[Tech50] How fintech startup Multipl is making saving money smarter

Multipl, a YourStory Tech50 startup, enables users to set up saving goals and invest their money in market instruments such as mutual funds that offer more returns than a fixed or a recurring deposit. The bootstrapped startup also rewards users every time they add money to their savings.

Paddy Raghavan, Co-founder and CEO of , an online fintech platform believes there’s a way to be smarter about savings. Instead of the ‘buy now, pay later’ model, he suggests the “plan now, pay smarter” route.

And that has been the philosophy behind his fintech startup, Multipl, which is part of YourStory’s Tech50 cohort in 2021.

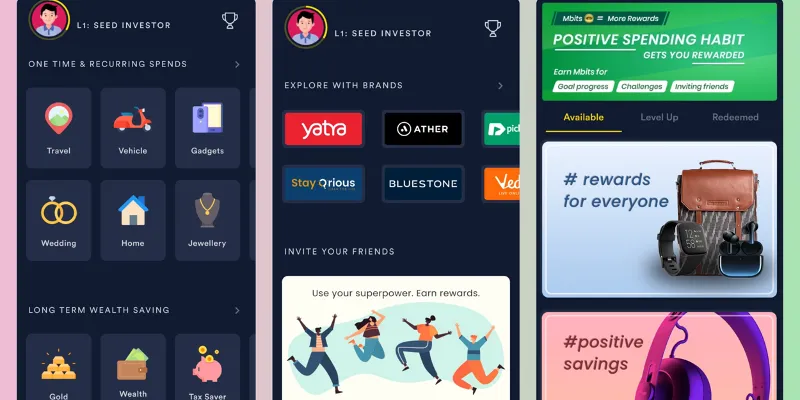

Essentially, Multipl allows users to save money for foreseeable spends such as weddings, jewellery, home furnishings, vacation, etc, but instead of locking it up in a savings account, or even a fixed deposit that might not net them substantially in returns, it invests it in the stock market.

Multipl claims people saving with the startup get up to 5X more value for money. The startup not only helps users invest in mutual funds and other financial instruments on the app, but also directly with the companies associated with their potential spends. For example, if one were saving for a vacation, they could park their money with a Yatra.com, which, in turn, awards the users with travel vouchers and deep discounts.

“We essentially help people to save up for a tangible expenditure (rather) than something arbitrary like ‘the future’. Our goal is to get people to come and save money, and the only way people usually do that is if they see an end-goal in sight,” says Paddy, who built Multipl with his co-founders, Jags Raghavan and Vikas Jain.

How it works

To get started, one simply sets up a profile on the app and plugs in their bank details for auto-debits.

Users are given the option to either invest in a permutation-combination of mutual funds or financial instruments, or park their money with a brand that is associated with what they’re saving up for.

Multipl has partnered with companies such as Ather, Vedantu, WakeFit, and Pepperfry, among several others, to enable its brand engagement savings product.

Every time a user successfully adds to their savings, Multipl rewards them with MBit coins — digital coins the startup issues users — that can be redeemed for rewards from over 200 brands, including Amazon, Myntra, Jio-Saavn, etc.

“Saving has to be fun, otherwise it feels like a task more than a reward,” says Paddy.

Revenue model and traction

The Bengaluru-headquartered startup does not take a cut from the money its users save and invest in financial instruments, nor does it earn any commission from the mutual fund issuers. Instead, if a user opts to park their money directly with a brand, Multipl takes a cut of the revenue the brand earns.

Soon, it hopes to launch a subscription service for users, pegged at around Rs 999 a year, that will provide AI-driven investment advisory services and insights, as well as financial planning help.

As of November, users had set savings goals worth more than Rs 25 crore. The startup has seen more than 10,000 downloads on the Google Play Store. It hopes to onboard over 50,000 users in the next six months.

Multipl’s competitor includes Jar and that helps people multiply their returns on savings by investing in mutual funds and other market instruments. Startups like , , are also Multipl’s competitors since they allow people to invest their savings in capital and debt markets.

With retail investors pouring into the markets in droves, market instruments have become an important part of not just active investing but also passive. In the fiscal year 2019, India added 3.4 million active demat accounts. In 2021, that number rose to 14.1 million, a 4.7X jump in a span of 12 months.

In fact, data from the NSDL (National Securities Depository Limited) and CDS (Central Depository Services Limited) show that in the first quarter of FY22, nearly 7.1 million demat accounts were opened, putting us on track for adding 28.4 million new accounts if the current average rate holds up.

Edited by Ramarko Sengupta

![[Tech50] How fintech startup Multipl is making saving money smarter](https://images.yourstory.com/cs/2/f49f80307d7911eaa66f3b309d9a28f5/Featureimages-newdeck8-1640180824062.png?mode=crop&crop=faces&ar=2%3A1&format=auto&w=1920&q=75)

![[Year in Review 2021] From spurt in BNPL loans, to growth in early-stage companies: trends that defined fintech in 2021](https://images.yourstory.com/cs/2/f49f80307d7911eaa66f3b309d9a28f5/Imagetemplateforself21-1639499803610.png?fm=png&auto=format&h=100&w=100&crop=entropy&fit=crop)