This Harvard-incubated fintech startup by husband-wife duo gives loans to schools and teachers

Chennai-based fintech startup Finwego offers loans to schools, managements, staff, vendors, teachers, and parents. It has disbursed working capital to 500 schools, and aims to grow 10x by the end of FY21.

In the first half of the last decade, Pavee Ramanisankar identified the one basic problem that schools across India faced: procuring working capital.

The realisation came from a personal pain point. Pavee was leading K-12 school chain Akshara Vidyaashram, which she took over from her mother and expanded from a nursery school to Class 12.

When she needed growth capital, she realised that banks and lending institutions in India continued to be apprehensive about providing working capital to schools, which are predominantly run by trusts or non-profits.

In 2018, she incepted her lending venture , that provides customised loans to schools, managements, staff, vendors, as well as teachers”.

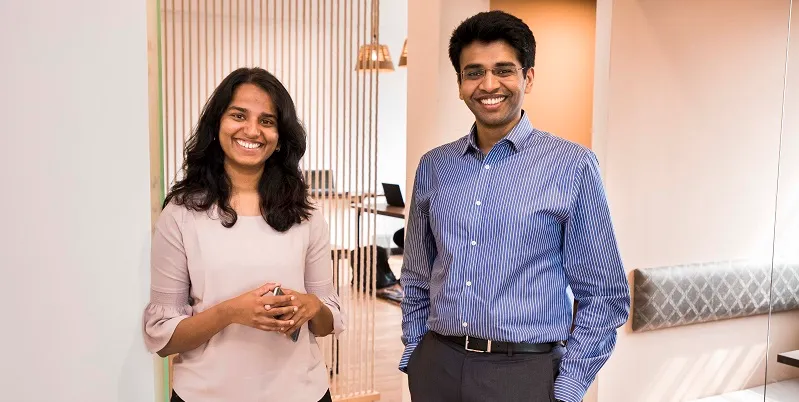

The Co-founders of Finwego: Pavee Ramanisankar and Shiv Vadivelalagan.

Starting up at Harvard

An IIM-Bangalore graduate, Pavee teamed up with her husband Shiv Vadivelalagan, who comes with extensive experience in the financial technology space, to start education-focused Finwego. The fintech startup is incubated at Harvard University.

The duo met during their undergraduate course at Delhi University, where they were pursuing economics and commerce respectively.

Pavee went on to start a textile company, Vasthra Enterprises, and later took over her mother’s school. Shiv studied international policy at Stanford University, and worked at IntelleCash, the NBFC arm of impact investment group IntelleCap. In 2014, he started cross-border remittance company OK Remit.

In his last role, he worked at US-based digital payments strategy firm Glenbrook Partners.

During the inception of Finwego, Pavee was pursuing her master's in education at Harvard University and began running pilots with schools in Tamil Nadu. She registered for Harvard Innovation Labs, an innovation programme for Harvard affiliates, and got incubated, receiving a grant of $25,000.

By June 2018, Shiv joined Finwego as Co-founder and the duo moved back to India to work on the startup.

Enabling the private school ecosystem

The founders say Finwego’s main aim is to cater to the financial needs of school staff, teachers, parents, and vendors.

“There is a demand-and-supply side to the school ecosystem. The supply side includes schools, staff, vendors, and suppliers, which Finwego focuses on. We don’t focus on the demand side, which includes parents, as other players are trying to solve for that part of the ecosystem,” explains Shiv Vadivelalagan, Co-founder and CEO, Finwego.

At present, the two-year-old startup has three product offerings: unsecured personal loans to teachers, secured and unsecured loans to private schools, and supply chain financing for vendors supplying to these schools.

Shiv says teachers often find it difficult to get loans, which is why Finwego provides personal loans starting from Rs 20,000 and going up to Rs 2 lakh. With an average ticket size of around Rs 75,000, the founders say teachers often take loans for buying two-wheelers, sudden family expenses, or upskilling.

However, the platform’s main focus is private schools. Finwego provides secured loans ranging between Rs 10 lakh and Rs 25 lakh to finance new infrastructural projects like building classrooms, labs, or other facilities.

Unsecured working capital loans to schools involve working capital needs with an average ticket size of Rs 5 lakh.

Finwego also provides loans to vendors and suppliers who supply education material like uniforms, notebooks, and others. Following a bill discounting model, the platform provides loans against billables.

The team at Finwego

The numbers game

Finwego claims to be adding Rs 3.5 crore to Rs 4 crore to its loan portfolio every month, and has a presence across Karnataka, Tamil Nadu, and Pondicherry. It claims to have touched close to 500 schools till now.

Borrowers on the platform pay interest of 19 to 21 percent for its secured loan products, and a standard 24 percent interest for unsecured loans.

According to the founders, the startup is on track to close a loan book size of Rs 20 crore and making revenues upward of Rs 1 crore by the end of this fiscal year. The founders are positive that the startup will be able to break even by 2022.

In June last year, Finwego raised $1.7 million in its seed round from SAIF Partners and a group of HNIs and angels. It aims to raise another round of funding in the coming year.

The founders say there is a strong need for lending, despite their focus on a niche segment like private schools.

Shiv says there are close to 350,000 private schools in India, with about 17,000 new schools opening every year. This represents a wide runway of opportunity from the private school ecosystem in India alone.

“We are also looking to increase our team strength from 40 individuals to 100 in the next financial year,” Shiv says.

Finwego aims to grow 10x and reach a loan book size of Rs 250 crore by the end of FY21.

(Edited by Teja Lele Desai)

![[Funding alert] Fintech startup Finwego raises $1.7M from SAIF Partners, others](https://images.yourstory.com/cs/2/a9efa9c0-2dd9-11e9-adc5-2d913c55075e/165-VC-funding1552277843560.jpg?fm=png&auto=format&h=100&w=100&crop=entropy&fit=crop)

![[YS Exclusive] Edtech startup Vedantu's Vamsi Krishna on pursuing impact at scale in the Indian education space](https://images.yourstory.com/cs/2/fd6b2ee0c6f411e8af1c974e95f3b2db/Image26lk-1581606154619.jpg?fm=png&auto=format&h=100&w=100&crop=entropy&fit=crop)