Can Amazon Pay overcome the KYC speed bump?

Amazon Pay offers features beyond the stored balance option, but the wallet is at the core of many of the features the company offers. This could be a limitation in the long run for the ecommerce giant's payments arm.

Not just a wallet — that’s the clear message that Amazon Pay’s India head Mahendra Nerukar wants to send out about the ecommerce giant’s payments arm.

Mahendra, whose official designation is General Manager and Director at Amazon, calls Pay a payment container providing multiple options to customers and merchants.

The idea is to see what issues a customer faces at different pit stops of his online payment or shopping journey and offer solutions that solve each of these challenges and not force fit one solution to all the problems. This could be through the wallet, stored cards, EMIs or even UPI.

There are three meta things we are focusing on — remove friction in payments, improve affordability, and make Amazon Pay an everyday habit,” says Mahendra.

It is in the areas of affordability and making Amazon Pay an everyday habit that the company has seen greater impact in recent months.

Focus on EMIs

EMIs is an area of focus for Amazon Pay and for the parent. This helps make a product easy on the pocket for a customer without the company having to offer deep discounts. Pay has launched debit card EMIs along with HDFC Bank.

This is what we are most excited about. HDFC Bank has pre-identified a set of customers based on their risk models to whom they are willing to give a loan. That experience integrates seamlessly into the Amazon shopping experience. An Amazon customer while shopping gets the debit card EMI option when he goes to payments if he is eligible. This happens in real time. We will soon scale this to other banks,” says Mahendra.

The company is now in the middle of discussions with banks on combining data that Amazon has with that of the banks to create better credit models.

The debit card EMI is not unique to Amazon. Flipkart too offers such EMIs in partnership with banks like Axis Bank, SBI, HDFC Bank, and ICICI Bank.

Amazon is offering other EMI-based schemes as well. Numerous brands have taken on the interest cost during specific campaigns or sales making the EMI effectively no-cost for the customer.

“I don't think there are many markets globally where EMIs and the creativity around EMIs has been as high as in India. Ecommerce players like us have made EMIs` so easily accessible at the point of sale where the customer can literally make a particular transaction in a couple of clicks,” says Mahendra.

Amazon also ran a “buy now pay later” scheme during the last Diwali sale, where customers needed to start EMI payments only in the New Year. Recently, ICICI Bank ran EMI fest on Amazon.in where instead of no-cost, the bank offered a cash bank which amounted to a no-cost EMI for the customer.

A daily habit

While customers can use Pay across all Amazon properties, including using voice instructions to make the payment from the wallet via Alexa-enabled devices. Since late last year other online merchants have started offering Amazon Pay as a payment option. Now around 60 online merchants, including brands like redBus, BookMyShow, Freshmenu and Yatra, are using Amazon Pay as a payment gateway. Customers buying on these sites can now access Amazon Pay wallet or cards stored in their Amazon account and make payments.

Merchant partners seem pleased with the rise in repeat rates of users who use Amazon Pay. Niki, a digital chat-based AI enabled shopping assistant, has enabled Amazon Pay on its app. Sachin Jaiswal, Co-founder and CEO of Niki, says on an average, users using Amazon Pay on Niki do seven transactions a month.

While the intention is to expand the merchant base, Mahendra says with Amazon.in, Pay has a large anchor merchant with massive volumes. Customers on Amazon use Amazon Pay for payments across digital goods like mobile recharges and e-books to subscribing for diapers.

Amazon.in’s customers offer a treasure trove of customer behaviour and use cases for Pay. For instance, for subscription, customers who have a Pay balance get just an alert to let them know the product will be shipped (customers can opt out at that point). The amount gets deducted automatically. Similarly, if a customer is voice shopping through Alexa it makes for a more seamless experience if the customer can make the payment through a voice command, which works only with Pay balance.

The company has also just launched a couple of weeks back, an auto-reload feature, where customers can pre-set an amount and a day of the month. If the Pay balance falls below this pre-set amount, then Pay automatically hits up the card for an auto reload. The same happens on the pre-set day of the month.

Wallet at core

What these features show is that there is no escaping the fact that Amazon Pay Balance or the wallet is in many ways at the core of the ecommerce giant’s payments arm. With the Reserve Bank of India mandating that wallets need to be KYC-compliant, the sheen has gone off this payment instrument. All wallet companies have been affected, including Amazon Pay. The numbers are quite startling. Pay has seen a 95 percent drop in the number of customers loading cash at the doorstep through the delivery executive since KYC became mandatory. There has also been a 30 percent hit in number of customers who have newly started digitally maintaining a Pay balance.

