What are NFTs, the cryptographic tokens that are making the news

NFTs have been in existence since 2015, but it was only in 2017, the first projects began appearing on the Etherium blockchain.

NFTs or non-fungible tokens are suddenly the talk of the town, thanks to a recent Christie’s auction, where Mike Winkelmann — popularly known as Beeple — sold an NFT at a record-breaking $69.3 million. It is the third-highest price achieved by a living artist.

Taking the art world by storm, NFTs are cryptographic tokens, which exist on a blockchain. Most of the NFTs in the market are centred around collectables, including digital artwork, sports cards, and rarities.

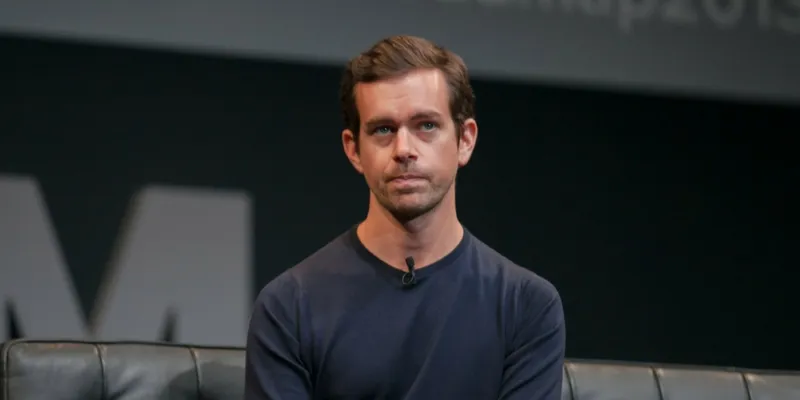

One of the most famous NFT is CEO Jack Dorsey tweeting a link to a tokenised version of the first tweet ever written, where he wrote: "Just setting up my twttr."

Jack Dorsey, CEO, Twitter. (Image: Flickr)

Let’s take a deep dive into the world of NFTs.

Understanding NFTs

While cryptocurrencies are fungible — which means they can be traded or exchanged — NFTs shift the crypto paradigm by making them unique and irreplaceable.

This makes NFTs impossible for one non-fungible token to be equal to another, hence not tradable in an exchange.

Similar to Bitcoins, NFTs store ownership details for easy identification and transfer between token holders. Owners, too, can add its metadata just as the creators.

This has helped NFTs become a way to empower the authenticity and ownership of unique digital collectables and goods.

In a world of cut, copy, and paste, non-fungible tokens are bringing in a revolutionary change in the world of digital art by tackling the deep-rooted issues of ownership and compensation.

Free access to data is one of the key reasons why the internet has entered every facet of our lives. Netflix changed the way we consume movies and tv shows; Napster and Spotify transformed the music industry.

NFTs can play a crucial role in how digital artists create and sell artwork and how people interact and consume artwork in the digital age.

The true potential of NFTs

Let’s take an example to comprehend the true potential of NFTs.

Imagine listening to Thriller by Michael Jackson on YouTube Music or Spotify (or for that matter any music streaming service). NFTs will allow music aficionados the chance to own the original recording of the song. Creators can even make special limited editions of the piece and sell them to collectors.

The purchasers can breathe easy that they have paid for something genuine and own the content, thanks to NFT’s unique identification.

Similarly, Beeple’s 5,000-piece digital art album — which sold for $69.3 million — can be viewed by anyone with access to an internet connection. However, only the purchaser will be the real owner of the album backed by blockchain verification. Hence, when a person buys an NFT-based artwork or music, the purchaser does not necessarily own the copyright or the sole ownership.

Gaming is another sphere where NFTs can be the next big thing. Developers can offer players access to special modes or tools, willing to purchase them for a premium.

Market size of NFTs, and scope of art

In July 2020, amidst the COVID-19 pandemic, NFT sales crossed the $100 million mark as per NFT Report 2020. The value of the total NFT market grew by nearly 299 percent last year, with the valuation of trades going past the $330 million mark.

The report said, “Art is arguably the segment that is driving the most growth in this type of ‘High Value’ sale, which naturally echoes the traditional art market.”

In fact, it comprises 24 percent of the total market distribution based on US dollars traded via sales. The scope of growth is further exemplified by the fact that in terms of the number of sales, it is at just 5 percent of the total volume.

Edited by Suman Singh