How COVID-19 changed the behaviour of consumers and retailers in India

Data gathered by SaaS startup Bizom shows how Indians consumed food during the coronavirus lockdown, and how consumers and retailers from across the country reacted to the situation.

The coronavirus pandemic has taken the whole world by storm. While people are caught up in the fear of contracting the virus, the nationwide lockdown, announced by Prime Minister Narendra Modi on March 24, led to severe disruptions and widespread confusion among people.

The consumer behaviour in India and across the world also changed rapidly over the course of the crisis.

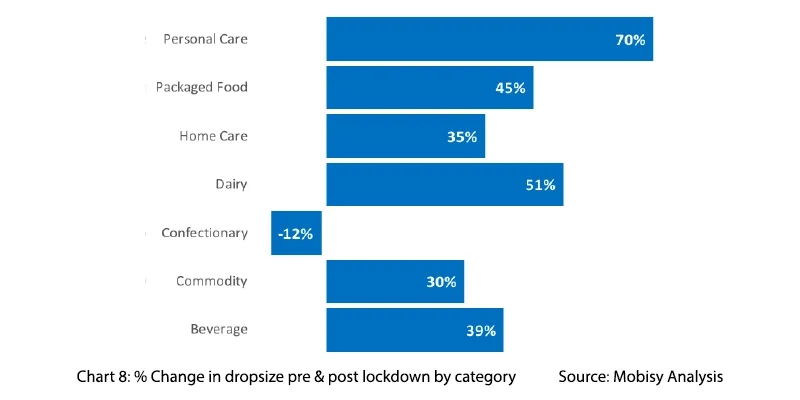

While the lockdown resulted in panic buying and people hoarding essential items such as rice, wheat, packaged food, homecare products, etc., reports suggest that people did not stock up much on confectionery and beverages, but only rushed to stock up on essentials.

Consumption is coming back

YourStory has gathered data from , a SaaS startup for retailers, for the first 15 weeks of the year. The startup has been working with more than 350 top brands, including Coca-Cola, Cargill, Hershey’s, Molson Coors, , and United Breweries.

Products that sold pre and post the lockdown.

The data shows how Indians consumed food during the coronavirus lockdown, and how consumers and retailers from across the country reacted to the situation.

“In the weeks following the ‘Janata curfew’, sales of all categories of consumer goods were impacted. Certain categories such as beverages and confectionery were wiped out, but few categories such as packaged foods and commodities are weathering the storm better. Local brands and Indian kirana stores have shown resilience, with recovery of almost 65 percent by the third week of the lockdown,” says Lalit Bhise, Co-founder, Mobisy Technologies, which also owns Bizom.

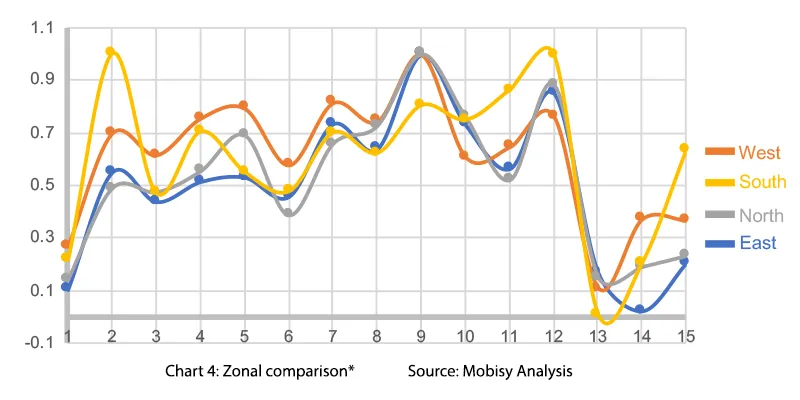

Area wise increase and drop in consumption

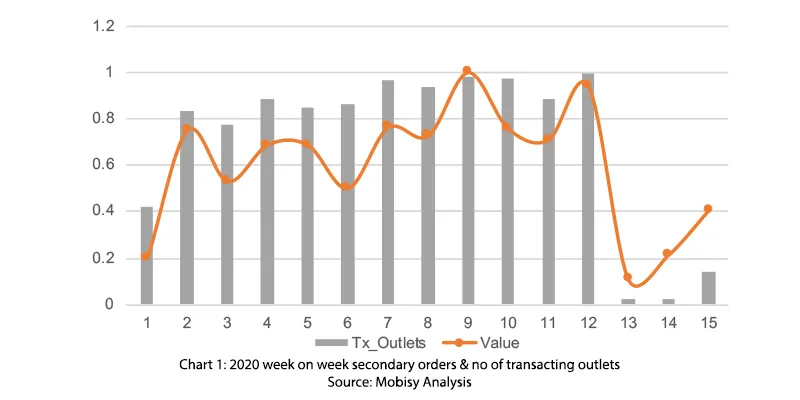

The lockdown effect on retailers

While essential items continue to remain a key priority, the consumer behaviour was well captured in retail outlets, which stocked up on these items before the lockdown was announced.

While people resorted to hoarding essentials, data suggests that Indian retailers did not get into panic mode of buying, but there was a significant drop in demand.

