How Flipkart and Ninjacart discovered a win-win partnership over 18 months

In December 2021, Walmart and Flipkart infused $145 million in agritech startup Ninjacart. The strategic investment is vital for Flipkart's groceries strategy, while Ninjacart will derive benefits as the ecommerce giant drives demand.

In May 2019, Thirukumaran Nagarajan, Co-founder and CEO of Ninjacart, was getting term sheets from investors of many shades and hues.

, a technology platform for small shops and restaurants to procure fresh fruits and vegetables, had grown its operational revenue by 2.5X in FY19 to Rs 133.64 crore.

The fresh-produce supplier already had the venture arm of Syngenta, which develops seeds and crop-protection products, and Nandan Nilekani's NRJN Trust on its cap table.

Nilekani also invested in his individual capacity in December 2018, and sits on the board of Ninjacart. And, Tiger Capital had lined up a $100-million round in the agritech startup in the following months.

In early 2019, Ninjacart had less than 5,000 active retailers on its platform in Bengaluru, Chennai, and Hyderabad, with plans to launch in Mumbai and Delhi. On the supply side, it sourced fresh fruits and vegetables from 3,500 farmers in Karnataka, Tamil Nadu, Telangana, Andhra Pradesh, and Maharashtra.

Its flywheel had been sorted. The Bengaluru-headquartered Ninjacart was scaling its procurement and fulfilment engine, constantly innovating for warehouse tracking, automation of sorting and picking of fresh produce, better capacity utilisation, and route planning.

The capital from enabled Ninjacart to scale by another 3.5X to touch Rs 469 crore in operational revenue in FY20. This saw it sell fresh produce to more than 60,000 shops and restaurants across seven cities, and work with 44,000 suppliers of fruits and vegetables.

But even as Ninjacart was growing to hit those numbers in the summer of 2019, it got an expression of interest from Walmart and the Flipkart Group.

The due diligence took six months, and the three companies announced a strategic partnership in December 2019. and infused $10 million each in Ninjacart — it would become a supplier in Flipkart's grocery delivery strategy.

That would be the last time Thirukumaran and Ninjacart would publicly disclose any of its business performance metrics.

By then, the Ninjacart network comprised more than 200 collection centres and 1,200 warehouses.

"It moves over 1,400 tons of fresh produce per day, having doubled its volumes in the last four months," stated Flipkart and Walmart in a joint statement dated December 11, 2019, on Ninjacart's ability to handle scale.

Few guessed in December 2019 how vital the alliance would prove for Ninjacart and Flipkart, much less about how the COVID-19 pandemic would wreak havoc on small shops and restaurants in the following year.

The year of living dangerously

With the outbreak of the pandemic, Ninjacart's core customer based shrank in 2020. Small shops and restaurants were closed for three months because of the nationwide lockdown.

Supply chains got disrupted even as curbs and restrictions continued across states.

At the time, Ninjacart hunkered down to address new sellers of fruits and vegetables, including people who sold fresh produce on push-carts.

What was more unexpected during the first wave was the overnight increase in the numbers of people shopping online for groceries. This category got a boost with Amazon, Flipkart, and Bigbasket seeing a surge in demand.

By June 2020, even got into the thick of this action, as it launched Jiomart.com, as well as a pilot in Kalyan, Thane, and Navi Mumbai for customers to order from small shops using WhatsApp.

Investment firm Silver Lake infused Rs 7,500 crore in Reliance Retail Ventures soon after. Meanwhile, the Tata Group was closing in on acquiring BigBasket, a category leader in the online groceries space.

Flipkart, which had begun to build Supermart since November 2017, needed a sourcing and procurement engine to address the burgeoning demand for groceries.

Says a Flipkart investor requesting anonymity, "When Flipkart thinks a category is strategically important, they have to solve for supply. And quality supply was not easy to figure out in groceries.”

In its earliest days, in 2011 for example, Flipkart had acquired Letsbuy to grow in the consumer electronics category, and expand from books.

The strategic partnership with Ninjacart inked in 2019 would help Flipkart find a reliable supplier of fresh produce, which had a deep understanding of the complexity of agritech.

