How agri-commerce startup SuperZop used deep tech to grow 10x, and plans to reach one lakh kiranas

SuperZop’s B2B platform connects thousands of kiranas with the dry commodity supply chain. The startup has grown 10x in a year and now wants to expand pan-India.

SuperZop was founded by Prithwi Singh, Raghu Allada, and Darshan Krishnamurthy in Ahmedabad, in 2016, when the cost of internet connectivity in India was still very high.

That changed later that year with the advent of Reliance Jio, a disruptive force that went on to put the country’s internet economy on steroids.

And startups like SuperZop gained immeasurably as small retailers and neighbourhood kiranas enjoyed access to low-cost internet on their smartphones. As a result, India’s agri-commerce sector has undergone a significant transformation lately.

SuperZop Co-founders Prithwi Singh and Raghu Allada

SuperZop, which later set up base in Navi Mumbai, uses deep technology to organise the fragmented and “opaque” B2B2C food supply chain — from procuring to storage and packaging to delivery of 300+ SKUs.

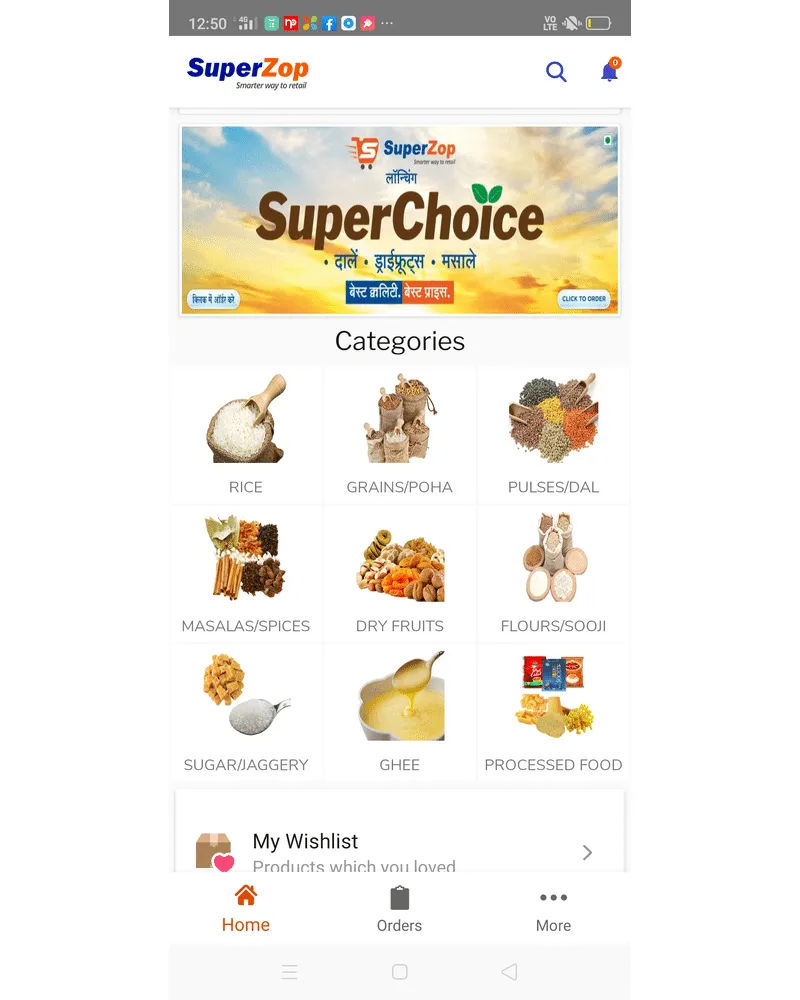

It helps kiranas place orders through a simple vernacular app interface, gain an understanding of consumer demand, stock up on daily inventory, and offer hygienic and well-packaged items to the end-consumer even in traditionally unorganised categories, including staples such as rice, wheat, pulses, dry fruits, etc.

But, it had begun differently. In the initial years, SuperZop would pre-install its B2B app on basic tablets and hand them to kiranas, who then had the option to place orders and manage their own inventory.

That model was dependent on the data the kiranas could feed in, and often, had inconsistencies galore. To fix that, SuperZop tweaked its platform and took central control, which eventually helped the startup scale up faster.

SuperZop’s B2B agri-commerce model

It started sourcing the staples directly from seven to eight Farmer Producer Organisations (FPOs) and a large selection of mills and food processors.

The platform manages the entire inventory movement, and helps predict demand at the individual kirana level with its proprietary AI and ML algorithms.

Once the kiranas place their orders on the app, SuperZop checks for quality, packages the staples, and ensures timely deliveries at retail stores through an undisclosed third-party logistics provider.

SuperZop app is available for kiranas in English and Hindi

“This model helped us scale up faster and clear the opaqueness in the value chain,” Prithwi Singh, Co-founder and CEO, SuperZop tells YourStory.

