‘Expensively valued’ Zomato is cash-rich

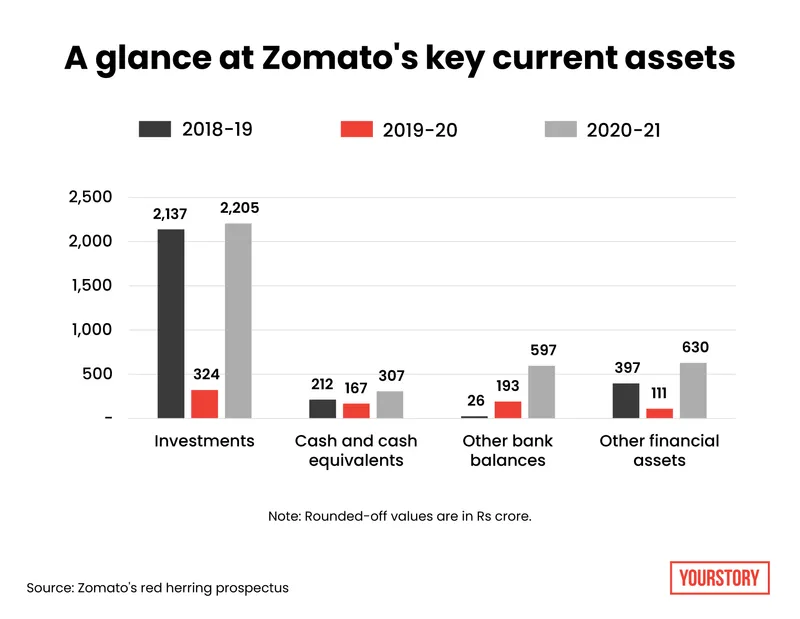

The Rs 15,700 crore cash on Zomato’s books is around 26 percent of its post-IPO market capitalisation, according to Edelweiss Securities’ analysts.

The initial public offering (IPO) of is slated to hit primary markets on July 14 to raise Rs 9,375 crore. At the price band of Rs 72-76 a share, there are feelers in the equity market that Zomato – an otherwise loss-making food-tech business – is valued expensively.

Take the case of Pranav Kshatriya, Sandip Agarwal, and Pulkit Chawla, the Mumbai-based trio who work as equity analysts at Edelweiss Securities. In a research note, the trio opined that the industry that Zomato operates in ‘is still nascent and provides a long growth runway’.

Also, while there is noise around disintermediation, however, the analyst trio believes that food delivery platforms offer better consumer experience, and hence the risk remains low.

But, the valuation of Zomato at the higher side of the IPO price band at 19.7 times and 13 times the respective estimated sales for 2021-22 and 2022-23 is certainly not cheap.

Image: YS Design

“Global peers trade at 2 to 12 times price to sales, but Zomato offers much stronger growth,” the Edelweiss Securities’ analysts noted.

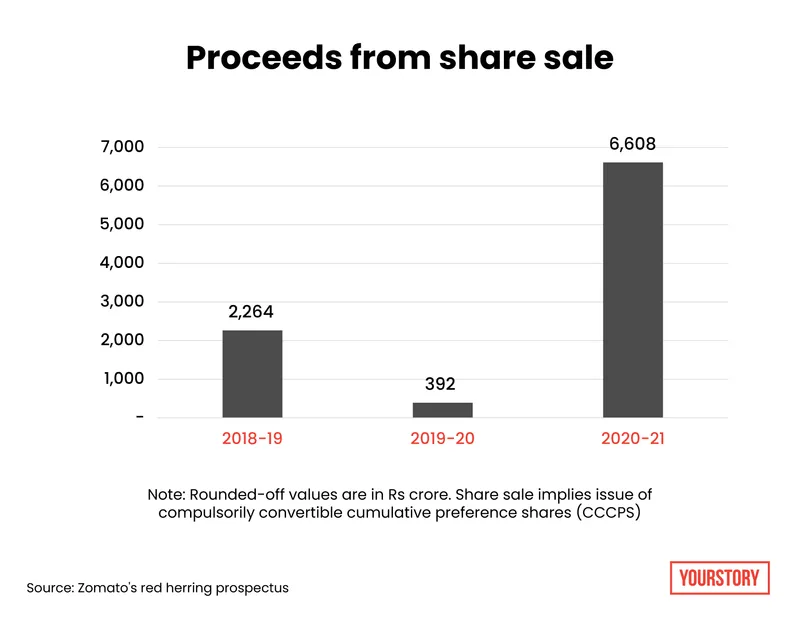

Zomato also has close to Rs 15,700 cash on its books, which in the trio’s view works out to nearly 26 percent of Zomato’s market capitalisation.

ALSO READ

Image: YS Design

While expensive valuation grabs attention, these analysts are not overlooking the catalyst factors that Zomato has to its advantage. These include food services industry in India being highly underpenetrated and offering a huge long-term growth opportunity, and the fact that Zomato’s management does not see a major threat from direct delivery, as the company will keep exploring various adjacent areas to leverage capabilities.

“Execution excellence would be key to long-term value creation,” the trio noted. “At its upper band, the company is valued at $7 billion pre-money, which is a 30 percent premium to the last funding round,” they added.

The trio also underlined Zomato’s focus on ‘sensible’ growth and ‘adjacent’ areas.

While the sensible growth opportunity in food delivery is seen from an increasing number of consumers joining the online bandwagon – particularly from Tier II and III cities, and eating out frequency increases. Zomato is also exploring opportunities in adjacent areas such as grocery delivery, fitness, and nutrition.

The IPO proceeds are proposed to be deployed in organic and inorganic growth avenues, and Zomato’s 9.3 percent stake-buy in Grofers can be seen as a financial investment, which would offer an adjacent opportunity in the near future.

Given the mix of the varied grab-me factors that Zomato offers, it would not be surprising to see investors of all types queuing up to grab a piece of the food-tech unicorn.

Unsurprisingly, Mint has reported that a government-owned insurance juggernaut – Life Insurance Corporation of India (LIC) – is evaluating participation in Zomato’s IPO.

Zomato seems to be a promising long-term story, and the IPO would markedly be an important milestone in the unicorn’s journey.