India’s angel investors grow

Despite the high risks associated with startup investments, the ecosystem is now witnessing more entrants coming in as angel investors.

For long, angel investments in the Indian startup ecosystem have largely been driven by bets made by successful entrepreneurs and tech executives as startups were viewed by many potential investors as a risky asset class.

But that’s changing now and leading to a spurt in angel investments in Indian startups, say experts.

Despite the high risks associated with startup investments, the ecosystem is now witnessing more entrants coming in as angel investors.

These include high-net-worth individuals, professionals of various organisations at levels below that of CxOs, and business owners of non-tech companies.

And this trend is reflected in the surge in the number of angel investments in Indian startups. According to a recent report by the Indian Private Equity and Venture Capital Association (IVCA), startup investments by super angels and angel networks rose 24 percent to hit a new record of 341 in 2020 from 275 a year earlier.

The Interview

Mercedes-Benz set up shop in India in 1994 and has a dominant market share of around 40 percent in the luxury car market in the country. Having been in the country for over a quarter of a century, Mercedes-Benz India Managing Director and CEO Martin Schwenk says the German automaker has studied Indian consumer behaviour closely. They (Indian consumers) look for value for money and that's even in a high-end product.

Editor’s Pick: India’s first accessible-to-all book café

Delhi-based architect and interior designer Aatika Manzar is on a mission to convert vacant spaces into beautiful moulds through her crafty vision. However, living her dream through more than the 150 projects in her array was not always a cakewalk for Aatika. Read more.

Startup Spotlight

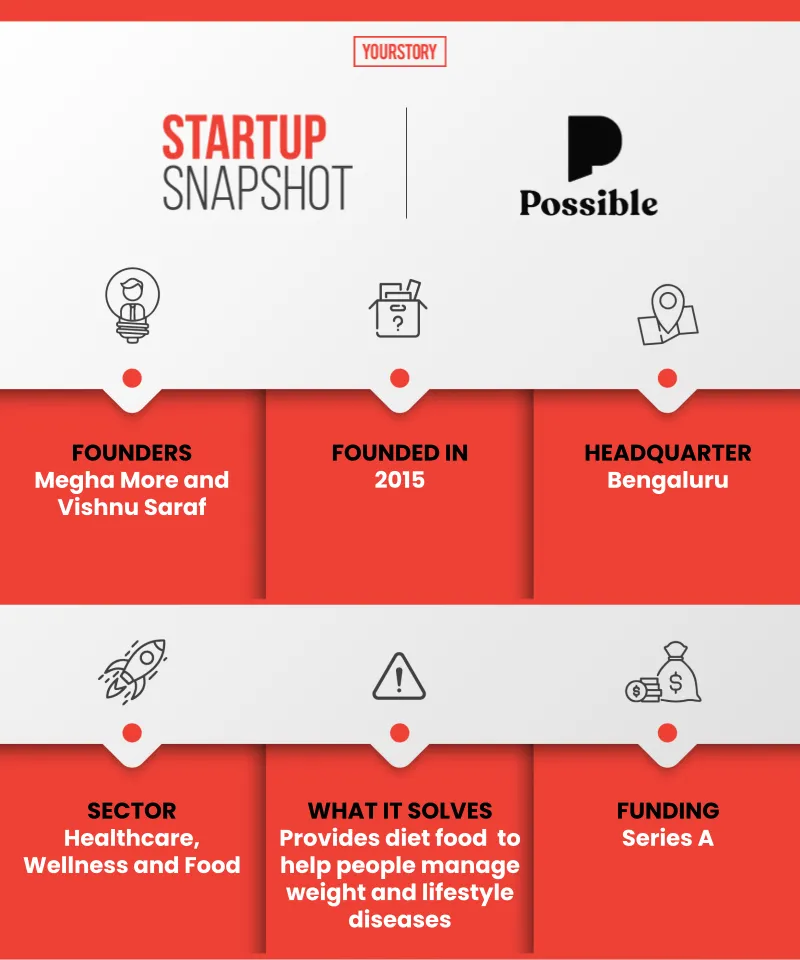

This is making it ‘possible’ to stay fit and healthy with research-driven nutrition products

Founded in 2015 by former Mckinsey colleagues Vishnu Saraf and Megha More, Bengaluru-based startup Possible is aimed at helping people fight lifestyle diseases and manage their weight through the right nutrition-based healthy diets. In January, it raised Rs 5 crore from renowned Bollywood actor Aishwarya Rai Bachchan as a part of its Pre-Series B funding round. Read more.

Illustration: YS Design

News & Updates

- Singapore-based neo-banking startup Morus Technologies Pte Ltd StashFin announced, on Saturday, that it has completed its Series B extension equity funding round, raising $40 million from a clutch of global investors.

- Details from more than 500 million Facebook users have been found available on a website for hackers. The information appears to be several years old, but it is another example of the vast amount of information collected by Facebook and other social media sites, and the limits to how secure that information is.

- Rajinder Balaraman, Director, Matrix Partners India, and Debleena Das, Vice President, Human Capital, Matrix Partners India, believe that human capital plays an important role in the VC ecosystem as well.

- Public sector banks may have to bear a burden of Rs 1,800 to Rs 2,000 crore arising due to a recent Supreme Court judgement on the waiver of compound interest on all loan accounts which opted for a moratorium from March to August 2020, sources said.

Before you go, stay inspired with…

“I do feel that slowly the Indian companies would also appreciate software being built for them, at enterprise and SME level. We see a lot of very exciting companies getting built for local SaaS.”

— Pankaj Makkar, Managing Director, Bertelsmann India Investments

Now get the Daily Capsule in your inbox. Subscribe to our newsletter today!