Some of the key indicators that might have influenced them not to stock up includes higher availability of stock due to the orders placed during the month-end, and festivals such as Holi and Ugadi. A small clue regarding the impending lockdown also helped these retailers to anticipate demand better and stock up.

However, for most retailers, the sales were lukewarm even during the festivals, since gatherings reduced due to social distancing concerns.

“However, in the first week of the lockdown, the demand form retailers had reduced by 71 percent, with no orders from 95 percent of the outlets. All categories, barring commodities, lost 60 percent after the lockdown was announced, but recovered by 40 percent by the third week of the lockdown, with the exception of personal care, which saw a consistent demand from consumers,” says Lalit.

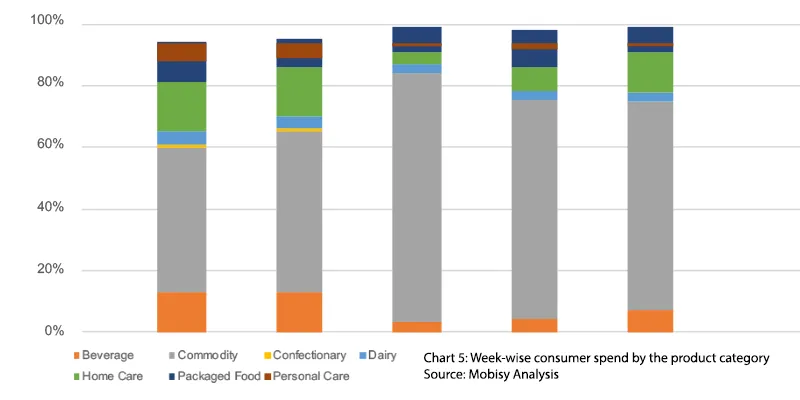

Weekly spending during the COVID-19

Biscuits and cookies were the worst hit categories during the lockdown, followed by the snacks category, which had the lowest revival curve, and has been the most impacted.

“Ready-to-eat products, biscuits, and cookies are likely to reach pre-lockdown average demand by the second week of May,” adds Lalit.

According to the report, the demand for commodities was high between March 23 to April 25, and the same was the case with staples such as rice and wheat.

The rise of kiranas

Despite the proliferation of big FMCG brands and swanky supermarkets, the humble kiranas have continued to hold sway in India during the pandemic.

A whopping 90 percent of India’s $700 billion retail market is unorganised, and mostly made up of neighbourhood kiranas that have for years offered consistency and efficiency.

Wholesale online marketplace Jumbotail, which works with 25,000 small stores, was able to supply key branded items to retail stores.

Total retail outlets that saw a drop in consumption during COVID-19

“During the COVID-19 pandemic, kiranas are using our app to order products 24x7. On the brands side, we work with 20 top brands. We also have our own private labels in staples, and deliver over 3,500 stock keeping units. We manage the supply chain ourselves. It is critical because we prioritise service levels to customers,and that is our competitive edge. As many as 85 percent of our customers order more than 10 times a month. They get their supplies in one consolidated lot in 48 hours. This is very important during the lockdown as the third-party supply chain has failed and cannot keep capacities high, which is why we have done well,” says Ashish Jhina, co-founder of Jumbotail.

According to brands like Mojo Bars and HoneyTwigs, kiranas will emerge stronger after the COVID-19 crisis if they adapt technology.

“Kiranas still stock 95 percent of the country’s food and grocery, but big brands are represented better. These stores do not have one consolidated voice. However, the vast majority of the population still goes to kiranas during the pandemic,” says Ashish.

Challenging times for brands

Most brands have also taken a hit during the pandemic. Amazon India's biggest skincare brand Wow Skin Science, which used to receive 19,000 orders a day, has now seen its orders drop to less than 2,500 per day.

“We received 4,000 orders a day in the second week of April when we expected nothing at all, and we celebrated it. The orders have dropped to 2,000 per day now. The only saving grace is our US business, where we are getting aid from the government to retain our employees,” says Manish Chowdhary, co-founder of Wow Skin Science.

It has been nearly four weeks since the lockdown, and the company is beginning to see a slight pick-up in activity, as well as several beneficial changes in customer behaviour.

The lockdown order effectively forced people to switch to online shopping because of movement restrictions and social-distancing norms even for bare necessities such as vegetables and groceries.

That, along with people re-evaluating their lifestyle choices with more free time on their hands, bodes well for online sellers.

While the coronavirus pandemic has increased sales of packaged food, personal care, and homecare products, it has certainly put pressure on the supply chain.

Soon, there might be a shortage of these items if the government does not allow movement of trucks to wholesale and retail centres.

As of May 3, the government has allowed the opening up of non-essential goods segment. Hopefully, the supply becomes better with time, and the world returns to normalcy. However, some would say that until the vaccine is found, our consumption would never be normal.

Edited by Megha Reddy

![[WATCH] Online marketplace Jumbotail’s unlikely hero in coronavirus fight: the kirana](https://images.yourstory.com/cs/2/79900dd0-d913-11e8-a160-45a90309d734/Jumbotail_founders1563889490084.jpg?fm=png&auto=format&h=100&w=100&crop=entropy&fit=crop)