Google's investment in simsim is not its first. Here's a look at other deals by the tech giant in India so far

Google-owned YouTube recently acquired Delhi-based simsim. But this is not the first time the tech giant has set its eyes on the Indian startup ecosystem. Here's a quick rundown of the investments and acquisitions Google has made in India so far.

Alphabet-owned YouTube's acquisition of social commerce startup simsim earlier this week marked a crucial moment for the startup ecosystem in India - it signalled that was beginning to look beyond , where the company last year invested $4.5 billion of the $10 billion it had earmarked to help increase tech adoption in its key overseas markets.

But even before Jio, Google had been tracking Indian companies closely and making strategic investments or acquisitions that could easily integrate with or enhance its products, and therefore, give it access to a wider user base.

In 2018, Google bought Sigmoid Labs, a startup that had developed the popular "Where is my train" app, which it integrated with Google Maps in a bid to provide nearly 30 million passengers better visibility into train timings and schedules.

Google, at that point, had been setting up Google Station - a programme that provided free Wi-Fi in more than 400 railways stations in India, as well as other key markets around the world. So, the Sigmoid Labs pick was natural, and it helped shore up Google's user base in India, as was the intention. However, it announced plans to shut the service down last year because of cheaper mobile data prices, thanks to Jio - but it had already met its goal by then.

Similarly, , an app that helps connect local businesses, influencers and customers, fits in well with YouTube's ecosphere of enabling companies to reach buyers via videos and influencers.

"By bringing simsim and YouTube together, our goal is to help small businesses and retailers in India reach new customers in more powerful ways...the app will continue operating independently while we work on ways to showcase simsim offers to YouTube viewers," Gautam Anand, VP, YouTube APAC, wrote in the blog announcing the acquisition.

What Google picks next in India would be interesting to see. Fintech, an evergreen sector in India, and a foreign investment favourite, could help build out Google Pay, although navigating regulations might be tricky; edtech and healthtech have boomed too and have seen a lot of capital inflow, especially over the last year. Or it could be any one of India's brilliant deeptech and AI companies - all ripe for the plucking.

But here's a quick rundown of the investments and acquisitions Google has made in India so far:

2014: Freshdesk

Google, via Google Capital, invested in SaaS-based support software Freshdesk in a funding round led by Tiger Global. The $31 million series D round, which Google Capital participated in, was a historical move since it was its first in India.

2015: Practo

Google Capital participated in healthcare information company 's $124 million round, which also included investments from Tencent, Sequoia, Matrix Partners and Russian billionaire Yuri Milner, among others.

Healthcare was one of the focus areas Google had outlined for its $10 billion India investment fund.

2015: Drivezy

Formerly known as JustRide, was selected for Google's startup accelerator programme, Launchpad, in 2015.

Co-founded by five IITians, Drivezy received a two-week mentorship program, $50,000 as seed investment, financial assistance for office space, as well as $250,000 of assistance including access to Google's products such as Maps and Adwords, as part of the programme.

2016: Girnar Software

Girnar Software, which owns , raised an undisclosed amount of funding from Google Capital, and other investors such as Hillhouse Capital.

Headquartered in Jaipur, and founded in 2008, CarDekho has footprints in India, Indonesia and the Philippines. The group currently operates various leading Indian auto portals such as CarDekho.com, Gaadi.com, ZigWheels.com, BikeDekho.com, PowerDrift.com, and more.

2017: Halli Labs

An AI startup, Halli Labs was acquired by Google as part of its Next Billion Users focus. The startup was building deep learning and machine learning systems back in 2017 when it wasn't a buzzword, to address what it described as "old problems".

The startup was founded by Pankaj Gupta, a data scientist, who was also the CTO at now-defunct Stayzilla, an Airbnb-like company.

The move was perceived by the industry as Google doubling down on AI and ML, through hardware and software.

2017: Dunzo

Bengaluru-based hyperlocal delivery platform , in late 2017, raised $12.3 million in a Series B funding round. The fundraising was unique because it was Google's first direct investment in a startup in India.

Dunzo later went on to raise several more investments from Google, including its latest $40 million Series E round, where Google was a lead investor.

The startup has disrupted the models of ecommerce companies such as and , as well as e-grocers and e-pharmacies in India, making it easy for people to buy what they need and have it delivered immediately, instead of waiting for a day or more.

2018: Sigmoid Labs

Google acquired Sigmoid Labs, the parent company of the popular train tracking app, Where Is My Train, for an estimated deal value of $30 million to $40 million, although neither company confirmed the consideration amount.

