From invention to re-invention: can Bengaluru become the ‘Super Silicon Valley’ of the world?

The combination of startups, IT services firms, R&D, and Global In-house Centres in Bengaluru can propel it beyond Silicon Valley, according to an industry panel at the Times LitFest.

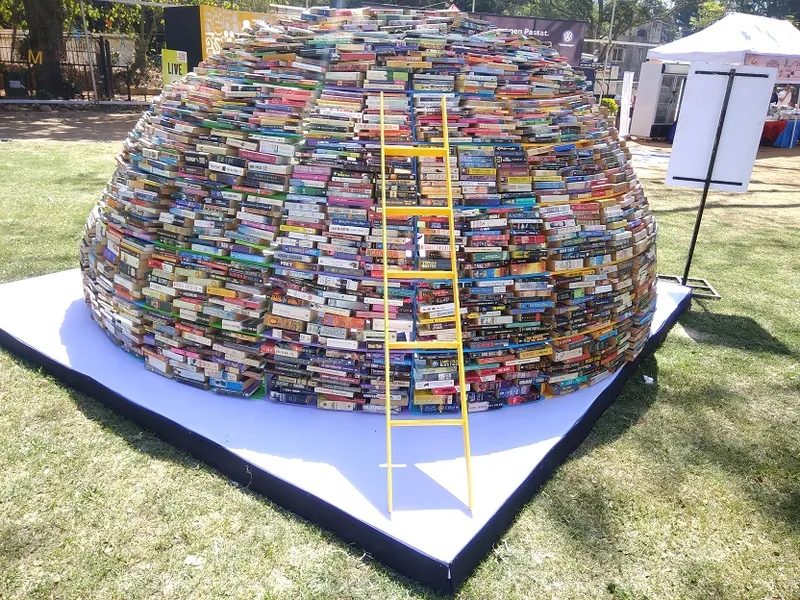

The recent Times LitFest 2018 in Bengaluru covered a diverse range of literary genres – biography, poetry, fiction, fantasy, romance, crime, short stories, history, and plays. For an event in India’s Silicon Valley (or Silicon Traffic Jam?), there were also the inevitable panels on digital publishing, startups, offshoring, and tech trends like cryptocurrency.

Two enduring narratives in business literature are invention and re-invention. For example, what are the inventions that are transforming our world? Books like Fifty Things that Made the Modern Economy and The Inevitable are in this first category. The second category (reinvention) features stories about the turnaround of companies such as Apple, IBM and Microsoft (see my book review of Let The Story do the Work).

The narrative of invention and re-invention apply not just to companies and products, but to countries as well. Books such as Startup Nation and India Re-imagined are good examples; the Times LitFest featured these kinds of narratives in two panels. How did the startup boom in India takeoff? And how is India reinventing itself from low-cost BPO centre to high-value R&D and global innovation hub?

Here are my 12 takeaways on this transformative journey of India, as presented by the panel on global business R&D. Moderated by Sujit John, the panel featured Lalit Ahuja (CEO of ANSR Consulting; Co-founder, Kyron); Manu Saale (Managing Director & CEO - Mercedes-Benz Research and Development India); and KS Viswanathan (Vice President, Industry Initiatives, NASSCOM).

Insights from the earlier panel on entrepreneurship in India are covered in the YourStory article, Dream, build, grow: 10 startup tips. See also my takeaways from earlier editions of Times LitFest (2015), as well as Bangalore Business LitFest (2017, 2016), Jaipur Literature Festival (2017), and Bangalore Literature Fest (2015).

- Digital transformation

“Every company is now a tech company,” said Lalit Ahuja. Digital is not just an add-on or bolt-on, but a core element of business model re-redesign. He cited a quote by Michael Corbat, CEO of CitiBank: “We see ourselves as a technology company with a banking license.”

Frameworks like connected design and code halos have emerged to show how companies can re-imagine customer pathways, configure interactive touchpoints, and build a digital skin with sophisticated capabilities for experimentation and prediction. Much of this digital design requires software skills, which play well to India’s advantage.

- The ‘Amazonisation’ of industry

While digitisation driven by the internet, SMAC (social, mobile, analytics, cloud), AI and IoT have been around for some time, it is the ruthless competitive force by giants such as Amazon that is serving as a wake-up call to industry.

Western companies, particularly in the US, are being ‘Amazonised’ as the Seattle-headquartered giant is using digitisation to dramatically disrupt sector after sector, ranging from retail to media. (See also my book review of The Four: The Hidden DNA of Amazon, Apple, Facebook, and Google.)

“India is the battleground for global retail. In the coming years, 80 per cent of global retail players will have some capability in India. This will be a $1 trillion opportunity by the end of 2019,” said Lalit, pointing to the moves by Amazon, AliBaba, and Flipkart in India, as well as investments in companies like BigBasket.

E-commerce along with “click and mortar” hybrid models will play centre-stage in India’s retail landscape, and is also drawing global players like Target and WalMart to India. “Retail lends itself well to centralised management, which is a good opportunity for India,” said Lalit.

The next wave of offshoring to India for digital transformation is just beginning, he explained. This will be driven by the talent crunch in AI, supply chain management, predictive analytics and smart store operations.

- Advantage India: from cost to talent

Emerging economies like China and India have begun at the low-cost low-value end of the IT chain, and then captured high-value segments as well. India was seen as the back office of the world in terms of IT services and BPO, but is now diversifying across the chain.

India has not just a lot of cheap talent, but diverse talent, said KS Viswanathan. Cisco VP Dan Scheinman once famously said, “We came to India for the costs, we stayed for the quality, and we are now investing for the innovation.”

- Back office, front office

Indians know there is a lot of talent here, but how are global MNCs viewing India’s talent pool? India’s steady march up the offshoring value chain was well described by Lalit as a series of office moves.

