Startup funding: 2018 was the year of Fintech startups, ecommerce investments slipped to second place

2018 saw Fintech lead the funding charts as investments in Lending surged and Payments held its own. The early-stage continues to see great momentum and funding has increased in almost every sector across the board. While the total amount raised is slightly lower, that’s mainly because 2017 saw Paytm raise $1.4 billion and there were no such billion-dollar deals this year.

It has been a little over two years since demonetisation gave India’s fintech sector the boost it needed to burst into the mainstream. India-specific payment infrastructure innovations such as the Unified Payments Interface (UPI) have won the common man’s trust, and global companies have turned their rudders towards the country to cash in on the opportunity (no pun intended).

So, it’s not surprising that fintech has received much attention and (monetary) love from investors. The last two years, one might say, have seen the sector come of age, showing investors a strong value proposition, helping with financial inclusion and taking the mystery out of finance.

As we wrote in our 2018 funding analysis, Fintech has emerged as the sector of choice this year among investors. Last year, it played second-fiddle to Ecommerce, but only because Flipkart’s super-giant funding rounds tipped the scales away from Fintech. 2018 is yet to see any large deal like Paytm’s mega $1.4 billion round raised from SoftBank last year. The payments giant is at the top of the leaderboard again this year with the $300 million it raised from Berkshire Hathaway.

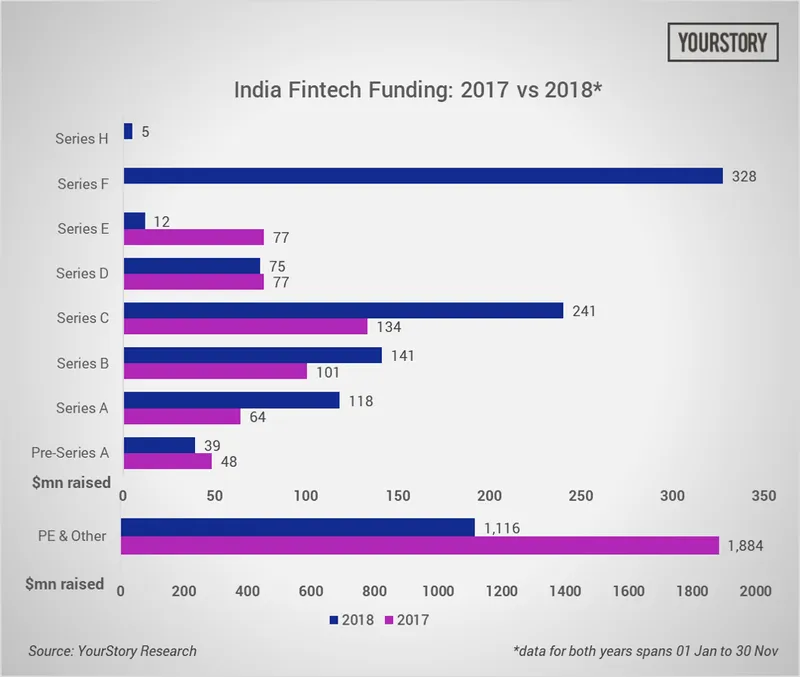

Total funding raised across fintech and financial services came in at a shade over $2 billion as of November 30, 2018, down by 13 percent over $2.4 billion in 2017. Nevertheless, the number of deals increased to 132 versus 103 last year, reflecting increased interest and activity in the sector.

Sanjay Swamy, Managing Partner at early-stage VC firm Prime Venture Partners, which has invested in a number of fintech startups, believes the size of the opportunity for the sector continues to be large considering that it remains highly underpenetrated. “Apart from the ones not catered, there is also a newer population of millennials who are entering the financial gamut every year.”

[Also read: India’s most active finding investors startups poured funding into this sector in 2018]

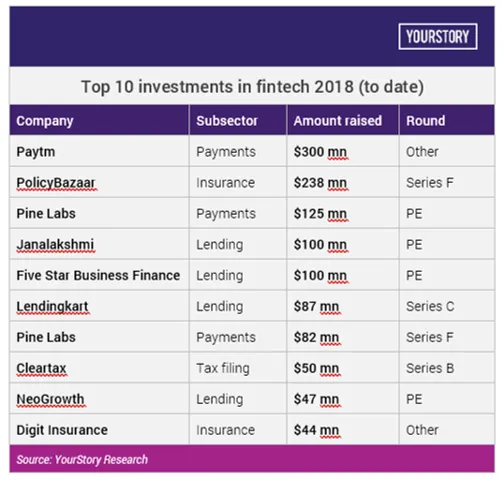

Top 10 deals took 60 percent of total funding raised

The top 10 deals by value in fintech accounted for 60 percent of total funding raised, once again reflective of the overall trend – that investors are taking pole positions in companies with a proven track record and the ability to scale. Amid the mix of payments, lending and insurance startups in the top 10 list, tax service provider Cleartax stood out for its $50 million Series B round.

