[Funding alert] Fintech startup Hyperface raises $1.3M from CRED's Kunal Shah, Better Capital, GFC

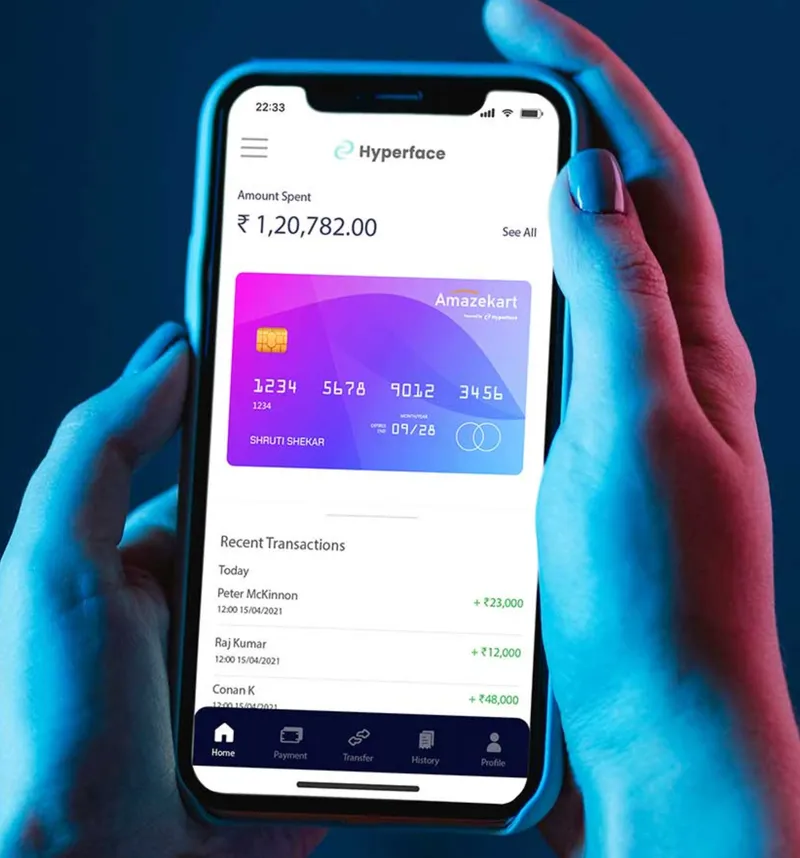

Founded in February 2021, Hyperface is a banking-as-a-service startup that helps companies create and launch their own credit cards.

Bengaluru-based fintech startup has raised $1.3 million in funding from investors including 's Kunal Shah, , and GFC, it said on Monday.

The startup will use the funding to strengthen its tech platform, launch card programmes, grow its team, and accelerate growth.

Founded in 2021 by R.V. Ramanathan, ex-CTO of , and banker-turned-entrepreneur Aishwarya Jaishankar, Hyperface helps companies launch their own credit card programme in a matter of 4-8 weeks, as opposed to 18-24 months.

Ram and Aishwarya set up Hyperface after they realised that fintechs, neobanks, and other companies often had to go through a complex, lengthy process to launch their own credit card programmes, and that integrating with the banks they were launching it with required extensive regulatory footwork.

Even after companies managed to clear those hurdles, engagement was an issue, which existing models did not properly solve.

"We both really believe that integrating with banks should be simple and seamless, allowing entrepreneurs to spend their valuable time refining their valuable ideas and building great value propositions to their customers," the co-founders told YourStory in a conversation.

Hyperface offers two products currently:

- CCAAS: Credit card as a service stack, which helps fintechs, neobanks and companies define everything from their onboarding processes to card controls — basically the entire customer life cycle.

- BNPL on prepaid: The startup says it has partnered with leading prepaid payment instruments for the offering.

The startup's key clients include ecommerce companies, neobanks and fintechs looking to offer credit cards to their customers. It earns its revenue via the pay-as-you-use pricing model.

"There is currently an unprecedented need for a partner who can help bridge the gap between financial institutions and fintech companies who wish to issue a credit card product for their customers," said Vaibhav Domkundwar, CEO and founder of Better Capital, about Hyperface's latest fundraise.

Better Capital is an early-stage VC firm that has also backed other fintech startups such , and , among others.

"Providing fintechs with a flexible, fast-to-integrate, and scalable solution will enable them to power and execute unique credit card programs," he added.

Hyperface's early founders include founders and executives of , , Rippling, and . It's currently getting set to launch its MVP, and claims it has a "healthy pipeline of clients".

"Our mission is to reinvent, simplify and improve access to credit cards by enabling fintech companies to partner with banks in a 10X more productive way," Ram said.

Edited by Saheli Sen Gupta

![[Funding alert] Fintech startup Hyperface raises $1.3M from CRED's Kunal Shah, Better Capital, GFC](https://images.yourstory.com/cs/2/f49f80307d7911eaa66f3b309d9a28f5/Imagetemplateforself1-1633355210825.png?mode=crop&crop=faces&ar=2%3A1&format=auto&w=1920&q=75)