The company was founded by five former employees of TiVo Corporation, a technology entertainment company in the US, which was based out of Bengaluru, and had a team of about 10 people.

2020: Reliance Jio

Google invested Rs 33,737 crore for a 7.7 percent stake in , becoming the second-largest minority shareholder in the company after .

The Google-Jio partnership was aimed at expanding the benefits of digitisation across the length and breadth of India, beyond the current 500 million-plus internet users in the country.

Jio Platforms and Google also signed a commercial agreement to jointly develop an entry-level affordable smartphone with optimisations to the Android operating system and the Play Store, which Reliance unveiled in June, during its AGM, this year.

2020: Wysa

AI-driven virtual coach and mental health platform raised funding from Google's Assistant Investment Program in its series A round of $5.5 million, which saw participation from existing investors too, including Boston's W Health Ventures and pi Ventures, among others.

Founded by Jo Aggarwal and Ramakant Vempati, Wysa is a virtual coach that combines empathetic listening with evidence-based therapeutic techniques like CBT, meditation, and motivational interviewing to make mental health accessible at scale.

2020: Glance and Roposo

As part of its push into the world's second-largest internet market, Google participated in the funding round of - an InMobi Group-owned app that delivers news and media content on user's smartphones. The two-year-old startup raised $145 million in financing from Google and investors such as Mithril Partners.

Google also invested in , a Gurugram-based short-form video app, which ad giant InMobi acquired.

2020: DailyHunt

The tech giant invested an undisclosed amount in VerSe Innovation, owner of , as part of its $100 million fundraising round, which also saw participation from Microsoft and AlphaWave, among others.

Co-run by Virendra Gupta and Umang Bedi, the app offers content in local Indic languages, which was one of the four types of investments Google had outlined when it announced its $10 billion plan.

2021: DotPe

Google participated in DotPe's series A funding round, where it raised $27.5 million. The round was led by PayU, and Google put in money in the company as a returning investor.

DotPe was founded in 2020 by PayU Founder Shailaz Nag, Gyanesh Sharma and Anurag Gupta. It has successfully digitised enterprises as well as SMB customers through a full-stack solution — from giving them an online presence to enabling seamless ordering (in-store and remote), online payments, and delivery.

It claims to have deep integration with 10,000+ restaurants and food courts, including leading global and domestic FnB brands.

Google has been quite active in the SME/MSME space in India - and its investment in DotPe ties in with the tech company's broader India strategy.

Possible acquisitions/investments:

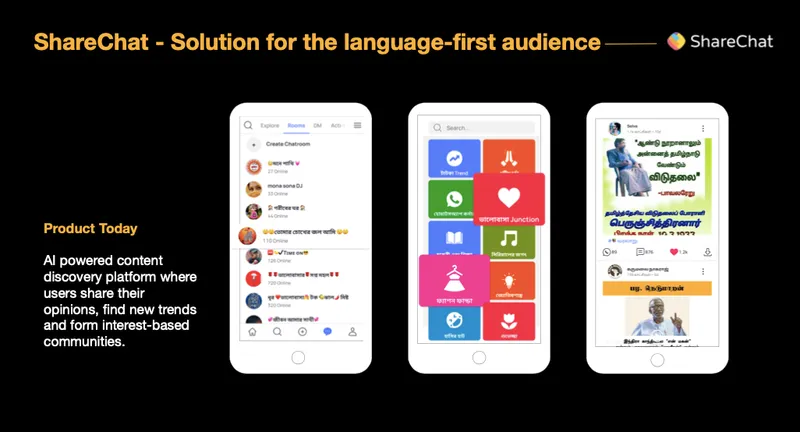

ShareChat: Several media reports suggest that Google is reportedly holding preliminary talks with Bengaluru-headquartered social media startup for acquisition at an estimated valuation of around $1.03 billion.

Current product, ShareChat

According to a report in The Economic Times, both ShareChat and Google have signed a non-binding proposal and appointed investment bankers to take the talks forward. Google has also already begun conducting the due diligence of the startup.

ShareChat's investment would again tie into the tech giant's goal of encouraging people to use tech in the language they prefer and are comfortable using.

Edited by Megha Reddy

![[Product Roadmap] How Drivezy is navigating the road ahead amid coronavirus crisis](https://images.yourstory.com/cs/2/a9efa9c02dd911e9adc52d913c55075e/product-roadmap-1586851181283.png?fm=png&auto=format&h=100&w=100&crop=entropy&fit=crop)