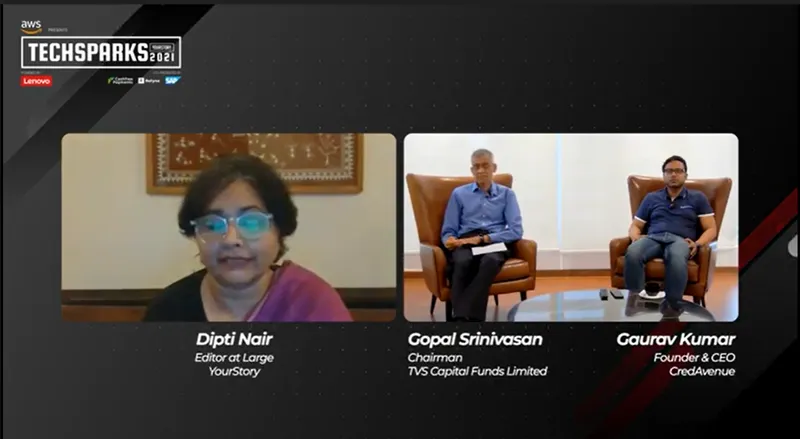

What is the strength of a startup? TVS Capital Funds Gopal Srinivasan and CredAvenue's Gaurav Kumar discuss

At TechSparks 2021, Asia's largest and most influential startup-tech summit, Gopal Srinivasan, Chairman of TVS Capital Funds Limited and Gaurav Kumar, Founder and CEO of CredAvenue, came together for a panel discussion on 'Backing the next wave of game-changers'.

What makes a great founder? And what do investors see in founders to invest in the next big startup?

At TechSparks 2021, Asia's largest and most influential startup-tech summit, Gopal Srinivasan, Chairman of TVS Capital Funds Limited and Gaurav Kumar, Founder and CEO of , came together for a panel discussion on 'Backing the next wave of game-changers'.

Gopal has a long history of backing new businesses and now, he has turned his attention towards ventures that are tech-enabled. He believes one should not take too much time in making an investment into a startup, and the sole focus should be on determining the quality of the founder.

“It is the quality of the founder who will always attract talent and build teams,” Gopal said.

On the other hand, a young entrepreneur like Gaurav has a laser-sharp focus on the evolving debt market in India.

Gaurav said, “We are certainly operating for the long term and this decade is going to be one of debt and fixed income.”

Given the huge inflow of capital into the startup ecosystem and the presence of easy funding, there are questions on how long it is going to last.

Being philosophical, Gopal said, “Ultimately, nothing has changed and it is always great entrepreneurs who build great businesses."

However, he noted that over the last two decades, access to entrepreneurship has been greatly democratised, where the only thing that matters to start a new business is merit and ambition.

“The question for us is how do we get access to the top quality founders as once the capital washes away it only they who are going to save us,” Gopal remarked.

On the future prospect, Gaurav felt that startups are going to fundamentally reimagine business, which will be very transformative, and added, “We should add access to finance as a fundamental right.”

Gopal, who has been through various business cycles and witnessed the socio-cultural changes in the country, felt that there was a great degree of positivity when it comes to investing in India and the Indian startup ecosystem — something which was not the case about two decades ago.

He felt the time has come to break down barriers and allow the vast majority of Indians to get access to quality education and technology, enabling entrepreneurship.

“One should be open-minded about the people we back as there are people who have talent and merit but might not speak English,” Gopal said.

This also bought forth the question of their affinity towards the Chennai startup ecosystem.

According to Gopal, the city has witnessed many underdog entrepreneurs who didn't show much promise but over-delivered.

Gaurav, who has been residing in Chennai since 2007, felt the culture of the place and access to stable and deeply committed talent makes him rooted in the city.

To log in to our virtual events platform and experience TechSparks 2021 with thousands of other startup-tech enthusiasts from around the world, join here. Don't forget to tag #TechSparks2021 when you share your experience, learnings and favourite moments from TechSparks 2021.

For a line-up of all the action-packed sessions at YourStory's flagship startup-tech conference, check out TechSparks 2021 website.

Edited by Kanishk Singh