fund investment options suited for a young population - Sqrrl away for small automated investments and savings, Bring Your Own Dreams (BYOD) for goal-oriented investments, and Axe tax for optimal tax savings. In the case of Sqrrl Away, the minimum savings amount is Rs 100. In case of BYOD, the minimum saving will depend upon the type of your goal and how soon you want reach it. For Axe Tax, minimum savings amount is Rs 1,000.

Sqrrl had a trial launch in March 2017 to test the product with a closed audience and was launched in July 2017. Sqrrl claims to have attracted 40,000+ customers who have used the platform for mutual fund investments.

Having started with mutual funds, the startup plans to expand to loans, insurance, payments and aspires to morph into a digital bank. The startup has an ambitious aim to be amongst the top 10 digital financial players by 2022 with an AUM (Assets Under Management) of $14 billion and catering to 12 million customers.

In 2017, mutual fund investments in India saw a monthly pipeline of Rs 5,000 crore, with industry AUM growing to Rs 21 trillion. This was about one-third of total bank deposits. Mutual funds investments are still under-tapped in India. Given the complexity of mutual fund brokerage companies and their web services, app-based digital financial service providers are gaining market share, with their convenience and offerings.