He elaborates,

“The kiranas now get better market linkages and visibility on daily demand and inventory, and are connected better with all other stakeholders in the chain. Our app is now available in Hindi too, and that has helped us establish the core value proposition better.”

Numbers testify to the founder’s claims.

10x growth in 12 months

In the last 12 to 15 months, SuperZop has leapfrogged from less than 40 orders per day to 400+ daily orders. It also claims to have grown its ARR by 10x to Rs 60 to 70 crore, and is targeting to reach the Rs 1,000 crore-mark in the next 18 months.

Its B2B platform is now being accessed by 13,000+ kiranas across Mumbai, Thane, Navi Mumbai, and Pune. By the end of the year, the startup wants to reach 100,000 kiranas across 10 cities.

SuperZop focuses on small retailers whose monthly turnover is in the range of Rs 6 lakh to Rs 10 lakh. The startup is also inking bulk deals with a few supermarkets, hypermarkets, and small restaurants in the Mumbai-Pune corridor.

SuperZop is organising dry staples under its in-house brand SuperChoice

In July 2019, it raised Rs 8 crore in pre-Series A funding from MS Fund of SIDBI Venture Capital Limited, IIM Ahmedabad’s technology incubator CIIE Initiatives, and angel investor Gurumurthy Raman to expand its existing store network.

Raghu Allada, Co-founder and Director, SuperZop, says,

“We are planning to raise a Series A round in the next four months. We will use the capital to reach more kiranas, ramp up the distribution and supply chain, and also improve the technology backend, which is at the core of our platform.”

Since SuperZop is primarily focused on Western India, it plans to add two more languages (Marathi and Gujarati) on its app to be able to go deeper into the market.

Proprietary products for supply chain efficiency

SuperZop found that one of the biggest pain points in agri-commerce is the kiranas’ access to short-term finance.

To fix this, the startup launched SuperKredit, a product that allows kiranas to apply for institutional credit in a quick and hassle-free manner to meet their working capital needs and ensure daily flow of staples to their stores.

Prithwi explains,

“Our app allows multiple modes of payment through different payment gateways and SuperKredit, which gives instant credit to kiranas. This is collateral-free credit provided on our platform in partnership with NBFCs.”

Not only this, to ensure supply chain efficiency and maintain timeliness, SuperZop has also developed SuperDisha, a proprietary vehicle routing algorithm.

SuperZop has built a proprietary grain recognition technology for quality assessment

This helps the platform assess delivery routes, improve asset utilisation of vehicles depending on their capacity, and prioritise important deliveries.

“SuperDisha provides optimised route planning and store navigation technology to our logistics providers, and allows us to deliver the staples to retailers within 24 hours of ordering,” Raghu explains. “The technology has helped us bring down the cost of deliveries by 20-30 percent, and improved our unit economics,” he adds.

The startup has also developed an AI-based grain recognition technology known as SuperGRT, with which it conducts quality assessment tests before packaging.

SuperZop is also bringing more organisation to fragmented and unbranded staple categories through its in-house brand SuperChoice, which is witnessing fast adoption.

“There is an emerging need for good quality packed products on the consumer side. As a result, even kiranas are warming up to the idea of well-packaged dry staples like rice and pulses,” the co-founders reveal.

Finding a niche in a competitive market

India’s food and grocery market is estimated at $600 billion, which is one of the largest in the world. But, despite the proliferation of technology-led services, the share of online in this sector is only 8-10 percent still.

Hence, the opportunity is massive, especially because kiranas still lack the technology expertise to exploit the market.

The startup competes with the likes of Udaan, Jumbotail, Ninjacart, Shopkirana, GramFactory, and many others in a rapidly-evolving ecosystem. But SuperZop believes it has found its niche focus in dry staples, and will stick to that category.

Raghu elaborates,

“I think this space needs a vertically-driven player more than a horizontal approach, which is what most B2C retail is. There is scope for a lot of innovation in staples itself, and we will continue to focus on this niche.”

“We are working with vendors on the transportation side and on the procurement and supply chain side, and training them to use the technology,” he adds.

How will the sector be impacted by the imminent entry of Reliance Industries, which plans to digitise five million kirana stores by 2023 with what it calls ‘new commerce’?

Also, given RIL’s history of disruption, do independent startups feel threatened?

Prithwi observes, “Historically, it has been seen that those who do B2C well cannot replicate that success in B2B and vice versa. So, Amazon is B2C and Alibaba is B2B. These are two different value chains, and it is not a winner-takes-all market.”

“And everyone is finally realising that they have to work with the kiranas instead of trying to replace them,” he says.

After all, co-creation and co-existence harmed none!

(Edited by Teja Lele Desai)

_(1)1566221502621.jpg?fm=png&auto=format&h=100&w=100&crop=entropy&fit=crop)