SoftBank’s stock soars by 17 pc following announcement of share buyback

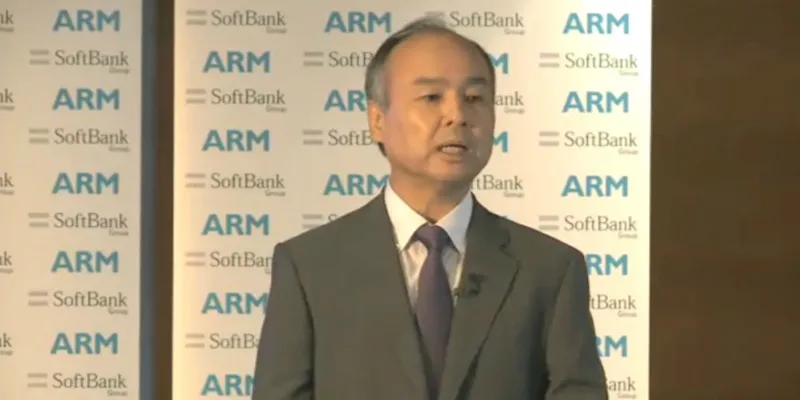

SoftBank Chief Executive Masayoshi Son termed the valuation of the company’s shares as very cheap as the market has not taken into account its various technology investments through the $100 billion vision fund.

SoftBank Group, the Japan-headquartered technology conglomerate, has announced a share buyback programme where it would repurchase 112 million shares worth 600 billion yen (around $5.46 billion) in the next 11 months, which sent its stocks soaring by 17.73 percent on Thursday.

The share repurchase period will start from Thursday, and will last through the end of January 2020. This is the biggest ever buyback in SoftBank’s history.

SoftBank Chief Executive Masayoshi Son had described the company’s shares as too cheap, and it is worth far more than its current market value. He also reiterated that if one takes into account all the investments that has been made through SoftBank’s $100 billion Vision Fund in new global technology companies, then the value is certainly higher.

SoftBank will pay for the buyback with the proceeds of the IPO in December, 2018 of its domestic telecom business, where it raised 2.4 billion yen. Of the total money raised from the telecom unit’s IPO, 700 billion yen will go towards debt repayment, 700 billion yen for investments and 600 billion yen for the share buyback, according to the SoftBank Chief Executive.

SoftBank also reported a 60 percent jump in its third-quarter operating profit, lifted by rising valuations of its technology investments. Through the Vision Fund, SoftBank has stakes in leading unicorns of the world like Uber, Grab, Didi Chuxing, Slack, WeWork and chip designer ARM.

However, the company sold its stake in US chipmaker Nvidia after weak demand for its gaming chips pushed its share value down by 50 percent.

SoftBank is also one of the leading investor in the Indian startup ecosystem with significant stakes in companies such as Paytm, Ola, Oyo, Snapdeal, and Grofers to name a few. It had made an investment of $2.5 billion into Flipkart in 2017, but later exited following its takeover by Walmart in a $16 billion deal.

The Japanese Conglomerate had announced in 2014 that its investments would exceed $10 billion in a span of a decade, but this milestone is likely to be achieved in less than half the time. Reports indicate that it is likely to cross this threshold during the current year itself.