Mahendra concedes that compulsory KYC has become a major area of concern.

There has been intense dialogue (with the regulators) that Amazon Pay has led. We will continue to do that with policy makers, and industry players. We believe in our cash product (cash load at doorstep). It is one of the most convenient ways to get a customer to move from entrenched cash habits to digital habits. We need to continue to impress that on various decision makers,” he says.

However, that’s still work in progress and compulsory KYC remains in place. That is a challenge for Amazon.

For Amazon, wallet has clearly been the most seamless payment offering for its customers. For instance its cash load at doorstep feature only works with the wallet. In fact, the need to roll out this feature was one of the top reasons for Amazon applying for a Prepaid Payments Instrument licence. Amazon has deployed over 40,000 mobile Point of Sale machines that covers over 95 percent of India’s serviceable pin codes. Similarly voice-based payment will not work with a credit card, where OTP entry needs to be done, or with UPI, where a pin needs to be entered.

Will this wallet focus become a roadblock for Amazon?

Let’s take a step back and see the entire market at present. There are three strong strategies which are playing in the Indian payments market — the wallet players, payment systems led by merchant focussed businesses (like ecommerce) and then social messaging payment tools.

At present, the second and third strategies are dominated by payment arms of ecommerce companies like Amazon Pay and Flipkart’s PhonePe along with internet and messaging majors Google Tez and WhatsApp.

By experience we know that ecommerce models will push P2M (Peer-to-Merchant) payments use case while Social messaging payment players will solve for the P2P (Peer-to-Peer) use case.

Sachin Seth, Partner at EY, says P2P will significantly expand and capture the market because of domestic remittances.

All of this is increasingly riding on the UPI layer.

So, does this mean that wallets are deemed worthless, in the new payment scenario? Not really.

Sachin states:

There will be two to three wallet players considering the life of cashbacks, and there will always be cashbacks in ecommerce. And closed loop wallets will definitely serve this used case. At the same time, it creates a certain level of stickiness to the entire commerce ecosystem. From a loyalty management perspective, if let’s say you want to convert loyalty points to cash, how do you do it? So wallets work best for that.”

But at a time when Amazon Pay’s competitors are strengthening on an ecosystem strategy, is Amazon losing a fight?

To this Sachin explains,

“Every big player in the market has their own strategy. PhonePe is not just supporting Flipkart but creating an independent ecosystem of its own. Paytm on the other hand started with payments and now has a Payment Bank licence. While for Amazon everything is pure play ecommerce and the rest is secondary. They are trying to play on customer stickiness through different subscription and payments (or Amazon Pay) is just supporting the ecommerce arm with this strategy.”

However, Amazon still needs to get aggressive on UPI if it plans to take the fight to financial services.

“If the payment player in question has financial services as a part of its strategy then having a UPI based paying layer becomes equally important. For example, Paytm and Flipkart both have financial services as a part of their core strategy so UPI becomes extremely important for them. Because it helps them understand consumer behaviour not just within but also outside their own relevant ecosystem,” adds Sachin.

Amazon has already allowed payments from UPI handles, but it is yet to enable creation of UPI handles. What this means is someone who already has a UPI account can make a payment on Amazon but the company does not create new UPI users, as of now. Mahendra only says the company has a roadmap for UPI.

For Amazon, enabling digital payments is an important objective. About 40 percent of transactions on Amazon were pre-paid in the beginning of 2017; by end of the year that increased to 60 percent.

