How ShareChat is banking on content revolution to scale business across India

In a recent conversation with YourStory’s Daily Dispatch, Ankush Sachdeva, CEO and Co-founder, ShareChat and Moj shares the company’s contribution to the blooming content space in India and lays out its blueprints for the future.

Founded in 2015, is an Indian social media and networking platform developed by Bengaluru-based Mohalla Tech. Recently, ShareChat’s parent company Mohalla Tech raised $266 million as a part of its Series G round of funding, which pushed its valuation to $3.7 billion.

Speaking about the latest fundraise, Ankush Sachdeva, CEO and Co-founder, ShareChat and Moj says that it has been an incredible year for the company in terms of growth and capital. It is a large and capital-intensive market and a good amount of the capital will go into user acquisition, helping creators to monetise, and building the AI infrastructure.

“I think we are very confident that if we are going to put this capital in the real core competency in the company, which is about building the AI infra, it will give us long term gains to stay competitive in this market,” he says.

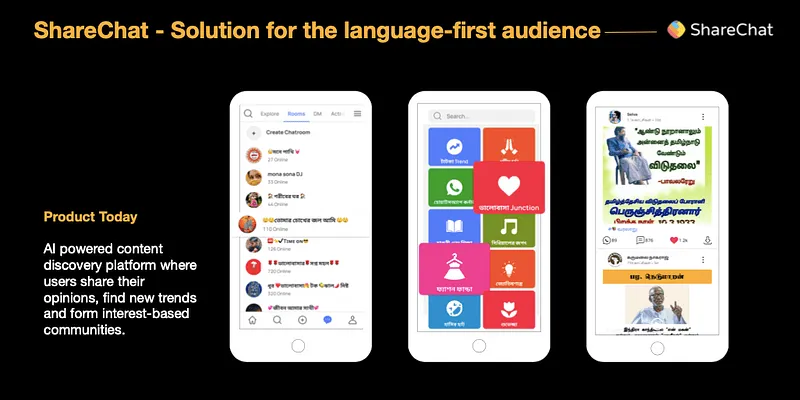

Current product, ShareChat

In terms of community reach, he shares that there are 180 million monthly active users (MAUs) on ShareChat, and about 160 million on Moj. ShareChat has a Tier II and III based audience as it started out as a non-English product. Moj, on the other hand, is a pan-India visual product which is why it is more diversified across Tier I and II regions. “They are both very reflective of the demographic of the country,” says Ankush.

Ankush mentions that the core competency of the company is feed ranking, and that is something that won’t change. The company would be scaling massively and aggressively around the theme of creator monetisation next year as creators put in a lot of effort to create content. “We are going big on multiple dimensions to help them make money,” he says.

While commenting on the revenue picture, he says that ads will comprise most of their revenue five years down the line. Virtual gifting would be another avenue that would contribute to the revenue. Video commerce would also be an important factor. “Platform monetisation and creator monetisation go hand in hand,” says Ankush.

He adds that their long-term goal is to hit a billion monthly active users by the end of 2025 and a billion dollars in annual revenue. The company also expects to at least double their numbers every year.

According to Ankush, it is a very fascinating time to be in India, building a content company. There are a host of creators who bring a lot of unique ideas to the table. Everything, starting from dancing content to education content, is on the internet for the consumers. “The creators’ story is what is becoming extremely interesting,” he says. On top of that, next year, ShareChat plans to go even more aggressive on the live streaming aspect which will bring in a whole new ballgame of content.

He says that there are macro-events such as the lockdown and the pandemic which decide and impact the average time spent on the platform. However, the biggest factor which affects the time spent on content apps is the content supply. He believes that in the next few years there will be a positive movement around enabling creators to create content which in turn will push the average time spent by consumers on the platform. They are expecting at least a 20 percent jump in the average time spent on the platform.

While speaking about the demand for short snackable content, Ankush says that there are two extremes of content consumption. The post lockdown world would need short-form content in his opinion. Lastly, in terms of valuation, he thinks that the market is full of high-quality companies that are very well priced. “I feel the money is being well utilised by the companies to build the core IP,” he says.

Edited by Anju Narayanan