How India's payments majors Paytm and PhonePe are battling it out for the Gold Rush

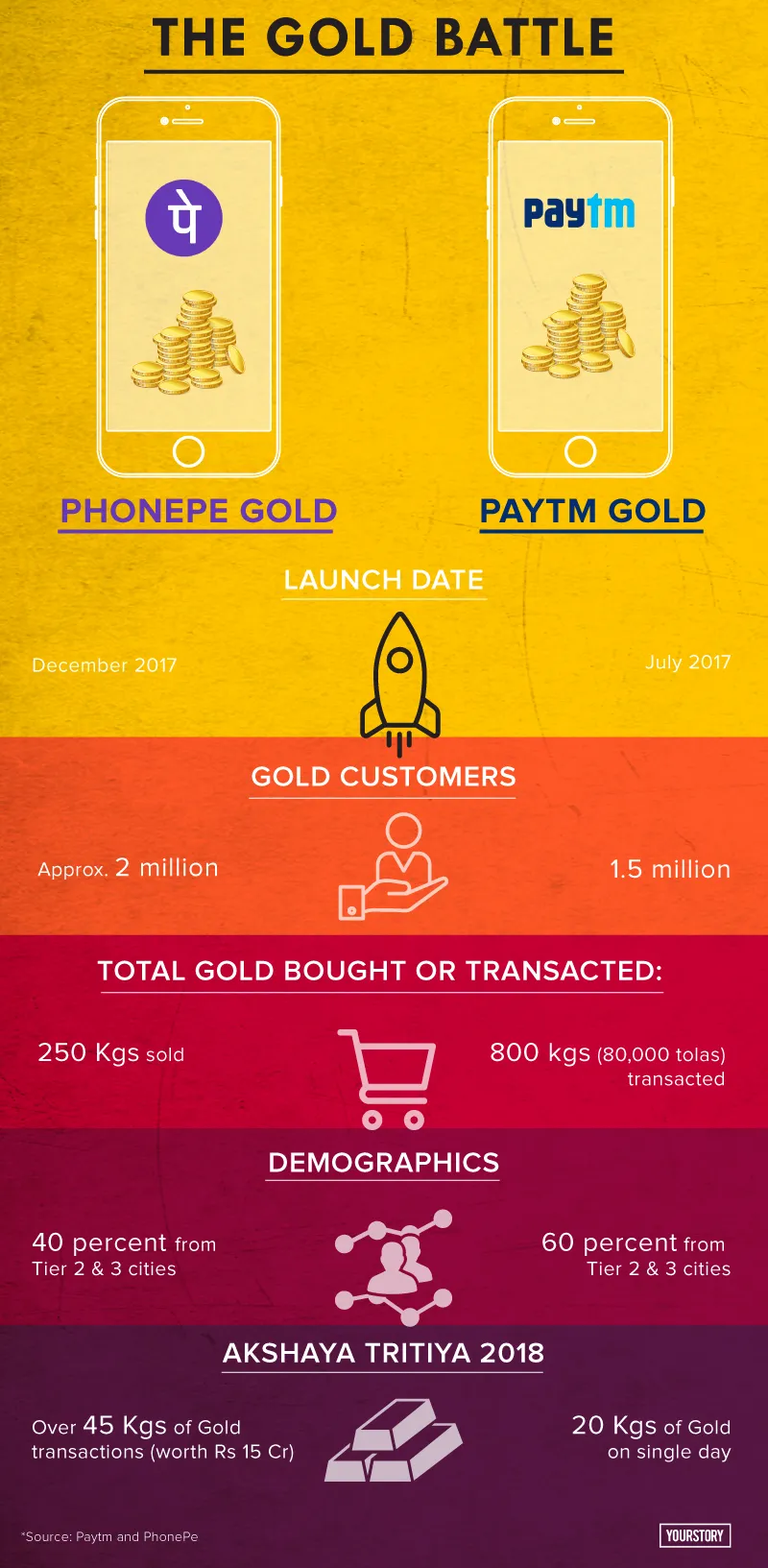

Bengaluru-based payments company PhonePe on Monday announced it had sold over 250 kg 24K gold on its platform since launch of the product in December. Competitor Paytm, which launched its gold offering in July last year, claimed that by mid-April, it had recorded gold transactions worth around 80,000 tolas (approximately 800 kg) spanning 1.5 million customers.

The Noida-based company claimed customers had bought 2,000 tolas of gold (approximately 20 kg) online on Akshaya Tritiya. PhonePe, on the other hand, claims Akshaya Tritiya sales of over 45 kg gold worth over Rs 15 crore.

Akshaya Tritiya is considered an auspicious day across the country to buy gold.

PhonePe claims it registered a 200 percent growth in gold purchased through the UPI channel, while transaction ticket sizes were as high as Rs 1 lakh on Akshaya Tritiya.

The Flipkart subsidiary, just last month, had announced a partnership with MMTC-PAMP to offer 24K gold of 99.99 percent purity on the PhonePe app. This made PhonePe, the first digital gold marketplace to have two major gold suppliers - Safegold and MMTC-PAMP.

Speaking to YourStory, Karthik Raghupathy, Head of Strategy, PhonePe said,

“We think of gold as an interesting category, and it very much plays to our platform and open ecosystem approach taken with payments on PhonePe. We are the first player who have made a marketplace in digital gold. And we are looking at building further relationships with banks and stores for redemption.”

On whether PhonePe was looking to add more gold suppliers to the marketplace, he added,

“We believe that customers need to have a choice. And I think it is an ongoing discussion whether we need another supplier for the marketplace. However, it will strongly depend on the value proposition which can be provided to the customers.”

Gold in numbers

Total users

PhonePe has close to 2 million total customers using its gold offering; Paytm claims to have a total user base of 1.5 million customers.

New Customers

PhonePe claims 70 percent growth in new customers month-on-month; Paytm did not share its growth numbers.

Demographics

Paytm claims over 60 percent of the gold purchases on its platform are from Tier II and Tier III cities; PhonePe says only 40 percent of its users are from Tier II and Tier III cities, and that metros are a strong growth opportunity for it.

Age demographic

Both PhonePe and Paytm have younger customers for their gold products. PhonePe's customers are mainly in the 25-40 year age group.

Betting in the future

Redeeming gold offline

On its future plans, PhonePe is looking at multiple offline partnerships with jewellers, and is betting big on redemption of digital gold at these stores. Karthik explains, “If a customer tomorrow likes a piece of jewellery at one of these stores, they can immediately redeem their gold (on PhonePe) at one of these offline partner stores.”

While PhonePe has started partnering with several offline jewellery chains for redemption of gold, it already had payment partnerships with players like PC Jewellers, which accepts digital payments through PhonePe.

Savings through Gold

At present, PhonePe is also looking at popularising gold as an investment. However, Karthik hints there might be more features that will be added to the gold offering, which will allow users to set up automatic monthly payments to purchase and invest in gold.

The Flipkart-owned company is also looking to launch 'Gifting with Gold' which is essentially gift coupons for the purchase of gold.

In March this year, Paytm had launched Gold Gifting and Gold Savings Plan as a part of its wealth management offering Paytm Gold.

While PhonePe shows promise when it comes to growth of new customers, Paytm has the advantage of more transactions on its platform, along with a faster headstart. However, it is still to be seen how two of the biggest payment companies in India battle out on product innovation to win the gold race.