Two of India’s newest unicorns also feature on this list. Insurance aggregator PolicyBazaar raised $238 million from Softbank in June at a valuation of a little more than $1 billion. Singapore-based Temasek, along with PayPal, invested $125 million in payments service provider Pine Labs, also taking its valuation over $1 billion.

The number of deals amounting to $100 million or more also rose to five versus just three in 2017.

“Unlike other sectors, fintech isn’t one where there is a ‘winner-takes-all’ model. And there is a possibility for creating meaningful companies. Perhaps payments had that possibility, but now it is clear that there is an opportunity for new players to come considering the latest interoperability guidelines,” says Sanjay.

Lending came across as the most active category, raising a total of $953.03 million, or 46 percent of the total deal value, doubling its share from 2017. With 69 deals, it accounted for more than half the number of deals in the sector, across stages, versus 47 percent last year, when payments dominated the charts.

“Lending startups have better algorithms and have aced the distribution race over the incumbents. Sure, the cost of raising capital is way lower for incumbents. But the fact that fintechs are looking (discovering) at newer sets of data and taking risks is what will continue to make the difference,” explains Sanjay.

Insuretech accounted for 16 percent of total investments, tripling to $333 million this year (dominated by PolicyBazaar), while the number of deals more than doubled to 9.

Wealth Management startups saw fewer deals (15 vs 24) and lower funding this year. Investments were down to $70 million (vs $105 million in 2017).

Payment ecosystem sees more mature capital

In the first 11 months of 2018, payments as a category accounted for 29 percent of equity investments in the Indian fintech space, raising $610.86 million. This is a 61 percent fall from last year when payments firms – including Paytm - had raised $1.59 billion.

Like last year, Paytm’s investment made up a large chunk of this year’s funding numbers in the payments space. Other late-stage deals included Temasek and PayPal funded PoS player Pine Labs in a secondary share sale. Pine Labs also raised a Series F round from Actis and Altimeter Capital, and entered the coveted $1 billion valuation club. Pine Labs’ competitor Mswipe raised an undisclosed round this year and Tiger Global-backed RazorPay raised $20 million from existing investors.

Early-stage sustains investor interest

Activity in the early stage gained solid momentum with the number of deals in the Pre-Series A space rising 10 percent but the total deal value up by 40 percent to $39.38 million.

At the other end of the spectrum, overall funding last year via private equity and venture deals totalled $1.90 billion and made up almost 79 percent of total equity funding raised, partly boosted by Paytm’s mega round. This year, the number was much lower at 53 percent of the total, indicating that investor interest was well spread out across stages. (See chart below for stage-wise split.)

Sanjay believes the focus on early stage investments will stay in the years to come as there is enough space for more players. Also, sectors like lending will open the doors to newer segments including debt collection, among others, in future.

As interest in early stage fintech startups rises, competition too has increased. Sanjay says, “We see businesses around savings, liabilities, assets and wealth all starting to be there. However, with these being heavily regulated markets, the scope of innovation is less. Hence, the differentiator and success of these early stage businesses purely depends on their distribution model or hack, as well as newer data sets they can leverage.”

Debt finance shrinks 40 percent

Debt financing declined this year. Total debt funding in fintech startups was $186.35 million this year, down 40 percent from 2017. Typically, lending startups raise debt funding to provide credit. This year, the sector saw 18 debt financing deals from January to November as against 16 deals in the same time last year

The primary reason for this is tightening liquidity for small NBFCs. Ashish Sharma, MD and CEO of venture lending firm Innoven Capital explains,

“New age NBFCs would face some near-term challenges due to tightening liquidity. Strongly capitalised NBFCs with strong risk management and good ALM practices would have the advantage.”

New investors on the block

While the most prolific fintech investors of 2017 stayed just as active this year, 2018 also saw global behemoths like Amazon and Xiaomi donning the investor hat and funding late-stage deals.

[Also read: Who were India's most active investors in Fintech in 2018?]

As Sanjay puts it, “All these brands have customer pools and they want to keep the customer busy by offering more. Hence, letting these partners into their ecosystem and investing in them will create stickiness for these consumer brands.”

This year, CapitalG, Google’s investment arm, made its first investment in the Indian lending space with Aye Finance. Sanjay points out that in early stages, there are multiple micro-segments that get formed and are getting funded. These include education loan startup Propelld which raised pre-Series A, and SlicePay which gives credit to youngsters and college students and raised Series A funding.