“India has moved from the back of the back-office to the front of the back-office. We are now moving from the back of the front-office to the front of the front-office,” he joked. Many global businesses will now be run out of India.

- India in global brands

Many earlier models of global business have explained how Indian brands may not be globally known, but Indian skills are embedded in the back-end of global brands. “The contribution of India is ‘invisible’ in the form of embedded support for R&D and business processes,” explained Nirmalya Kumar and Phanish Puranam in their book, India Inside (see my book review).

Today, however, the India contribution is in visible components as well, said Manu Saale. He cited a quote by Mercedes’ advisor Thomas Weber: “In every Mercedes car, there's a huge part of India.”

Other frameworks like reverse innovation have explained how MNC innovations in India are being replicated in other emerging economies. Some of these innovations are even implemented back home in the Western home base, such as GE’s low-cost ultrasound scanners.

- The Global In-house Centre (GIC)

Global In-house Centres (GICs) of MNCs in India are moving from a ‘proof-of-concept’ to centres of strategic importance, thanks to becoming centres of excellence and IP creation. GICs (formerly called captive centres or shared-services centres) are playing a more active role in helping their enterprises excel in the digital world, according to Viswanathan. NASSCOM, Bain and Zinnov have published a range of reports which show how GICs in India enable transformation of their parent firms.

GICs in India account for over a fifth of IT-BPM exports and a fourth of India’s export employees. India is the leading country for MNCs to set up GICs. Most GICs are in the software and internet sector, followed by industrial and automotive (embedded and engineering services).

- From GIC to gee-whiz: craft, design

Some observers have commented that while products are designed elsewhere in the world, they are only being crafted in India. But a growing trend is that design as well as R&D are happening in India.

GICs in India are now becoming well-versed with a wide range of ingredients of global business. The Mercedes centre in Bengaluru is the company’s largest, outside of Germany. “We are close to being able to design the whole car in India,” said Manu.

However, India still has weak spots when it comes to large-scale design and hardware manufacture, as identified by forums like Design4India and Bangalore Technology Summit.

- Where else but India?

India stands out from other countries when it comes to sustaining and ramping up global operations. Manu recalled that a senior manager from Mercedes’ headquarters, on a visit to India, said that he felt the future of the company is assured thanks to the India centre’s younger workforce and skills in software as compared to Germany.

China is a big enough local market to keep Chinese companies engaged and excited, said Manu; it has established its own domestic and export capabilities in hardware. Many of its overseas digital forays are linked to expanding its e-commerce players such as Baidu, Alibaba and Tencent.

English skills, a willingness to solve the world’s problems, and compliance with established process standards are India’s differentiator as compared to China, said Viswanathan. Chinese software companies also have services centres in India, he joked.

- Frugal mindset

Another advantage is the cost of experimentation in India for GICs, which is lower than in many other parts of the world, according to Viswanathan. Indians have a frugal mindset, and this lends itself well to constraint-based models of innovation.

In earlier forums, innovation experts like Navi Radjou have identified India’s potential to develop models like “conscious innovation” that blend frugality with holistic thinking (see my writeup on his TiE Bangalore panel discussion).

- Co-creation: engaging with startups

India has the world's third largest startup base, and a number of business models have arisen for large corporates to engage with agile entrepreneurs (covered in my framework of 15 Innovation Tips). Companies ranging from Target and Pitney Bowes to NetApp and Microsoft have set up accelerators in Bengaluru (see the profile series Startup Hatch). Indian startups are working more closely with academic institutes and large companies, said Lalit.

YourStory has helped a number of accelerators find startups for cohort selection in this regard, and has also partnered with the Shell E4 (Energising and Enabling Energy Entrepreneurs) accelerator programme. Indeed, ‘co-creation’ has become another popular business narrative of our times.

- The dark side: urban chaos, disparity

There are 16,000 IT firms in India, over a thousand MNCs, and more than 5,000 startups, according to Nasscom. However, the proverbial dark side of India’s tech story is in urban chaos, traffic snarls, pollution, and economic disparity.

Can ‘global Bangalore’ do more for ‘local Bengaluru?’ How can smaller towns up their game? How can rural India and marginalised communities be brought into the game? The Indian IT industry and GICs need to go beyond considerations of the bottom line and CSR, the audience at Times LitFest urged.

Some companies have tried to reach out to local government and urban planners, but have been dissuaded by the bureaucracy, corruption, and lack of access to key decision makers. More outreach and alignment is urgently called for.

Working with government is not easy but not impossible either, said Jagan Venkataramanan, an architect who designed some of the first GICs in Bengaluru. His firm has also helped renovate Bengaluru’s Church Street district.

- Upskilling

India’s outsourcing industry must reinvent itself, urged Lalit. Industry, government and academia are coming together to upskill India’s workforce. For example, centres of excellence in analytics, IoT and cybersecurity are being ramped up by the Karnataka government. Examples to watch of other countries that combine urban planning with upskilling are Singapore.

It is often tempting to compare Bengaluru to Silicon Valley (though Silicon Valley is not a city but a region), and ask when India can produce the next Google or Apple.

Such comparisons were made even 20 years ago by scholars like AnnaLee Saxenian, Dean of the University of California (see also my book review of The Next Generation High-Tech Hotspots). It is often said that Bengaluru has a lot of catching up to do to match Silicon Valley, but has Bengaluru gone ahead and excelled it in some parameters?

Bengaluru’s unique combination of software skills, R&D, GICs, startups and VCs has created a world-class ecosystem. “Silicon Valley does not have GICs the way Bengaluru does. Bengaluru can truly become a Super Silicon Valley,” Lalit summed up.