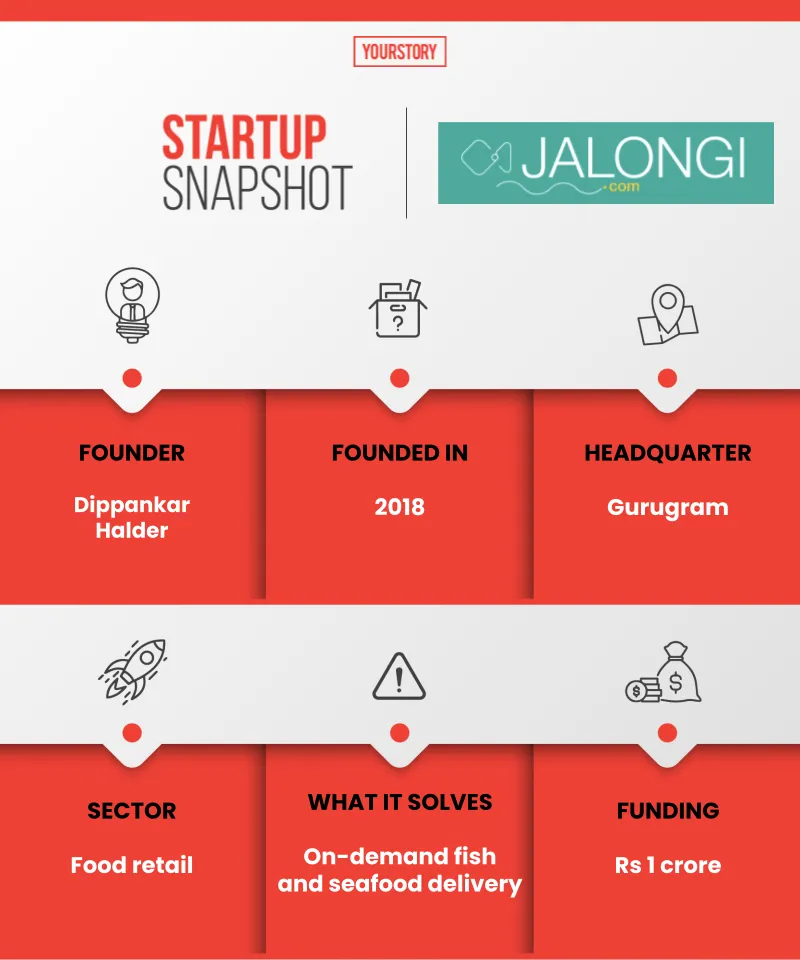

How this fish and seafood delivery startup recorded 200 pc growth in transactions in the pandemic

Gurugram-based startup Jalongi made the most of people’s fear about ‘wet markets’ following the COVID-19 outbreak. The on-demand fish and seafood retailer grew its transactions by 200 percent since the lockdown.

That the pandemic has altered consumer behaviour is no secret. When it comes to items like fish, seafood, and meat, a chunk of ordering has moved online due to the alleged role of ‘wet markets’ in triggering the coronavirus outbreak.

As a result, on-demand fish and meat delivery platforms have gained tremendously over the last few quarters post the lockdown, with urban shoppers opting for direct-to-consumer (D2C) channels for raw food.

One such gainer is, a homegrown specialty fish and seafood retailer.

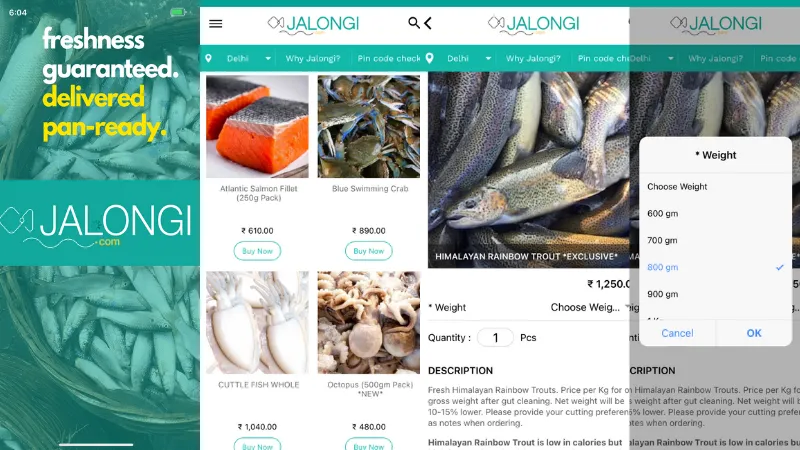

Jalongi (which means ‘water body’ in Bengali) sells a wide variety of custom cut — fresh or pan-ready — fish and seafood.