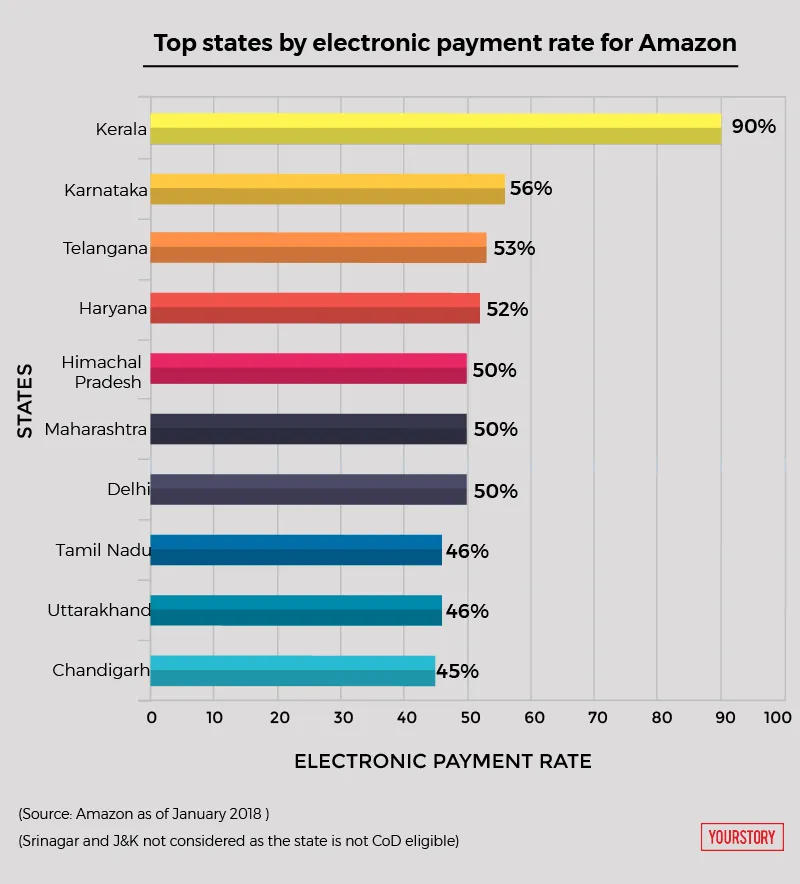

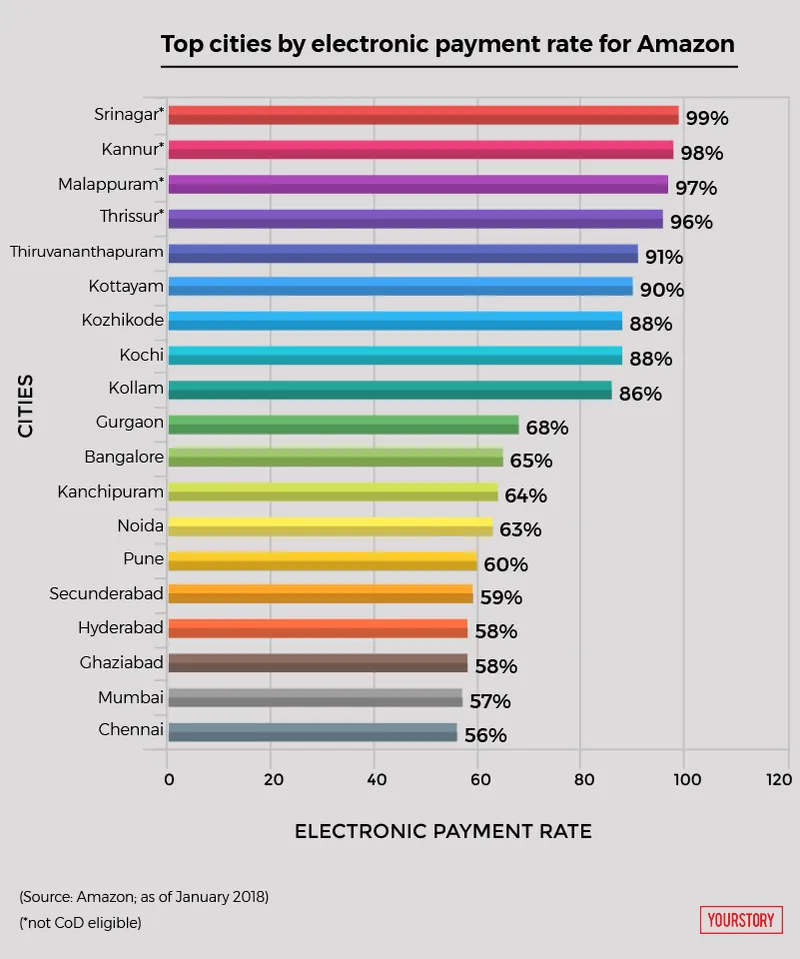

As we have shown in the charts in this story, customers in many states are increasingly transacting digitally. But, the wallet question remains for Amazon.

While wallet might offer the most seamless experience, can they afford to wait for KYC norms to be relaxed?