"In fresh produce, the complexity of scaling up varies from state to state," the Flipkart investor says. "Some states have laws that you can directly procure from farmers, whereas in some states, you have to go through the APMCs (Agricultural Produce Market Committee)."

This makes it hard to have a playbook for procurement in groceries.

Manish Kumar oversees the grocery category at Flipkart. In 2018, the ecommerce company had built Supermart as an online grocery app, and as an option on the Flipkart app. This promised next-day delivery of groceries, or delivery within two days, in the top five cities.

But the sourcing and supply determined Flipkart's delivery efficacy, which is why it required Ninjacart.

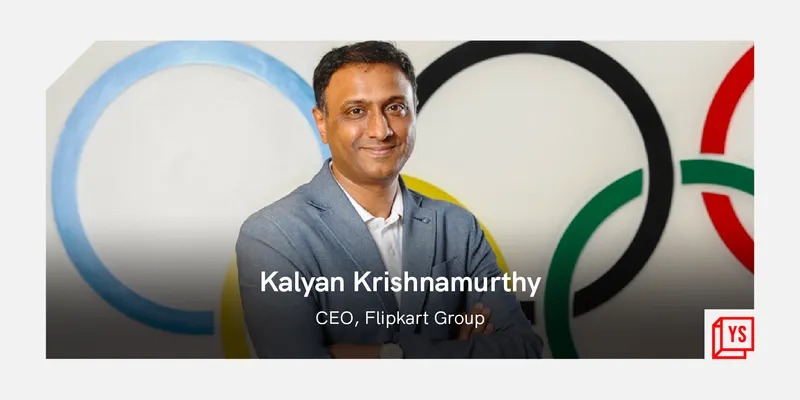

"Developing Flipkart Supermart over the past year, we have focused on creating the right infrastructure, supporting local farmers, producers and food processors, and building sustainability into the ecosystem," said Kalyan Krishnamurthy, CEO of Flipkart Group, in December 2019.

With the strategic partnership, Flipkart was able to also launch a hyperlocal business called 'Quick' in July 2020.

Quick started with a promise of 90-minutes delivery, and also introduced slotted delivery. Users could choose a slot for delivery, and get the fresh produce in that time slot.

For Ninjacart, Flipkart would generate demand. This meant scale and speed, over and above its core business of catering to small shops which began to recover by late 2020.

Flipkart has a grocery fulfilment centre in Bengaluru, which is 1.5 lakh square feet in area. This has called for different systems of picking, sorting and packing of food items, compared to the processes to cater to the standard size and formats Flipkart has handled at scale in electronics, apparel and so on.

Fresh-produce suppliers like Ninjacart and bring in the procured fresh groceries to the fulfilment centre.

Flipkart's systems then plan the dispatch sequence to cross-docks that are situated close to the neighbourhoods where the orders emanate from.

At the cross-docks, orders are transferred from big centres to nearly 3,000 smaller delivery vans. Bengaluru will have seven or eight cross-docks.

Flipkart is now piloting groceries on its Shopsy app, a destination for community-buying. This will prove important for demand to hit a critical mass in Tier 2 and Tier 3 cities.

Ninjacart allows Flipkart to focus on demand build-up. If Flipkart had to go and source fresh-produce, it would have had to build a network of farmers in mandis, or go to vendors who source from mandis.

It would have taken Flipkart a year or two to build that sourcing capability in a low-margin business.

In December 2021, the relationship saw a reaffirmation as Walmart and Flipkart Group infused another $145 million in Ninjacart.

For Ninjacart, Walmart's experience of groceries procurement and supply in other geographies has also become invaluable.

But its relationship with Flipkart has the potential to bring in synergies on the warehouse and logistics front too, as the ecommerce giant aims to grow to more than 2,000 cities this year. Ninjacart doesn't own its own fleet of delivery vans and vehicles.

In a low-margin category like groceries, and in a competitive market featuring Reliance Retail, Bigbasket and Amazon, Flipkart, and Ninjacart are finding efficiencies at every step of the way ahead.

Edited by Rajiv Bhuva