Buyers can choose from seasonal and local favourites, including prawn, mackerel, pomfret, rohu, catla, hilsa, tuna, trout, and more. Jalongi also sells premium items like salmon, squid, crab, lobster, reef cod, baby octopus, and so on.

Jalongi sells both fresh water fish as well as seafood

Even though meat and poultry items are available on Jalongi, its focus is on fish and seafood, which is estimated to be a Rs 65,000-70,000 crore market in India.

All the products are handpicked from the startup’s network of coastal farmers and village-level partners, following which they are cleaned, cut, processed, and packaged at Jalongi’s own distribution centres, transported in self-owned cold chains, and door-delivered to customers in seven cities across India.

Dippankar S Halder, Founder and MD, Jalongi, tells ,

“Almost 99 percent of the fish market in India is unorganised. We did innovations in terms of curry cuts and other custom cuts. We also introduced pan-ready or fry-ready fish so you don’t have to touch it. And that became our USP.”

Dippankar S Halder, Founder and MD, Jalongi

Pandemic-led growth and expansion

While the Gurugram-based startup was founded in early 2018, it is only in 2020, in the aftermath of COVID-19, that it witnessed sizable growth and expansion in line with the overall surge in the online grocery retail space.

In the first year, Jalongi was doing doorstep deliveries only in Kolkata, its largest market till date, accounting for over 50 percent of sales. In 2019, it expanded to the Delhi-NCR region.

But the real growth came in 2020 as it added more cities — Mumbai, Pune, Bangalore, and Hyderabad — to its network, riding on the demand for online fish/meat retailers post the closures of wet markets. Jalongi will launch in Chennai and Ahmedabad shortly.

Putting the growth in perspective, Dippankar observes, “The core of retail, offline or online, is buying and selling. Whatever be the channel, how you source the product is important. Our success came because of our ability to source, and connect sourcing to processing and packaging of the product.”

Both raw and 'pan-ready' fish are available on Jalongi

He also highlights the importance of quality control in a segment like this.

“Quality control becomes difficult when you are distributing in multiple places. Because every time a perishable product changes hands, it loses a bit of life. That is the starting point of the business. You also have to get a good team of people who can differentiate between the good and bad fish,” the founder explains.

In 2020 alone, Jalongi claims to have recorded sales of Rs 10 crore, and is looking to close the fiscal year at Rs 12 to Rs 15 crore. That is more than 4X growth since 2019, when gross sales were Rs 3.4 crore.

Over 40,000 monthly users, with a repeat rate of 80 percent, currently order from Jalongi. Post the lockdown, transactions shot up 200 percent, claims the company.

Infographic: YS Design

Future plans and industry landscape

Buoyed by the huge tailwinds in the D2C food retail space, and the rapid adoption of online ordering, Jalongi is projecting a turnover of Rs 60-80 crore by 2022. By 2025-26, it aims to be a Rs 1,000-crore D2C brand.

The founder shares, “Geographical expansion will drive our growth in 2021. We will be getting into new markets, opening integrated distribution centres, and converting our three million social media users into active consumers.”

Jalongi also plans to raise a Series A round of Rs 70 crore (about $7-8 million) from institutional funds in the next six months.

Prior to this, it had raised Rs 1 crore from undisclosed angels in 2019. The capital would be used in expansion and scaling up technology and distribution.

Jalongi has 40,000 monthly users

Besides being in advanced talks with VCs, the startup is also in talks with online grocer Grofers for a distribution partnership. Interestingly, Grofers had pulled the plug on perishable products in 2018 after incurring huge costs in the category.

But the pandemic has turned the tide for online sellers of fish and meat. A plethora of organised fish and meat retailers, including , , Meatigo, , EasyMeat, , and others, are making a noise. However, these platforms are primarily focused on meat and poultry items.

Hence, Jalongi’s focus on fish and seafood gives it a headstart in the segment. Also, “the ability to source will help us stand out in a competitive market”, says the founder, adding, “Our range and availability are better than everyone.”

While that claim couldn't be verified, it is a fact that range and availability are better online as opposed to offline markets, which are often subjected to restrictions and curfews, depending on the number of active cases in an area.

Dippankar sums up the market opportunity by saying, “Organised fish and meat retailers have captured less than 1 percent of the overall market. But, this behaviour [of online buying] will continue once customers get used to it.

Edited by Teja Lele